Debra’s husband has an issue. He’s hooked on sports activities playing and has frittered away nearly $1 million of their financial savings.

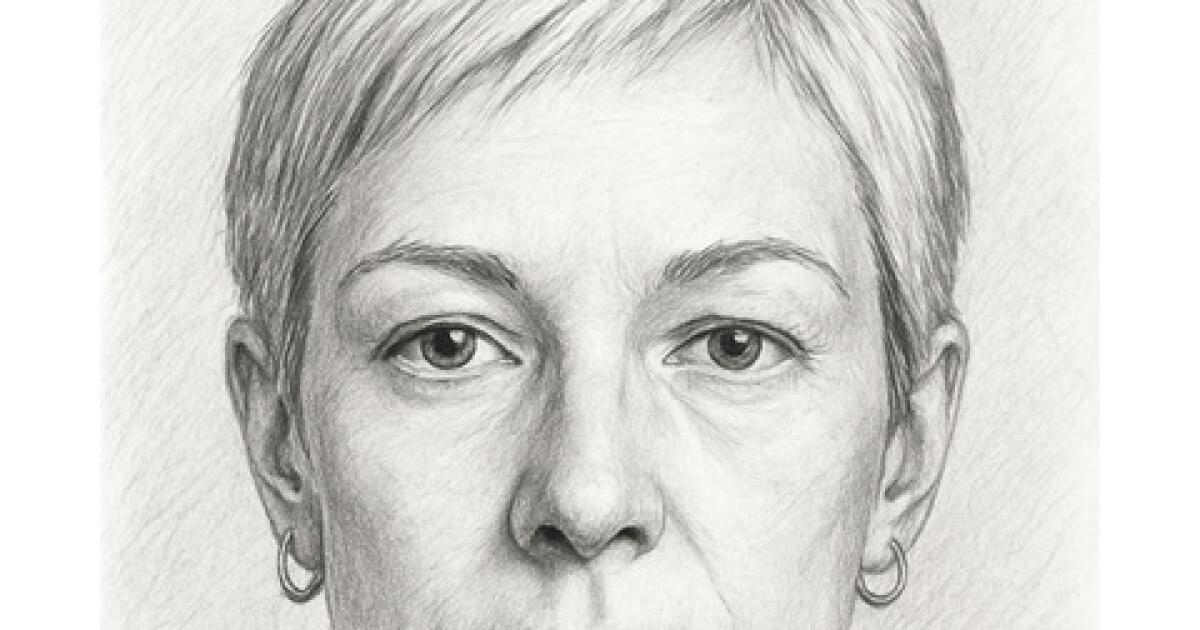

The Sacramento native, 69, known as in to The Ramsey Present, expressing dismay and frustration — classifying her husband, 79, as a extreme gambler.

The couple has been married for 11 years, and they need to be in a super place to take pleasure in their retirement. Originally of their marriage, they’d near $1 million saved collectively. Nonetheless, Debra just lately found that her husband had been dipping into their accounts for bets and mendacity about it.

The Nationwide Council on Downside Playing experiences that 2.5 million adults within the U.S. are estimated to have a extreme playing drawback, and an extra 5 to eight million have a gentle or average drawback with playing. (1)

“My husband has a playing drawback,” Debra stated. “Our financial savings are right down to $15,000.”

Debra is dealing with a critical private and monetary disaster, and Ramsey didn’t hedge his bets on what she ought to do.

“I can cease anytime I wish to,” is what Debra’s husband tells her; nonetheless, this heartbreaking story is a transparent instance of how habit can tear households aside.

Whereas they’d mixed their accounts after getting married and have been initially cautious with their cash, ultimately, Debra’s husband grew to become evasive, and she or he seen some crimson flags.

“A 12 months and a half in the past, one thing that was sort of a warning signal was that I noticed a late discover for taxes,” she recalled. “I stated, ‘Why are our taxes late?'”

She began digging and found that he’d missed a tax cost. Now, she’s came upon that her husband’s credit score rating is 600, whereas hers is within the 800 vary, and regardless of his $350,000 annual wage, they’ve little within the financial institution.

Worst of all, he is not dedicated to getting assist for his habit; as an alternative, he’s simply reducing again on his vice. (2)

“He stated … ‘We will get it below management. We will hold it right down to $700 or $800 a month,’” Debra recalled.

Debra and her husband aren’t alone. The Nationwide Council on Downside Playing experiences that the speed of drawback playing amongst sports activities bettors is no less than twice as excessive as amongst gamblers normally. (3) Moreover, 45% of sports activities bets now occur on-line, and with the extensive availability of apps, playing addicts have 24/7 temptation of their pockets.

The monetary loss from that quick access could be devastating, with Atlantic Behavioral Well being reporting that playing habit results in a mean debt of $40,000. (4)

The World Well being Group additionally warns that playing can:

-

Enhance the danger of psychological sickness

-

Enhance the danger of suicide

-

Drive households into poverty

-

Trigger relationships and households to interrupt aside

-

Enhance the danger of household violence

-

Enhance the danger of crimes like theft and fraud

-

End in baby neglect (5)

Learn extra: US automobile insurance coverage prices have surged 50% from 2020 to 2024 — this easy 2-minute examine might put tons of again in your pocket

Debra took step one in dividing her funds from her husband’s, however Dave stated she should do extra.

“You name a wedding counselor, and also you begin speaking to them. And also you name somebody who does habit counseling,” Ramsey urged. “Each can provide you a framework by which you lead them into an ultimatum, and the ultimatum is: You cease chilly turkey, you’re going to Gamblers’ Nameless, and you’re going to a therapist.

“You aren’t playing one other dime, or you’ll not see me anymore.”

One of the best time to take motion is as quickly as potential, or earlier than the monetary loss is substantial. Warning indicators can embrace:

-

Monetary points similar to overdue payments and maxed-out playing cards

-

A scarcity of cash regardless of incomes a great dwelling

-

Objects being bought for money

For these in a scenario much like Debra’s, and see these indicators of their partner, Higher Well being recommends:

-

Remind your self that you simply’re not at fault and might’t management their habits

-

Inform the gambler that they’re inflicting you hurt

-

Monitor all household spending and take management of your funds

-

Open a separate checking account

-

Discuss to the financial institution to make sure your property cannot be re-mortgaged

-

Put valuables right into a protected deposit account

-

Cancel overdraft safety on shared financial institution accounts

-

Make connections with others to help your personal psychological well being (4)

Lastly, as Ramsey urged, it is best to stage an intervention and confront your partner, offering particular examples of how their habits is inflicting issues. Additionally work with them to create a method on how you can tackle the playing and the implications of their actions.

Be part of 200,000+ readers and get Moneywise’s finest tales and unique interviews first — clear insights curated and delivered weekly. Subscribe now.

We rely solely on vetted sources and credible third-party reporting. For particulars, see our editorial ethics and pointers.

Nationwide Council on Downside Playing (1, 3); Dependancy Assist (2); Atlantic Behavioral Well being (4); World Well being Group (5); USC Suzanne Dworak-Peck (6).

This text supplies data solely and shouldn’t be construed as recommendation. It’s supplied with out guarantee of any type.

![[Tambay] Kaypalad ni Duterte sa The Hague [Tambay] Kaypalad ni Duterte sa The Hague](https://www.rappler.com/tachyon/2025/10/20251012-kay-palad-duterte-hague.jpg)