As 2025 wraps up, it is one other in a string of years after the 2020 pandemic by which most Individuals constantly voiced adverse views about the financial system amid ongoing considerations about prices — a subject that appears poised to dominate 2026, too.

That is as a result of within the eyes of many Individuals right now, the U.S. is an costly place to reside. Comparatively few describe fundamentals like meals and housing right now as straightforward to afford, whereas housing and well being care, particularly, are described by extra as “tough” to afford than straightforward.

In opposition to that backdrop, persuading the broader public that issues are improved — as President Trump aimed to do that previous week — units up a problem for him going into 2026.

Expectations aren’t that prime for the affect of his insurance policies to make them higher off in 2026, and many do not assume that occurred in 2025.

Fewer than one in 5 say Mr. Trump’s insurance policies made them financially higher in 2025. Outlook on that for 2026 is best by comparability, however nonetheless is not widespread.

And it nonetheless pales in comparison with 2025’s expectations. Simply forward of him being sworn in, extra anticipated Mr. Trump’s insurance policies to make them financially higher off.

Both approach, within the public thoughts, it’s extra Mr. Trump’s financial system than Joe Biden’s.

Including to his challenges: the Individuals who give the financial system dangerous grades are much more prone to maintain him accountable.

That is perhaps partly about what he is finished — individuals who oppose new tariffs, for instance, are particularly prone to name it his financial system — but additionally what they assume he hasn’t finished. Those that really feel he hasn’t put sufficient give attention to reducing costs are much more prone to say this financial system is his alone.

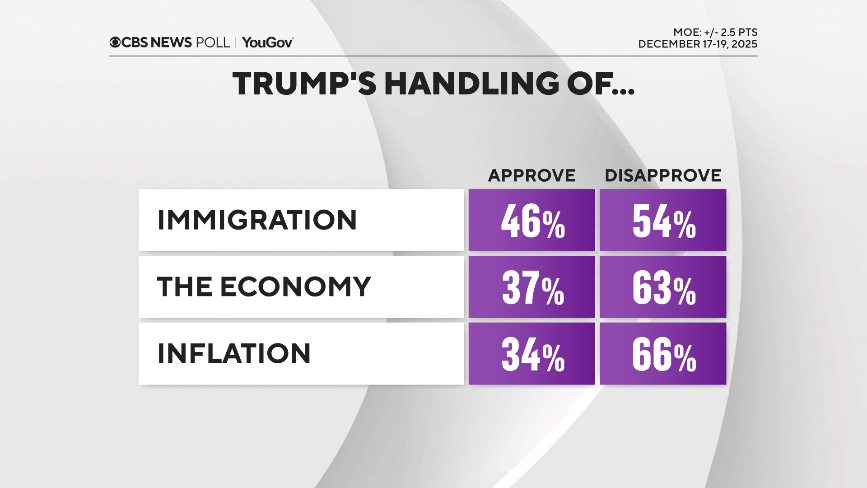

The president did halt a months-long regular decline in his dealing with of the financial system and inflation. Every continues to be low, however now up from the lows of this time period recorded in November. His total approval noticed the identical dynamic, again up one level.

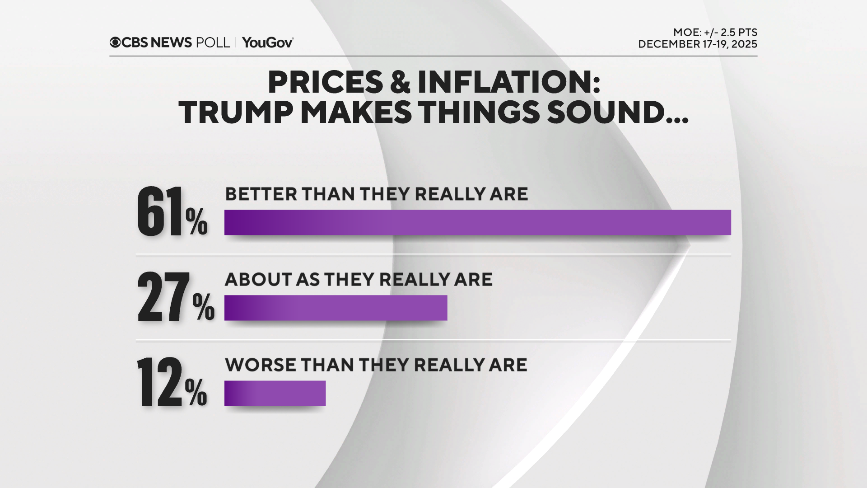

Most nonetheless really feel he describes issues as higher than they are surely. That hasn’t modified.

On stability, Individuals largely grade the financial system as both a “C” or “D” or worse.

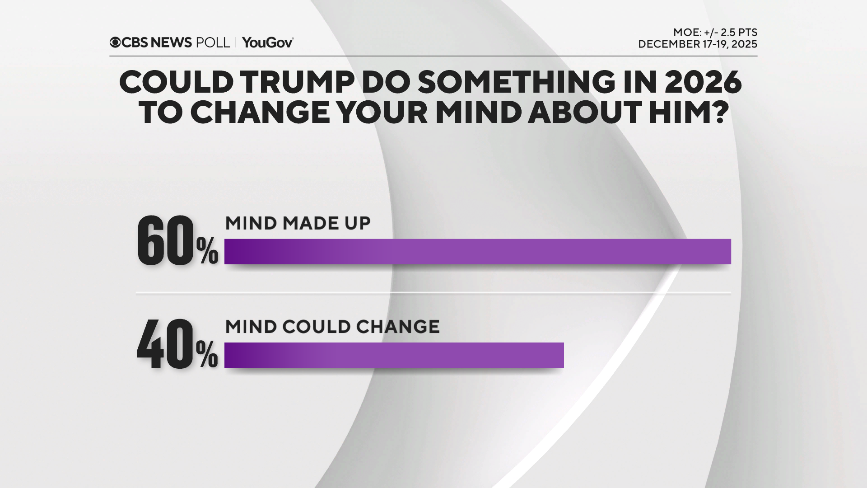

However loads of folks say their views of the president’s job efficiency might change within the new yr — that he might do one thing to vary their minds. That features a quarter of those that disapprove of Mr. Trump’s efficiency now.

