Analog Gadgets Inc. (NASDAQ:ADI) is among the finest QQQ shares to purchase proper now. On August 21, Truist raised the agency’s worth goal on Analog Gadgets to $249 from $219, whereas protecting a Maintain score on the shares. Earlier than this sentiment was reported, the corporate additionally introduced its Q3 2025 earnings report on August 20.

Income for the quarter was $2.88 billion, which marked a 25% year-over-year improve. This was pushed by a sturdy demand throughout all its finish markets, with each phase reaching double-digit progress year-over-year. The economic phase, which makes up 45% of whole income, grew 23%. The automotive phase, which represents 30% of income, grew 22%, whereas the communications and shopper segments, every at 13% of income, grew by 40% and 21%, respectively.

The corporate’s profitability additionally noticed vital enchancment, with the GAAP gross margin being 62.1%, up from 56.7% within the earlier yr, with a non-GAAP gross margin of 69.2%. The non-GAAP working margin was 42.2%, a 1% improve year-over-year. The GAAP diluted EPS was $1.04, and the non-GAAP diluted EPS was $2.05, a 30% improve.

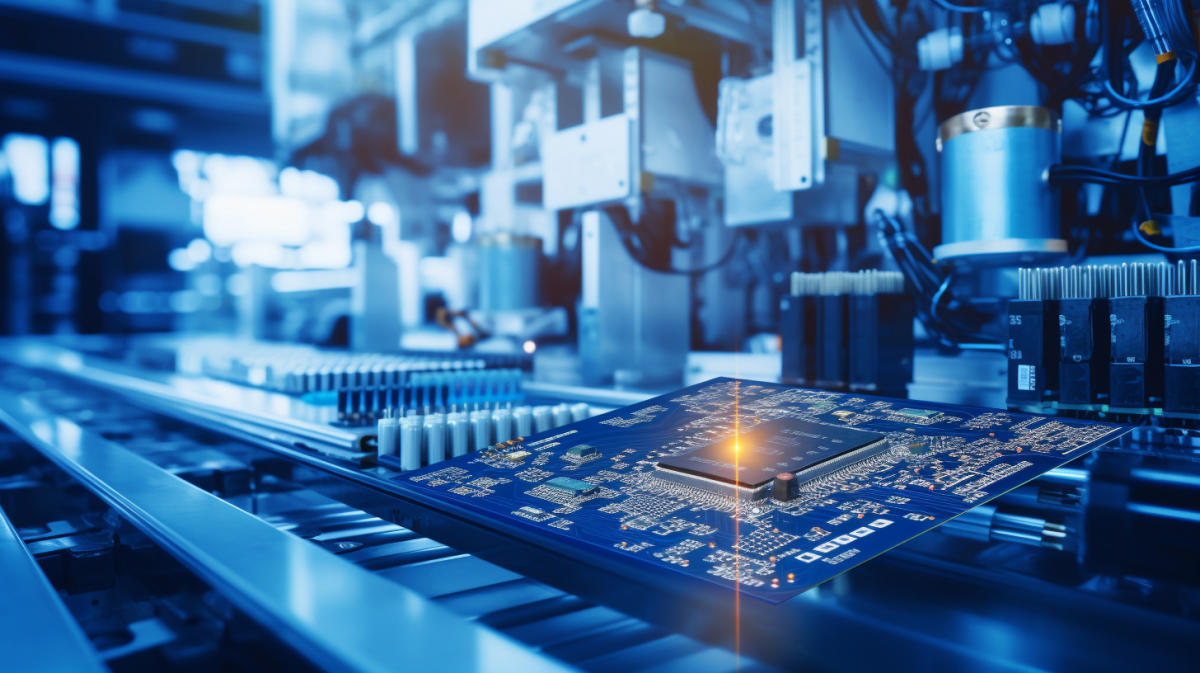

Analog Gadgets Inc. (NASDAQ:ADI) designs, manufactures, checks, and markets ICs, software program, and subsystems merchandise within the US, North & South America, Europe, Japan, China, and Asia.

Whereas we acknowledge the potential of ADI as an funding, we consider sure AI shares supply better upside potential and carry much less draw back danger. In case you’re searching for a particularly undervalued AI inventory that additionally stands to profit considerably from Trump-era tariffs and the onshoring pattern, see our free report on the finest short-term AI inventory.

READ NEXT: 30 Shares That Ought to Double in 3 Years and 11 Hidden AI Shares to Purchase Proper Now.

Disclosure: None. This text is initially printed at Insider Monkey.