This text was produced for ProPublica’s Native Reporting Community in partnership with Oregon Public Broadcasting. Join Dispatches to get our tales in your inbox each week.

Reporting Highlights

- Enviornment Deal: Oregon leaders pledged to assist a brand new and improved enviornment for the Path Blazers basketball crew when it went up on the market.

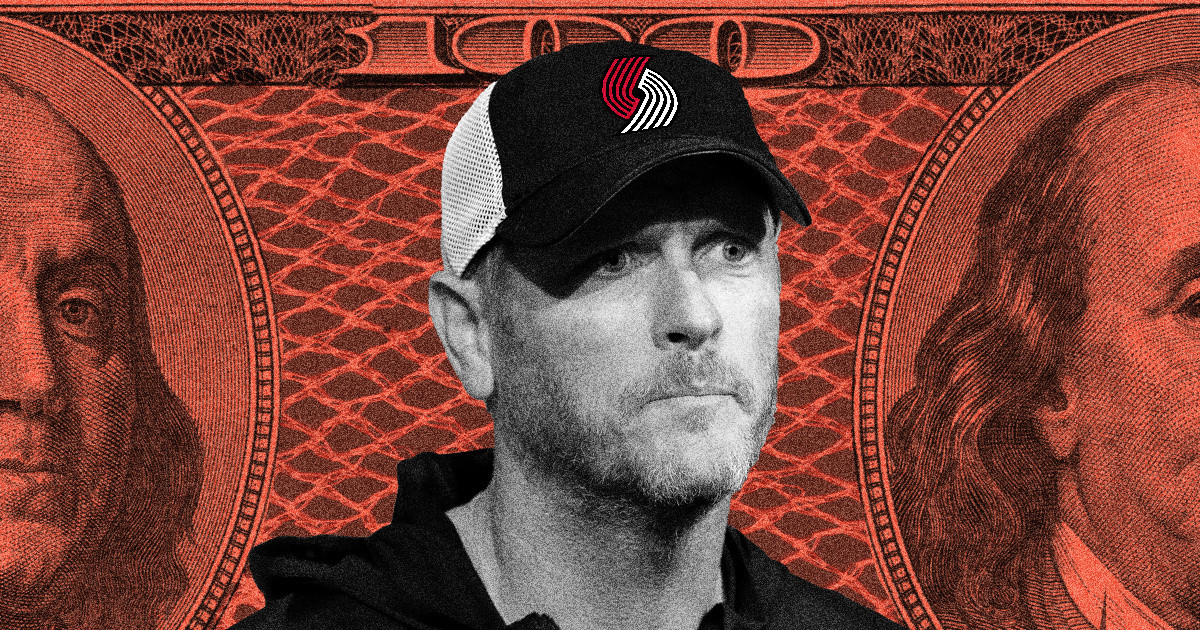

- Purchaser With a Previous: Tom Dundon, who agreed to purchase the Blazers, created an organization that Oregon sued, alleging predatory lending. He invested in one other lender now below state investigation.

- What’s Subsequent: Dundon didn’t reply to written questions, and Portland Mayor Keith Wilson and Oregon Gov. Tina Koteek declined to touch upon how his previous may have an effect on the sector deal.

These highlights had been written by the reporters and editors who labored on this story.

When the Portland Path Blazers went up on the market this yr for the primary time in three a long time, native leaders had been so decided to maintain the crew in Portland that they penned a extensively publicized letter promising the Nationwide Basketball Affiliation they’d work with whoever the brand new proprietor was to safe an overhaul of the crew’s enviornment.

Followers cheered as a gaggle of traders led by Texan Tom Dundon went all-in with a $4 billion bid for the crew, which has now been accepted. Many speculated about what Dundon’s possession of a newly profitable Nationwide Hockey League crew in Raleigh, North Carolina, would portend for Oregon’s oldest and largest sports activities franchise.

