Each market cycle finds a brand new obsession that skeptics rush to name a bubble. Should you take a look at historical past, it occurred with railroads within the 1800s, with electrical energy within the early 1900s, with the web within the Nineteen Nineties, and once more with smartphones within the 2000s. Every time, the identical sample performed out. The group dismissed structural change as hypothesis till it rewired your entire economic system. The reality is easy however usually ignored. When know-how reshapes value, habits, and productiveness, it isn’t hypothesis. It’s revaluation. Synthetic intelligence sits at that very same second now. What many name a bubble is mostly a repricing of productiveness and margin potential throughout each main trade. The error is believing that this example is merely about hype. It’s about construction. Sensible traders understand how know-how adjustments financial mechanics, not the way it trades on any given week. Those that study from the previous will acknowledge this shift early.

The Human Reflex To Name It A Bubble

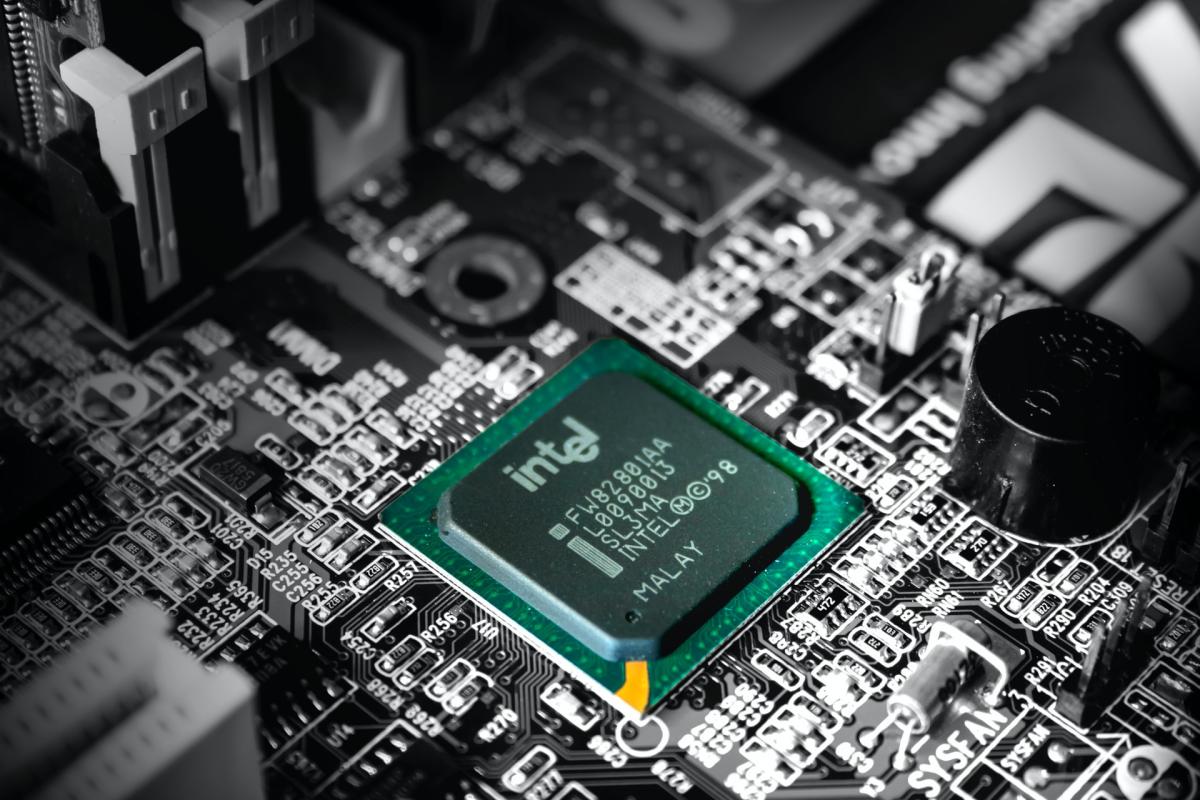

Traders hate what they’ll’t mannequin. When the inputs break their spreadsheets, they label the output irrational. In 1995, most of Wall Road dismissed (AMZN), (INTC) , and (CSCO) as hype as a result of they didn’t match the valuation screens of the day. The numbers didn’t make sense underneath an previous framework, so the response was to reject the brand new one. That is the reflex of each cycle: name it a bubble till it turns into too large to disregard.

The true offender is anchoring bias. Traders cling to the final paradigm as if it have been everlasting. They benchmark towards the previous, not realizing that know-how resets the baseline every time. The identical manner electrical energy rewrote industrial prices, AI is rewriting productiveness and pricing energy. The issue isn’t that AI valuations are inflated; it’s that traders are nonetheless evaluating a brand new world to an out of date one.

Productiveness, Not Hypothesis

AI isn’t a hype cycle. It’s a productiveness occasion on the size of railroads, electrical energy, and the web. Fairly frankly, every of these moments redefined the character of labor, not simply the beneficiaries. Within the 1800s, railroads related regional markets and crushed transportation prices, turning remoted economies into nationwide ones. Within the 1900s, electrical energy diminished manufacturing unit manufacturing by greater than 70%, multiplying output with out multiplying labor. By the Nineteen Nineties, the web compressed distribution prices to close zero, permitting a single concept to scale globally in a single day. AI’s equal is the compression of information work. A analysis report that when took ten hours now takes two. A customer support queue that wanted 5 people now wants one. That isn’t a theme; it’s a structural margin transformation. Microsoft’s Copilot and OpenAI integrations are the early indicators of what occurs when productiveness turns into pricing energy. Traders who proceed to pursue top-line progress are misdirecting their consideration. The true compounding will happen in working leverage, the place each greenback of recent output prices much less to provide. Historical past exhibits that markets don’t reward hypothesis for lengthy, however they all the time re-price effectivity when it scales. Traders overlook that progress by no means appears to be like low cost in actual time.

