A rocket maker is coming again to Earth after a powerful blast off.

Firefly Aerospace (FLY) inventory dropped greater than 10% in premarket buying and selling on Friday.

The inventory opened at $70 a share on its IPO day on Thursday, and closed the session at $60.35 — up 34% from its IPO worth of $45. The corporate’s market cap on the finish of its first day of buying and selling stood at $8.48 billion.

Simply final week, Firefly stated it had deliberate to promote 16.2 million shares at a variety of $35 to $39. A brand new regulatory submitting on Monday got here with a a lot increased vary of $41 to $43. The corporate ended up elevating $868 million from the IPO after promoting 19.3 million shares at $45.

The sturdy reception adopted fellow area exploration play Karman’s (KRMN) spectacular begin to the general public markets this 12 months. Its inventory is up round 60% since its February debut. Each names profit from investor urge for food to play the subsequent area in public markets, as SpaceX (SPAX.PVT) is a personal firm owned by Elon Musk.

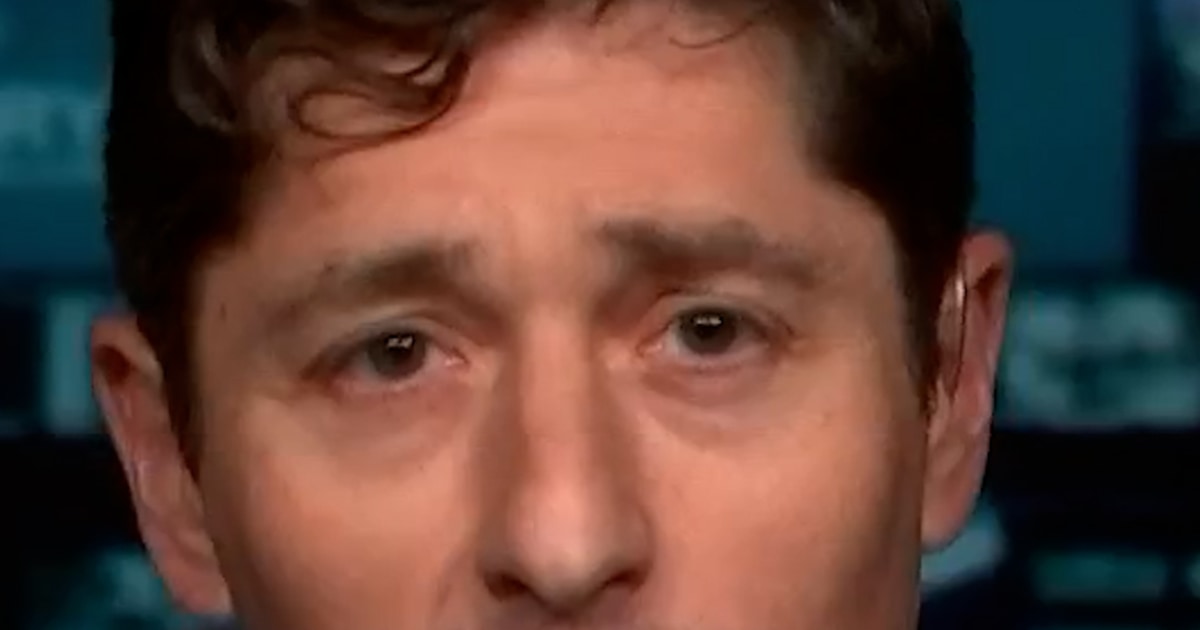

“This firm is just not aspirational — it is operational,” Firefly CEO Jason Kim informed Yahoo Finance. {An electrical} engineer, Kim joined Firefly in October 2024 from Boeing’s (BA) satellite tv for pc phase, Millennium Area Programs.

Kim declined to place a timeline on when Firefly would flip a revenue.

Firefly is a part of NASA’s Business Lunar Payload Companies program. Its lunar lander, Blue Ghost, efficiently touched down on the floor of the moon in March. The corporate’s new Eclipse reusable rocket is predicted to launch someday in 2026, becoming a member of the already confirmed Alpha rocket within the portfolio.

Firefly stays an early-stage firm, as its prospectus makes clear. The corporate boasts $1.1 billion in backlog, primarily enterprise which will (or could not) develop into gross sales sooner or later.

It additionally lists partnerships with Elon Musk’s SpaceX, Jeff Bezos’s Blue Origin, NASA, Northrop Grumman (NOC), and Area Power.

However the enterprise is prone to lose cash for the foreseeable future because it builds out technical capabilities and appears to generate worthwhile demand for its rockets.

For the six months ended June 30, Firefly estimated in its prospectus that it will lose between $95 million and $97 million on an adjusted working foundation. That will be on gross sales of $70.4 million to $71.4 million.

Firefly posted an adjusted working lack of $190.6 million in 2024, up from a $123.9 million loss in 2023.

Brian Sozzi is Yahoo Finance’s Government Editor and a member of Yahoo Finance’s editorial management crew. Observe Sozzi on X @BrianSozzi, Instagram, and LinkedIn. Recommendations on tales? Electronic mail brian.sozzi@yahoofinance.com.