Tuya Inc. (TUYA) demonstrates robust profitability, disciplined capital management, and strong cash flow generation, even as revenue growth remains moderate. The company’s SaaS segment fuels higher-margin expansion, with leadership focusing on earnings quality rather than aggressive top-line increases.

AI Integration Powers Platform Growth

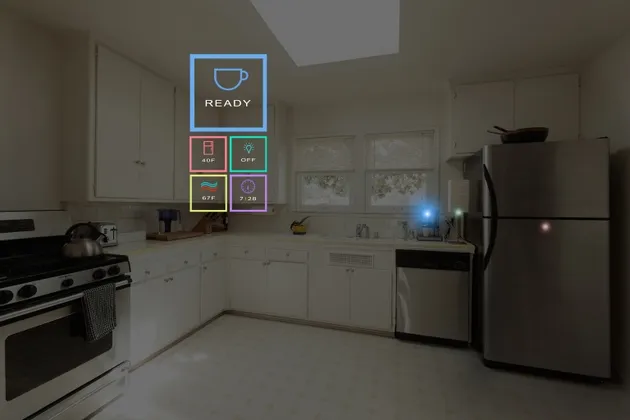

Artificial intelligence forms a core part of Tuya’s platform. A remarkable 94% of shipped devices feature AI capabilities, supporting 135 million daily AI interactions. While monetization of these features presents significant potential, current operations already highlight the technology’s depth.

Attractive Valuation and Financial Health

Trading at an enterprise value-to-sales multiple of 1.1x, Tuya holds nearly $1 billion in net cash. This positions the company favorably, provided profitability and capital discipline continue.

Earnings Outlook

Investors await Tuya’s Q4 and full-year 2025 results, expected in the coming weeks. These figures should underscore the company’s solid fundamentals and growth trajectory in high-margin areas.