There was no public dialogue domestically about the truth that Dundon created an organization Oregon accused in 2020 of preying on residents via high-interest automobile loans they couldn’t afford. The state’s then-attorney normal mentioned that the enterprise practices of Santander Shopper USA had been “predatory and dangerous and won’t be tolerated in Oregon” as she introduced Oregon’s piece of a $550 million multistate lawsuit settlement with the corporate.

As well as, Oregon is a part of an ongoing multistate investigation into one other nationwide subprime lender for which Dundon has served in a management function, Exeter Finance. The Oregon Division of Justice confirmed to Oregon Public Broadcasting and ProPublica the state’s function within the investigation, the existence of which Exeter has disclosed in securities filings.

It’s unclear how these points may have an effect on the dedication of Oregon Gov. Tina Kotek and Portland Mayor Keith Wilson to a partnership, which might embody tens or tons of of tens of millions in public cash primarily based on previous enviornment tasks in different cities. Spokespeople for each Wilson and Kotek declined to reply when requested if the elected leaders knew about Dundon’s historical past with regulators.

Mark Williams, a former Federal Reserve regulator who teaches finance at Boston College, mentioned Dundon’s document is a vital consideration.

“The cash used to purchase the Portland Path Blazers is cash that was constructed on predatory lending,” Williams mentioned of Dundon. “He had a chance. He seized it. He made numerous revenue. And the way did he make that revenue? He made it on the backs of low- and poor-credit people.”

Dundon’s buy of the Blazers awaits approval from the NBA’s board of governors, which regularly takes months, earlier than it may possibly shut.

OPB and ProPublica obtained no response after sending a abstract of their reporting and an inventory of inquiries to Dundon, his funding agency, the general public relations workers of his hockey crew and the attorneys representing him in a chapter dispute.

Dundon later answered to a textual content message searching for remark: “Sadly at this level within the course of I’m not out there. Completely satisfied to talk with you after closing. Thx.”

Dundon left Santander Shopper in 2015. In biographical posts on-line and former information media interviews, Dundon has described his method to subprime lending as offering alternatives for individuals with horrible credit to personal automobiles and ensuring debtors obtain a good deal.

“Simply because somebody has horrible credit doesn’t imply they’re a foul particular person,” he instructed The Dallas Morning Information shortly after leaving the corporate.

Santander Shopper declined to touch upon Dundon. In an announcement, the corporate mentioned: “Working in a extremely regulated business, we’ve sturdy processes in place which can be designed to guard clients and cling to all regulatory necessities and business greatest practices.”

A spokesperson for Exeter Finance declined to remark. The corporate has mentioned in filings that it’s cooperating with the present investigation by states’ attorneys normal.

The case that Santander Shopper settled with attorneys normal in 2020 involved greater than 265,000 debtors throughout the nation, together with 2,000 in Oregon. The settlement settlement mentioned it didn’t represent proof of, or admission to, any of the state’s allegations in opposition to the corporate.

As for Exeter Finance, Oregon shoppers have filed 23 complaints in opposition to it with the Shopper Monetary Safety Bureau, all of which the company listed as “closed with rationalization” from the corporate.

A type of complaints was from AshLe’ Penn.

Penn, a single mom of three working as a staffing firm account supervisor in 2021, wanted a automobile. Her credit score was dangerous. However a dealership was capable of get her a mortgage on a 2014 Chrysler 300 via Exeter Finance.

Penn must make $511 month-to-month funds over 72 months, reflecting an rate of interest of 28%.

“The rate of interest was fairly insane,” she mentioned in an interview. “However I wanted a automobile so dangerous.”

Two years later, Penn discovered herself three funds behind and had been evicted from her residence, she mentioned. In response to her client grievance, she was dwelling within the sedan when Exeter despatched an organization to repossess it in January 2023. It was late at night time, and she or he was parked exterior her ex’s home. Her daughters watched from inside. She wrote that she spent the following 10-plus hours locked in her automobile, in a standoff with the repo agent, earlier than enlisting a chapter legal professional who halted the repossession.

She recorded a lot of it on video, which she shared with Exeter.