Most of them say that it must do with the financial system.

All interviewing for this ballot was finished following the handle to the nation on Wednesday night time.

Trump drew loads of help in 2024 from voters in middle-income ranges, however right now two-thirds of Individuals say he favors the rich, not the center class — and that quantity is increased than it was this spring.

In the meantime, a spread of points swirl forward of 2026 that would affect folks’s backside strains subsequent yr. These embrace the rise of AI, the affect of deportation efforts (together with on jobs), and well being care coverage, which is looming giant.

AI

When a spread of various facets of the U.S. financial system, Individuals are typically most optimistic in regards to the know-how sector. (greater than housing or manufacturing, as an illustration).

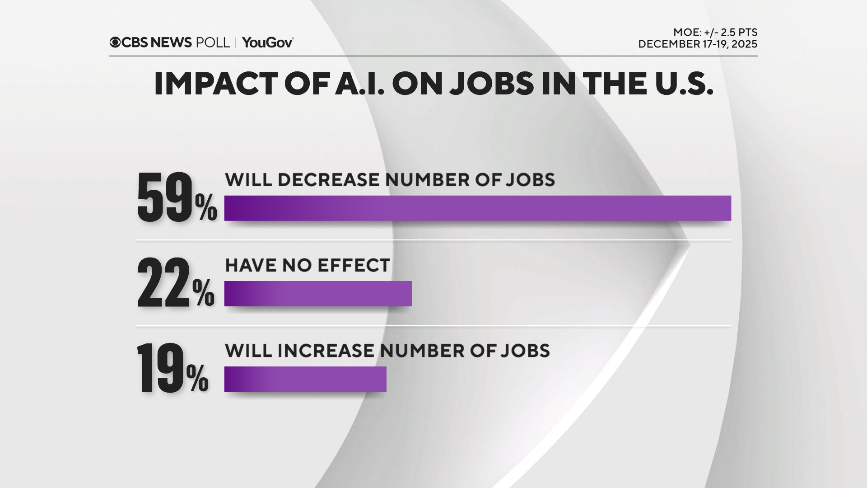

On the similar time, there’s a number of skepticism about AI’s affect, even because it drives the inventory market and investments at ever-higher charges in one of many yr’s largest financial tales.

A majority assume AI will lower American jobs, not enhance them.

On stability, folks would have authorities coverage limit, not promote, AI.

Immigration and deportation

The deportation program continues to divide the nation, and it’s also related within the public thoughts to an affect on the financial system and jobs. A large quantity — particularly those that approve of it — imagine jobs that had been finished by these being deported will now be finished by residents or authorized immigrants.

Most who disapprove of the deportation program assume these jobs will go unfilled.

Most proceed to say border crossings are down this yr. It is one cause the president’s approval rankings on dealing with immigration has been increased than his rankings for dealing with the financial system this yr.

Well being care

Most Individuals wish to see the ACA tax credit prolonged, together with greater than 4 in 10 Republicans.

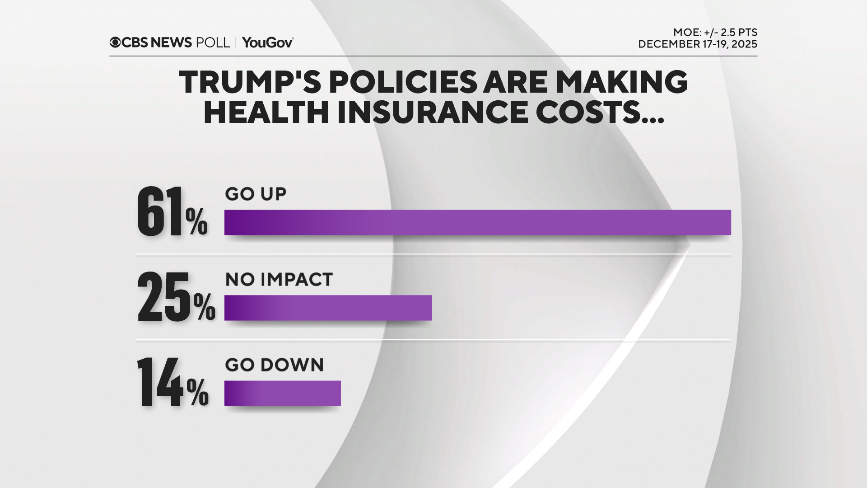

A giant majority assume the administration’s insurance policies are making medical health insurance prices go up.

Heading into his newest announcement of a current take care of drug makers, the general public was not satisfied but of the president’s method to reducing drug costs — extra assume he is making prices go up than down.

On the worldwide entrance

Individuals do not count on Mr. Trump’s insurance policies to have any extra affect on peace and stability than they perceived in 2025, and a big majority nonetheless says Mr. Trump wants to elucidate what is going on on with Venezuela.

This CBS Information/YouGov survey was performed with a nationally consultant pattern of two,300 U.S. adults interviewed between December 17-19, 2025. The pattern was weighted to be consultant of adults nationwide based on gender, age, race, and training, primarily based on the U.S. Census American Group Survey and Present Inhabitants Survey, in addition to 2024 presidential vote. The margin of error is ±2.5 factors.