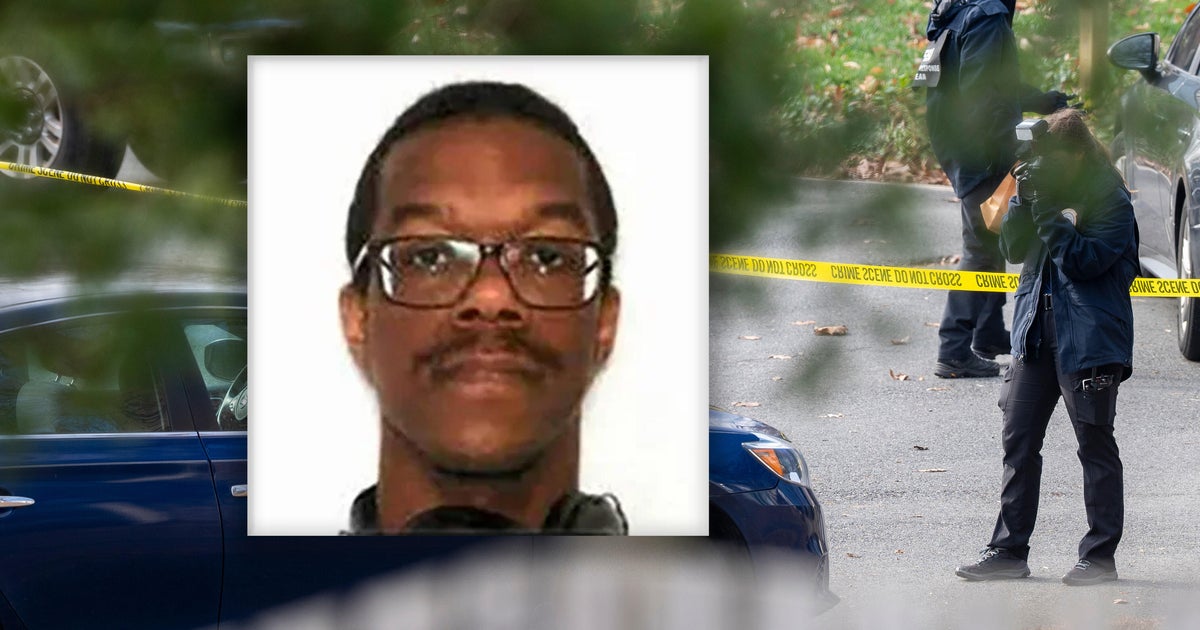

US businesswoman Charlie Javice (L), founding father of Frank, arrives for her sentencing listening to at federal courtroom in Manhattan on Sept. 29, 2025, in New York Metropolis.

Timothy A. Clary | AFP | Getty Photographs

Charlie Javice, founding father of a startup acquired by JPMorgan Chase in 2021 for $175 million, is going through sentencing Monday for defrauding the financial institution by overstating what number of clients the fintech agency had.

In March, a 12-person jury discovered Javice and her chief development officer Olivier Amar responsible on three counts of fraud and one depend of conspiracy to commit fraud.

Javice, 33, cried as she delivered an emotional assertion to the courtroom. Standing to deal with the decide, Javice mentioned she felt profound regret for her actions and requested for forgiveness from JPMorgan, staff of the startup, shareholders and traders. At one level Javice turned and immediately addressed her household, sitting within the entrance row, to apologize and thank them for what she known as unwavering help.

“I’ll spend my whole life regretting these errors,” Javice mentioned.

“I am asking with all of my coronary heart for forgiveness,” she mentioned. “I ask your Honor to mood justice with mercy … I’ll settle for your judgement with dignity and humility.”

JPMorgan purchased the startup, known as Frank, to assist the most important U.S. financial institution by property market its monetary merchandise to college students. Frank was a digital platform that helped college students apply for monetary help. In September 2021, JPMorgan advised CNBC in an unique interview on the deal that the fintech agency had served greater than 5 million college students since Javice based it.

However months after the deal closed, JPMorgan found that Frank had fewer than 300,000 actual clients; the remaining had been artificial identities created by Javice with the assistance of an information scientist.

Javice was arrested in 2023 on expenses that she defrauded JPMorgan within the deal. Particulars that emerged later confirmed that Frank staff expressed disbelief when Javice directed them to spice up their buyer roster earlier than the acquisition.

The week earlier than promoting her firm to JPMorgan, Javice directed an worker to manufacture thousands and thousands of customers. When the worker declined, Javice reassured him, based on testimony given earlier this yr.

“She mentioned: ‘Don’t be concerned. I do not wish to find yourself in an orange jumpsuit,'” the worker testified.

Javice’s lawyer, Ronald Sullivan, whereas arguing for a lighter sentence for his shopper, argued that Frank helped individuals. He contrasted the case towards that of Elizabeth Holmes of Theranos infamy, whose fraud he mentioned had “harmful medical penalties” and who was sentenced to 135 months in jail.

“Ms. Javice’s sentence must be nowhere close to Elizabeth Holmes’,” Sullivan advised the decide Monday.

Assistant U.S. Legal professional Micah Fergenson disagreed, arguing Javice’s crime was fueled by greed.

“JPMorgan did not get a functioning enterprise, they acquired against the law scene,” Fergenson mentioned.

The episode was embarrassing for JPMorgan, which was considered some of the refined of company acquirers. Involved about threats from fintech and large tech corporations, the financial institution, led by CEO Jamie Dimon, went on a buying spree of smaller fintech corporations beginning in 2020.

However JPMorgan, wanting to edge out rivals bidding for the startup, failed to verify that Frank truly had thousands and thousands of consumers earlier than shelling out $175 million for the corporate.

This story is creating. Please verify again for updates.