“It was horrific. I imply, I cried. I cried for God,” Penn instructed OPB and ProPublica. “I used to be afraid to depart my automobile. I couldn’t get out of my automobile after that. I used to be simply so afraid any individual was going to take it.”

Penn complained, arguing the regulation prohibits repossessing a automobile with somebody inside, and demanded $150,000 in compensation. Exeter instructed her that it had performed an intensive overview, which concluded that she had didn’t pay and that she was warned forward of time her automobile could be taken away.

Penn’s model of occasions, Exeter wrote, couldn’t be corroborated.

Credit score:

Kristyna Wentz-Graff/OPB

Constructing an Auto Mortgage Large

Allegations of predatory lending would hardly stand out amongst NBA homeowners.

It’s a billionaires’ membership whose previous and present members or their firms have been accused of housing discrimination, knowingly underwriting improper mortgages, exploiting jail inmates, making racist feedback and fascinating in sexual misconduct. The Blazers’ present proprietor, Jody Allen, settled lawsuits during which her firm’s safety guards accused her of sexual harassment and trying to smuggle penguin skulls and giraffe bones out of Antarctica and Africa. All of the homeowners, together with Allen, have denied the allegations in opposition to them in courtroom filings or in statements to the information media.

Dundon’s path to NBA possession started at used automobile dealerships, the place he labored in finance. Within the mid-Nineties, he and different former dealership employees co-founded the corporate Drive Monetary Companies. Dundon turned its president and chief working officer.

The corporate billed itself as “setting a brand new commonplace within the sub-prime lending business.” Sellers appreciated that Drive Monetary would mortgage cash to individuals different firms wouldn’t, in keeping with its web site on the time, as a result of it was capable of “overlook unfavorable credit score histories similar to cost offs, bankruptcies and repossessions.”

Finance consultants who’ve studied the subprime lending business say it affords a final resort for some individuals to personal a automobile. Lenders set excessive rates of interest partly to soak up the losses from those that can’t make funds. Even when lenders comply with client legal guidelines, defaults are frequent.

“The choice is, ‘Let’s simply not subject loans to individuals which can be very dangerous, after which they’ll by no means default,’” mentioned College of Utah professor Mark Jansen, who has authored a number of papers on subprime loans. “However in numerous locations with out public transport, no automobile means no job.”

In 2006, the Spanish firm Banco Santander acquired Drive Monetary and reworked it into Santander Shopper USA. Dundon saved a ten% possession stake and a seat on its board of administrators. He stayed on as CEO of the newly fashioned firm.

Dundon emerged as a key determine within the development of the subprime auto mortgage business, mentioned Williams, the Boston College finance professor.

Williams, who made automobile loans as a financial institution officer earlier than working in monetary regulation and threat evaluation, now teaches lessons about subprime automobile loans and different lending dangers. He began learning automobile financing firms like Santander when he was researching a 2010 ebook about systemic threat within the finance business. In 2015, he was one of many consultants the New York Senate tapped for assist with a report on the dangers of the subprime auto loans business.

Williams mentioned Dundon “was one of many people that actually grew the business. Many would argue that he took it to a brand new degree.”

Beneath Dundon, the worth of Santander Shopper jumped from simply over $600 million on the time of the acquisition to almost $9 billion in 2014, in keeping with Bloomberg.

That development was constructed virtually completely with subprime debtors. Filings with the Securities and Alternate Fee in Santander Shopper’s early years present the typical credit score rating on its loans was under 540. Roughly two-thirds of its loans had rates of interest over 20%.

A speaker bio for Dundon, posted by the MIT Sloan Sports activities Analytics Convention, mentioned he was “capable of influence lives by growing entry to dependable transportation for people with restricted credit score historical past” throughout his time at Santander Shopper.

However the firm was additionally drawing client complaints.

Kenneth Dost was dwelling in Scappoose, Oregon, when the housing market crashed and the structure agency he labored with went below in 2007.

