December WTI crude oil (CLZ25) on Friday closed up +0.32 (+0.54%), and December RBOB gasoline (RBZ25) closed down -0.0253 (-1.29%).

Crude oil and gasoline costs settled combined on Friday. Greenback weak point supported crude costs on Friday, when the greenback index (DXY00) fell to a 1-week low. Additionally, power in crude demand from China, the world’s second-largest crude shopper, is supportive of costs, after a report on Friday confirmed that China’s Jan-Oct crude imports rose +3.1% y/y to 471 MMT.

Financial considerations restricted positive factors in crude on Friday after US Nov shopper sentiment fell to a virtually 3.5-year low and after the S&P 500 dropped to a 2-week low, which undercuts confidence within the financial outlook and vitality demand. Demand considerations are additionally weighing on oil costs after Saudi Arabia on Thursday lowered the worth of its major crude grade to Asia for supply subsequent month to the bottom stage in 11 months.

Thursday’s motion by Saudi Arabia’s state producer, Aramco, to chop the worth of its Arab Gentle crude by $1.20 a barrel to an 11-month low for Asian clients with December supply alerts weakened vitality demand and is bearish for oil costs.

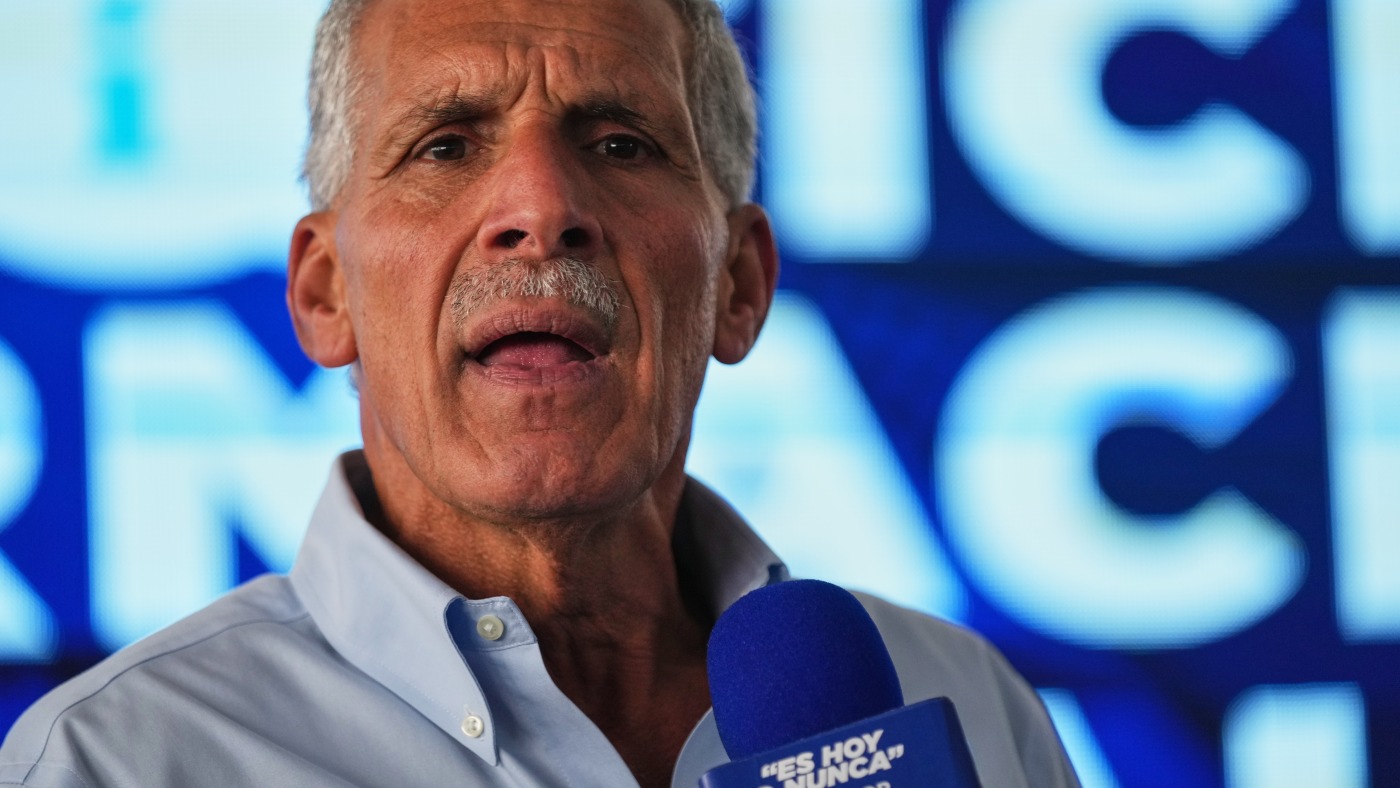

Oil costs even have assist on current stories that the US army could also be on the verge of launching army strikes on Venezuela, which is the world’s twelfth largest oil producer.

OPEC+ at its assembly on Sunday introduced that members will increase manufacturing by 137,000 bpd for December however will then pause the manufacturing hikes in Q1-2026 as a result of rising world oil surplus. The IEA in mid-October forecasted a document world oil surplus of 4.0 million bpd for 2026. OPEC+ is making an attempt to revive the entire 2.2 million bpd manufacturing minimize it made in early 2024, however nonetheless has one other 1.2 million bpd of manufacturing left to revive. OPEC’s October crude manufacturing rose by +50,000 bpd to 29.07 million bpd, the best in 2.5 years.

Diminished crude exports from Russia are supportive of oil costs. Ukraine has focused at the least 28 Russian refineries over the previous three months, exacerbating a gasoline crunch in Russia and limiting Russia’s crude export capabilities. Ukrainian drone and missile assaults on Russian refineries and oil export terminals curbed Russia’s whole seaborne gasoline shipments to 1.88 million bpd within the first ten days of October, the bottom common in over 3.25 years, and have knocked out 13% to twenty% of Russia’s refining capability by the tip of October, curbing manufacturing by as a lot as 1.1 million bpd. New US and EU sanctions on Russian oil corporations, infrastructure, and tankers have additionally curbed Russian oil exports.

![[Tech Thoughts] Environmental issues amid rising knowledge heart demand in ‘too sizzling’ PH [Tech Thoughts] Environmental issues amid rising knowledge heart demand in ‘too sizzling’ PH](https://www.rappler.com/tachyon/2025/12/DATA-CENTERS.jpg)