The Actual Sign: Capital Expenditure And Infrastructure Buildout

The web bubble of 2000 was constructed on client hypothesis, domains, advert clicks, and corporations with no income mannequin. The AI motion is the other. It’s pushed by enterprise capital expenditure in chips, knowledge facilities, and vitality infrastructure. Nvidia, Broadcom, and Tremendous Micro usually are not memes; they’re the railroads of the brand new economic system. Every greenback invested of their capability lays groundwork for many years of digital throughput. Over the following 5 years, greater than $1 trillion might be spent constructing knowledge facilities alone. This isn’t mere hypothesis; it’s the deployment of actual capital for enduring advantages. Within the late Nineteen Nineties, infrastructure adopted the mania. In the present day, infrastructure is the mania. That distinction issues. It’s the way you separate hypothesis from secular funding. One burns out when sentiment shifts. The opposite compounds quietly beneath it.

The Blind Spot Of Conventional Worth Screens

Basic worth traders hunt for affordable earnings, however innovation hides worth by miserable short-term margins. In 2004, Amazon traded at 300 instances earnings. Most worth managers handed as a result of the numbers appeared absurd. Since then, the inventory is up greater than 180 instances. What they missed wasn’t the valuation, it was the price curve. Amazon was within the funding part, constructing the infrastructure that may later flip into unstoppable money stream. AI is on the identical stage at present. Corporations like Alphabet spent billions on knowledge facilities and machine studying years earlier than these prices paid off. These early losses turned the spine of probably the most worthwhile enterprise fashions ever constructed. P/E ratios are deceptive once they prioritize value over worth. Worth traders misprice innovation not as a result of they lack self-discipline, however as a result of they measure the long run with instruments designed for the previous.

The Actual Winners: Structural Integrators

The subsequent part of AI management is not going to come from startups chasing buzzwords however from incumbents that embed it into their working DNA. (NOW) is a quiet standout. Now Help and Professional Plus instruments automate workflows throughout IT, HR, and finance, creating margin growth and contract stickiness, the essence of recurring leverage. (UNH), by Optum, is making use of AI to claims detection, fraud discount, and predictive care administration, structurally decreasing medical loss ratios and strengthening underwriting accuracy. The chance right here is regulatory oversight, not technological execution. (AMZN) , by way of AWS, stays the infrastructure layer of the motion. Bedrock and Brokers efficiently monetize the “AI picks and shovels” commerce, producing worth every time a mannequin undergoes coaching or deployment. (GE) is a textbook instance of structural alpha within the industrial economic system, utilizing predictive upkeep and digital twins to remodel service economics and asset uptime. And (MSFT) is the benchmark integrator; its Copilot suite has turned AI from a price heart right into a pricing lever, embedding intelligence into the world’s most used productiveness instruments. The takeaway is easy: don’t chase AI headlines. Personal the businesses that make it invisible, worthwhile, and structural.

What Markets Get Fallacious

Markets nearly all the time misprice time horizons. They chase the story that strikes subsequent quarter’s earnings as a substitute of the construction that shapes the following decade. That’s what occurred with the cloud. In 2014, most analysts valued Amazon Net Providers at zero. It generated 70% of Amazon’s total earnings in simply 5 years. The market was not unsuitable about Amazon’s ambition. It was unsuitable about timing. AI sits on the identical inflection level at present. The infrastructure buildout hides inside capital expenditure, invisible in near-term revenue and loss, however its affect compounds beneath the floor. Knowledge facilities, chips, and workflow automation usually are not traits. They’re foundations for multi-year margin growth. Traders who look ahead to readability will miss the compounding. Those that perceive construction will see it early. Persistence and structural perception all the time beat response and valuation screens.

The Investor’s Playbook

The first step is to cease asking if it is a bubble and begin asking the place effectivity compounds. Each main shift begins with skepticism and ends with scale. Step two is to separate hypothesis from construction. The trick is to comply with the place capital is being deployed, not the place commentary is loudest. Step three is to search for industries constructed on repetitive, data-heavy workflows comparable to insurance coverage, logistics, healthcare, manufacturing, and finance. These are the sectors the place AI will quietly rewire margins. Step 4 is to deal with firms embedding AI to decrease unit prices or increase switching prices, not these promoting a narrative about “AI publicity.” Actual adoption occurs behind the scenes, not in headlines. Step 5 is to increase your time horizon. Structural reratings take years, not months. The traders who perceive that effectivity compounds identical to capital would be the ones accumulating the true alpha when the noise fades.

The Edge Perspective

I’ve been round for a very long time and seen rather a lot. Each main know-how cycle begins with disbelief as a result of the market can not mannequin exponential change. Railroads, oil, electrical energy, semiconductors, and the web all appeared like bubbles earlier than they rewired the world. The traders who understood construction earlier than sentiment constructed fortunes whereas others argued over valuation. AI is that second once more. The chance isn’t in predicting hype however in proudly owning the mechanics of transformation. Structural alpha doesn’t reside in ratios or short-term screens. It lives within the quiet compounding that occurs when effectivity, capital, and time align. That’s the place my firm, The Edge has all the time targeted, earlier than the gang sees it.

On the date of publication, Jim Osman didn’t have (both immediately or not directly) positions in any of the securities talked about on this article. All info and knowledge on this article is solely for informational functions. This text was initially revealed on Barchart.com