He was nonetheless struggling financially in 2010 when Santander Shopper took over the 15.85% Citi Monetary mortgage that he’d used to purchase his yellow Ford F-150 pickup. He mentioned in his grievance with the Oregon Division of Justice that Santander Shopper agreed over the cellphone to decrease his funds from $399 a month to $281. Dost mentioned he then spent weeks going backwards and forwards with the corporate making an attempt to offer requested paperwork.

In November that yr, Dost mentioned, his daughter noticed the yellow truck being hauled away shortly after she stepped off her faculty bus. After repossessing the Ford, Santander Shopper mentioned in a letter to Oregon officers that the mortgage modifications Dost thought he obtained had been really topic to administration’s approval and that Dost’s mortgage “didn’t meet the rules.”

In one other letter, Santander Shopper instructed Oregon officers the documentation essential to change Dost’s mortgage was “not obtained in its entirety.” The letter additionally mentioned Dost was 59 days delinquent by the point he sought the modification.

After promoting the truck at public sale, Dost mentioned, Santander Shopper knowledgeable him he nonetheless owed greater than $2,000. That included a payment for repossessing his truck.

“This finally ends up being an extra windfall for Santander and more cash they will bleed from us,” Dost instructed state investigators. “That is improper.”

Dost turned one in every of 24 debtors Oregon’s Division of Justice named in an April 2012 “investigative demand” letter addressed to Dundon. The state ordered the Santander Shopper CEO to provide testimony in particular person or else flip over the debtors’ paperwork.

Santander selected the latter, and Oregon’s legal professional normal reached an “assurance of voluntary compliance” with the corporate in 2013 that required it to take steps to guard shoppers and pay the state $25,000. The settlement mentioned it was not an admission by the corporate that it violated the regulation.

There was extra to come back.

Leaving Santander

Dundon knew strain on his firm from regulators was mounting.

In monetary stories between late 2014 and early 2015, Dundon disclosed that along with a state attorneys normal investigation, Santander Shopper additionally had obtained a subpoena from the U.S. Division of Justice and a discover from the Securities and Alternate Fee that the company deliberate to analyze its lending practices.

In early 2015, the corporate reached a $9 million settlement with the U.S. Justice Division over allegations the corporate illegally repossessed army service members’ automobiles. The corporate neither admitted nor denied the allegations below the settlement. It was quoted as saying it absolutely cooperated with the federal government and had taken steps to enhance its compliance with the regulation.

Round that point, a front-page story in The New York Occasions detailed how Dundon and others had amassed wealth by packaging dangerous auto loans made to low-income individuals and promoting these loans as securities for tons of of tens of millions of {dollars}. Regulators mentioned it resembled the way in which banks bought bundles of shoddy residence loans earlier than the housing bubble burst within the mid-2000s.

Dundon reassured inventory analysts in April 2015 that “we’re too good to have a bust.”

However on the identical earnings name, Dundon acknowledged issues, saying the corporate had “numerous work to do” to satisfy regulatory expectations.

The Federal Reserve Financial institution of Boston was one regulatory company trying into Santander Shopper. It discovered quite a few deficiencies with the corporate. In late June 2015, Santander Shopper’s board of administrators voted to simply accept a Fed enforcement motion that required the corporate to submit written plans to enhance its threat administration and firm construction.

Dundon was out as CEO the identical day the enforcement settlement took impact, July 2, 2015. In his interview with The Dallas Morning Information on the time, Dundon mentioned that the Federal Reserve points didn’t contain him and that he and Santander Shopper’s guardian firm “had completely different concepts about the way to run a enterprise.”

He netted greater than $700 million in his separation settlement, which included cashing out his inventory, SEC filings present.

A slew of multimillion-dollar authorized settlements adopted for Santander Shopper within the wake of Dundon’s departure: $26 million for allegations of “unfair, high-rate loans” in Massachusetts and Delaware; $12 million to the Shopper Monetary Safety Bureau, which discovered it engaged in “misleading acts” and violated client safety legal guidelines; and $550 million — the biggest payout — with 34 attorneys normal, together with Oregon’s. The corporate didn’t admit wrongdoing in any of those instances.

