With vital income and dividend development, Federal Agricultural Mortgage Company (NYSE:AGM) makes our checklist of the 20 Finest Shares to Purchase and Maintain for a Lifetime.

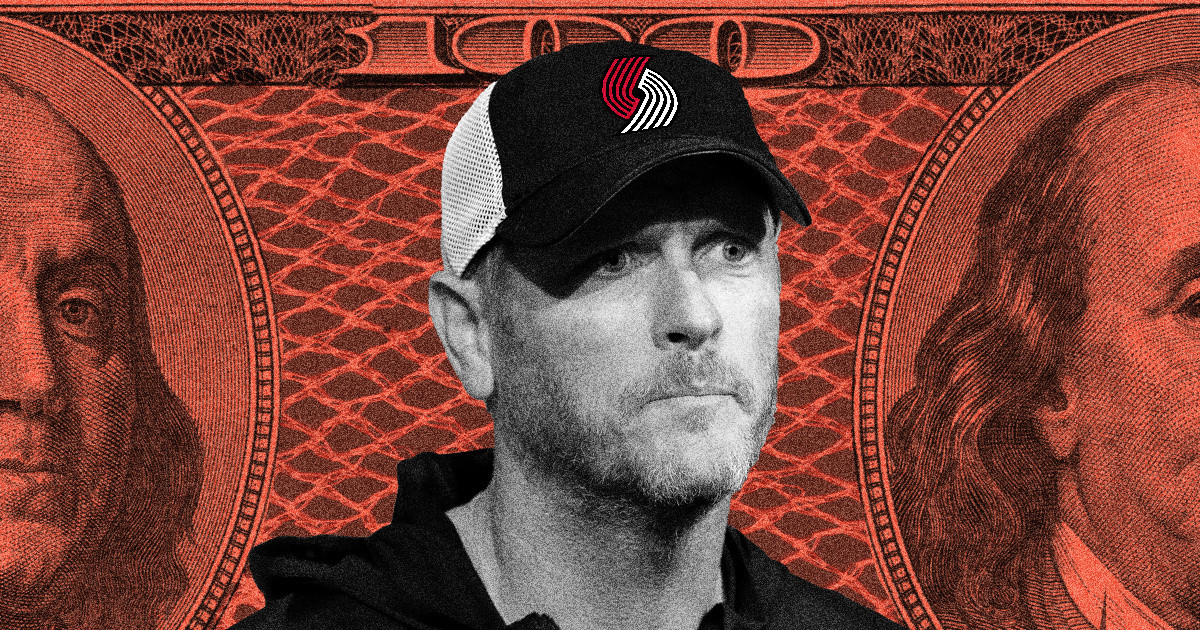

On September 25, 2025, Federal Agricultural Mortgage Company (NYSE:AGM) introduced that Carpenter will instantly assume higher duty as CEO following Nordholm’s retirement.

The announcement follows a year-long succession planning course of wherein Nordholm oversaw the doubling of annual earnings and the expansion of excellent enterprise quantity to over $30 billion. Federal Agricultural Mortgage Company (NYSE:AGM) additionally reported second-quarter 2025 income of $102.63 million, exceeding the anticipated $76.12 million, with an EPS of $4.32. Moreover, the corporate issued $100 million in Collection H non-cumulative perpetual most popular inventory, which is anticipated to checklist on the NYSE with the moniker “AGM PRH” and includes a dividend fee of 6.5%.

These initiatives present Federal Agricultural Mortgage Company (NYSE:AGM)’s robust monetary place, ongoing capital initiatives, and dedication to growing financing availability and liquidity for rural infrastructure and American agriculture.

Federal Agricultural Mortgage Company (NYSE:AGM) supplies secondary market financing options for American agriculture and rural infrastructure. It’s divided into seven enterprise classes, together with Farm & Ranch and Company AgFinance. It is among the finest shares to purchase.

Whereas we acknowledge the potential of AGM as an funding, we imagine sure AI shares provide higher upside potential and carry much less draw back threat. In case you’re on the lookout for an especially undervalued AI inventory that additionally stands to learn considerably from Trump-era tariffs and the onshoring pattern, see our free report on the finest short-term AI inventory.

READ NEXT: 11 Low-cost Clear Vitality Shares to Purchase Proper Now and 15 Finest Robotics Shares to Purchase Below $20.

Disclosure: None.