Many Individuals are feeling the pinch this vacation season.

Most really feel it is at the least considerably troublesome to afford the issues they’re shopping for for the vacations. Some are pulling again on presents, leisure and journey, notably these among the many majority who say objects value extra now than they did final 12 months.

Vacation spending additionally spotlights the long-standing variations in Individuals’ monetary conditions. Those that report their monetary state of affairs nearly as good, who are likely to have greater incomes, say affording the vacations is less complicated. However even they are saying issues are costing extra.

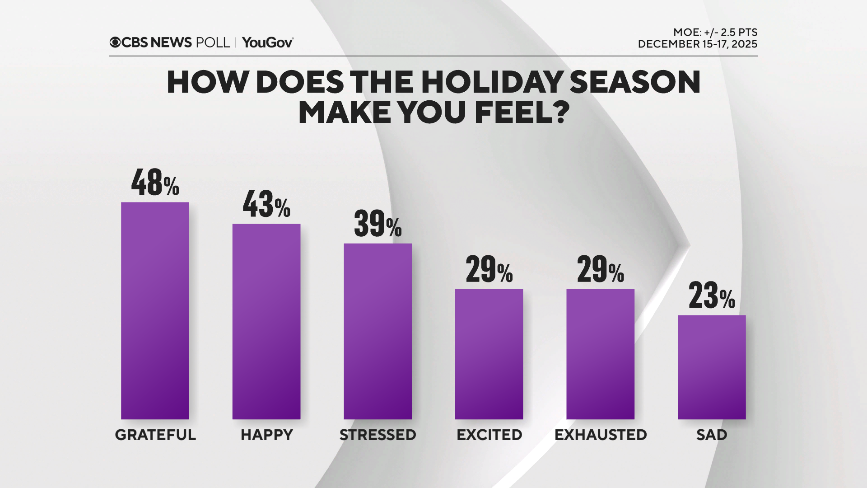

In all, the season typically brings emotions of gratitude and happiness, however funds can issue into sentiments, too: those that say it’s exhausting to afford issues are extra apt to say the season additionally brings stress.

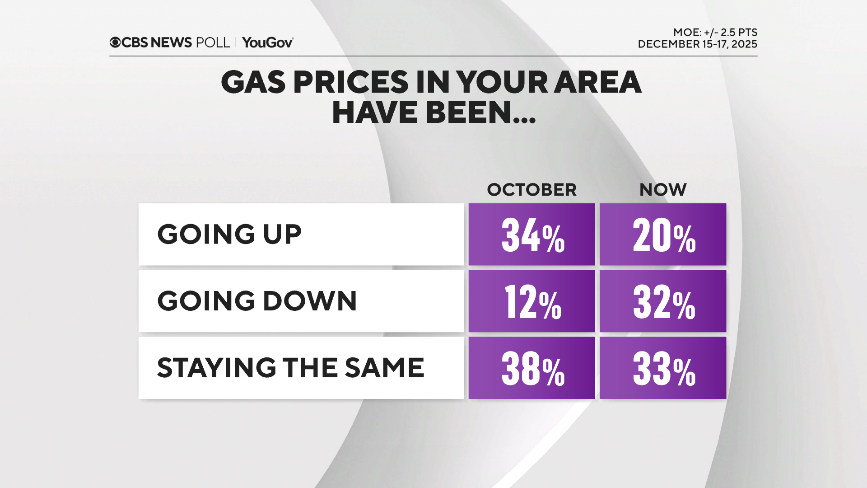

With vacation journey coming, many do really feel they’re getting reduction on gasoline costs. Extra say they’re going down greater than going up — the primary time we have seen that this 12 months.