After settling with state attorneys normal, the corporate acknowledged on the time it had “strengthened our threat administration throughout the board” and known as the lending that regulators had scrutinized a “legacy” subject.

After Santander Shopper

Dundon used the cash he made via Santander Shopper to make a variety of investments, and he quickly turned identified much less for his tenure as an auto lender and as a substitute as a outstanding determine in leisure {and professional} sports activities.

By way of a brand new agency, Dundon Capital Companions, he invested in Topgolf, an leisure and restaurant chain constructed round golf driving ranges that was quickly rising on the time. Together with forays into actual property and well being care firms, he turned the only proprietor of the NHL’s Carolina Hurricanes in 2021.

But Dundon remained a participant amongst subprime auto lenders.

Filings with the Securities and Alternate Fee present Dundon Capital Companions invested $100 million in Carvana in 2017, and bought a lot of the inventory a yr later. Virtually half of the loans that Carvana points are subprime, in keeping with a report from the short-selling agency Hindenburg Analysis.

In 2023, Dundon Capital invested in subprime automobile lender Exeter Finance, in keeping with the analysis agency Pitchbook.

Exeter Finance was based in 2006 in Irving, Texas, a suburb of Dallas, town the place Dundon and others based the corporate that turned Santander Shopper. Exeter’s web site reveals that a number of former Santander executives took management roles at Exeter beginning in 2015, whereas Santander Shopper was below state and federal scrutiny. Exeter is presently listed on Dundon Capital’s web site as a part of its portfolio, and a 2022 information launch from Exeter recognized Dundon as chairman of the board.

A 2024 investigation by ProPublica discovered that due to the way in which Exeter Finance dealt with loans, it typically made more cash when debtors defaulted than once they paid on time.

Exeter has settled allegations of unfair lending practices, paying greater than $6 million mixed to Massachusetts and Delaware. (The corporate didn’t admit wrongdoing in both case.) In the meantime, it’s below investigation by the attorneys normal in 42 states, it mentioned in a company submitting this yr. These embody Oregon, a spokesperson for Lawyer Basic Dan Rayfield confirmed.

Exeter has described the present multistate inquiry as an extension of calls for for info that began in 2015. The corporate wrote that the preliminary investigation involved its “origination, servicing and assortment practices” and that it cooperated with state requests for paperwork.

For JT Cotter of Bend, Oregon, Exeter Finance was the one lender out there when he purchased a used Honda Pilot at Carmax in 2022 for $28,000.

Cotter, who works privately with households of kids with particular wants, mentioned he had beforehand defaulted on a 2018 high-interest automobile mortgage from Santander Shopper.

“It demolished me,” he mentioned.

When Cotter wanted a brand new automobile and Exeter supplied him a price of 19%, he thought, “‘Oh, it’s simply one other Santander.’ However I didn’t know there was really a connection.”

Exeter let him skip funds and prolong his mortgage, a observe that ProPublica’s 2024 investigation discovered was elementary to the corporate’s enterprise mannequin. (The corporate mentioned on the time that it communicates with clients to make sure they know the prices concerned with extensions.)

Cotter mentioned what he didn’t know was that the funds Exeter let him skip had been moved to the tip of the mortgage, growing the curiosity and costs he needed to pay. By 2024, his $731 month-to-month fee went completely towards curiosity, in keeping with an Exeter billing assertion reviewed by OPB and ProPublica. Exeter repossessed the Pilot eight months in the past.

He by no means filed a grievance with the state Division of Justice as a result of, he mentioned, he didn’t comprehend it was one thing he might do.

Cotter now drives a Subaru. He mentioned he saved up and paid money for it.

A New Enviornment

Credit score:

Brooke Herbert/OPB

Portland’s city-owned Moda Heart enviornment has been the house of the Path Blazers because it opened in 1995 below the identify the Rose Backyard, changing town’s growing old Veterans Memorial Coliseum.

The crew’s future within the Rose Metropolis wasn’t a outstanding debate in Portland till Allen, the proprietor, market it in Might. Requested to touch upon the crew’s future in mild of a possible sale, NBA Commissioner Adam Silver declared to reporters that Portland “seemingly wants a brand new enviornment.”

“That might be a part of the problem for any new possession group coming in,” Silver mentioned on the time.

Others echoed Silver’s sentiment. Marshall Glickman, whose father based the Path Blazers in 1970, mentioned throughout an August interview on OPB’s “Assume Out Loud” that any new proprietor would have “extraordinary leverage” over town and the state to pay for a brand new or renovated enviornment. “And that leverage comes from the risk, which can be spoken or it is probably not spoken, however the portability of the crew that it might depart.”

Glickman began a corporation, Rip Metropolis Eternally, to construct public assist for protecting the Blazers in Portland. He declined to remark additional however mentioned his statements throughout the “Assume Out Loud” interview weren’t directed particularly at Dundon, whose identify had not but surfaced.

Cities hardly ever come out forward once they put tax {dollars} into these stadium tasks, a gaggle of researchers concluded in 2022 after inspecting greater than 130 financial research of publicly financed stadiums. Any public advantages from elevated foot visitors, new visits to close by companies or heightened civic stature had been too small to justify the quantity the general public spent, the overview discovered.

Wilson and Kotek, the Portland mayor and Oregon governor, stepped up in an enormous means nonetheless. Of their letter to Silver, they mentioned they’d heard his considerations in regards to the Blazers enviornment “loud and clear” and “absolutely assist renovating the Moda Heart to develop into a degree of delight for the Blazers and for our metropolis.”

“We’re ready to discover the public-private partnerships wanted to make it occur,” they concluded.

Then, on Sept. 12, the present Blazers proprietor introduced that the franchise had accepted Dundon’s buy provide.

Dundon has not commented on the Blazers acquisition since, however U.S. Sen. Ron Wyden of Oregon mentioned he’d spoken with him simply earlier than the bid turned public. “He sounded very excited in regards to the crew’s future being right here in stunning Portland,” Wyden instructed reporters.

As in Portland, there have been considerations the NHL’s Hurricanes would go away Raleigh for an even bigger market when Dundon purchased the crew. In 2023, the Hurricanes signed a long-term lease within the metropolis, saying the event of a billion-dollar enviornment and surrounding leisure district. The deal included $300 million in public cash.

Oregonians who borrowed cash from firms linked to Dundon voiced feelings starting from dismay to disgust once they realized their tax {dollars} may go towards supporting Dundon’s newest funding.

“Nice,” Dost mentioned. “Making a partnership with the satan, primarily is what that’s.”

Penn, who was homeless when Exeter despatched a repo firm to take her automobile away, mentioned she considers herself a Blazers fan. She’s by no means made it to a sport in particular person, however her youngsters went on a school-sponsored journey to the Moda Heart this yr.

She fended off repossession again in 2023, however the automobile broke down a number of months later. She couldn’t afford to repair it and stopped making an attempt to make funds. She ultimately discovered Part 8 housing, however with out a automobile, she mentioned her youngsters needed to cease enjoying soccer and basketball as a result of she had no solution to get them to practices and video games.

Penn mentioned she wonders if the individuals who run Exeter know what’s occurred to debtors like her.

“I’ve seen their government crew, they usually’re positively consuming and feeding their households,” she mentioned, having appeared the corporate up on-line, “and I feel it’s positively on the expense of others not having the ability to.”

Credit score:

Kristyna Wentz-Graff/OPB

Doris Burke and Mariam Elba of ProPublica contributed analysis.

![[Rappler’s Best] The Davao Boys and the Ilocano cronies [Rappler’s Best] The Davao Boys and the Ilocano cronies](https://www.rappler.com/tachyon/2026/02/rapplers-best-davao-boys-ilocano-cronies-February-16-2026.jpg)