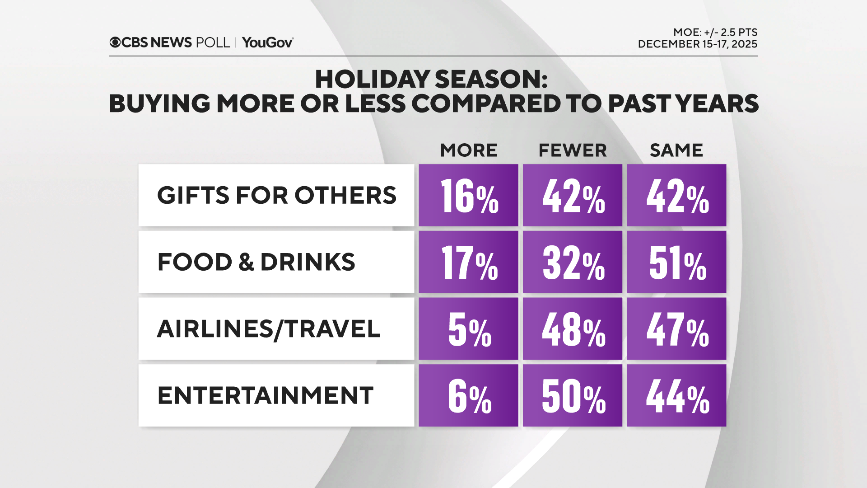

Comparatively few Individuals say they are going to be shopping for extra presents, leisure or airline tickets or meals and drinks this vacation season, in comparison with latest years. Those that say it will likely be troublesome to afford objects this 12 months are particularly prone to say they are going to be scaling again on these items.

The people who find themselves maintaining purchases regular or shopping for extra this 12 months are typically those that say their monetary state of affairs is sweet.

Emotions concerning the vacation season

General, the vacation season evokes extra constructive emotions than destructive ones, with many saying they’re completely satisfied and grateful.

However those that are having problem affording vacation bills are particularly prone to report feeling careworn, too.

Trying again on 2025

Views of the economic system have been low for years, and 2025 continued that pattern. However beneath these sentiments, the 12 months additionally confirmed a constant break up between those that really feel their funds are good and dangerous — the previous typically having greater incomes and saying the inventory market issues to their funds, the latter having decrease incomes and being extra impacted by costs and inflation.

On private funds, about half of the nation continues to say their monetary state of affairs is sweet, whereas about half say it’s dangerous, which has been the case all year long.

Trying again, total, for these whose monetary state of affairs modified over the 12 months, extra mentioned it received worse moderately than higher. However those that did really feel their state of affairs improved have been additionally extra prone to be these with greater incomes.

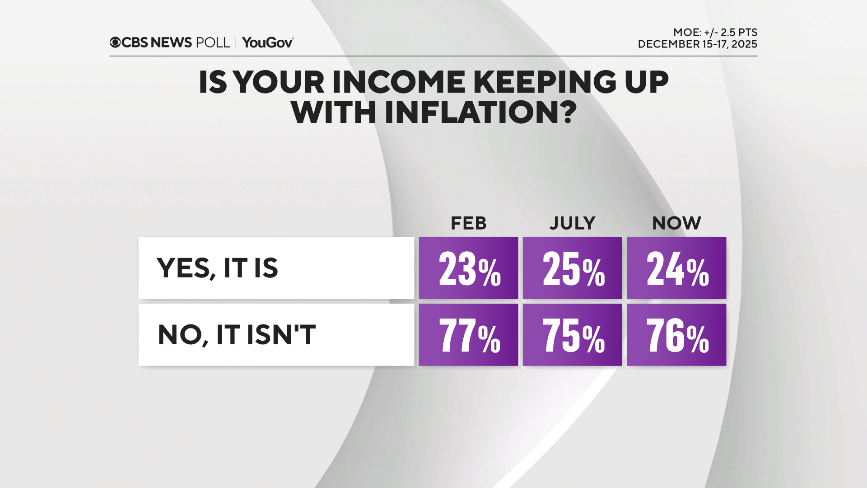

The 12 months ends with most Individuals voicing bigger considerations about inflation which have endured for years. All through 2025, about three-quarters mentioned their incomes weren’t maintaining tempo with inflation. Views of the general economic system stay low.

The general public’s evaluations of the U.S. job market particularly stay web destructive. This comes as the newest authorities information exhibits considerably of a blended bag: extra jobs have been added in November than economists anticipated, however the unemployment charge ticked as much as its highest degree since September 2021.

Among the many vibrant spots, on steadiness, extra Individuals charge the situation of the inventory market nearly as good than charge it as dangerous, and that is notably so amongst these for whom the market’s efficiency issues rather a lot to their funds.

Extra Individuals now say the value of gasoline of their space is coming down than say it is going up — a reversal from what we noticed this fall and over the 12 months.

All year long, like right this moment, Individuals have had a collectively blended outlook trying ahead. Simply over half of Individuals count on a slowing economic system or one in recession. Whereas others count on a rising economic system or one which holds regular.

This CBS Information/YouGov survey was carried out with a nationally consultant pattern of two,267 U.S. adults interviewed between December 15-17, 2025. The pattern was weighted to be consultant of adults nationwide based on gender, age, race, and schooling, primarily based on the U.S. Census American Neighborhood Survey and Present Inhabitants Survey, in addition to 2024 presidential vote. The margin of error is ±2.5 factors.