Following years of negativity in regards to the financial system, most People really feel there are rising alternatives for the rich immediately, however lowering alternatives for the center class. Huge majorities really feel it is more durable immediately to purchase a home, get a superb job, or elevate a household than it was for earlier generations — together with for immediately’s younger folks.

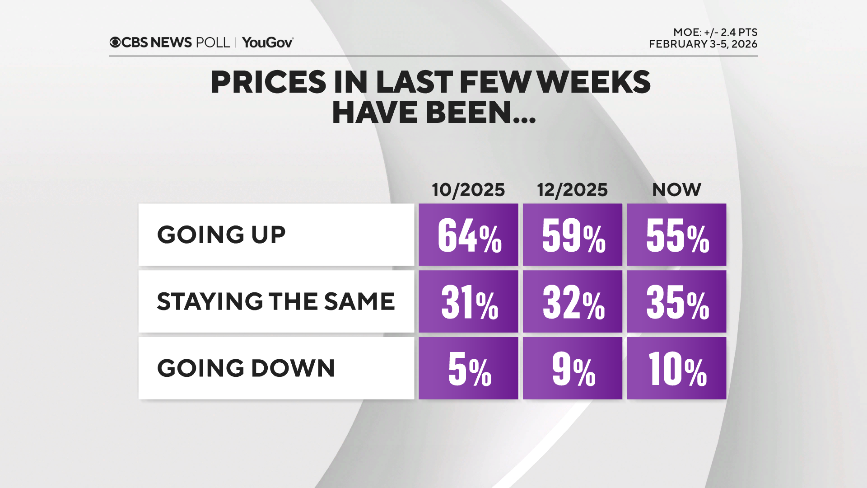

However extra instantly for People and their wallets now, the view that costs are rising is not fairly as widespread because it was this fall, so a number of the public is beginning to see the inflation charge stabilizing.

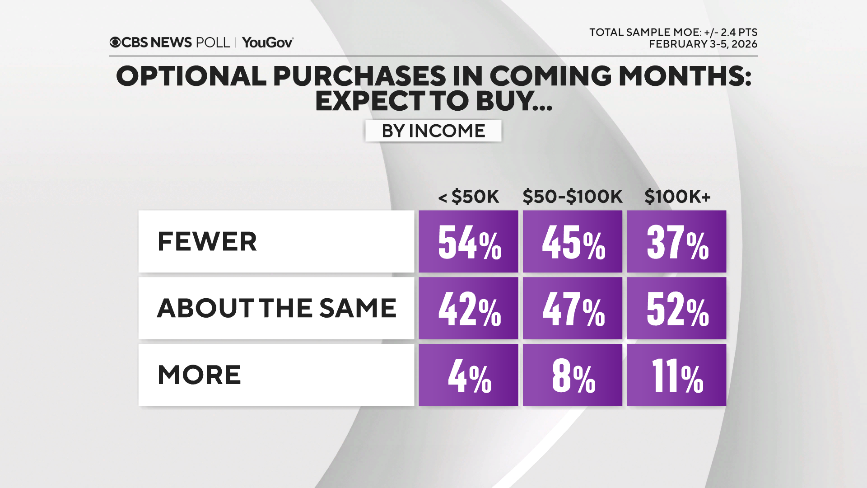

Monetary variations describe completely different selections about spending going ahead, too.

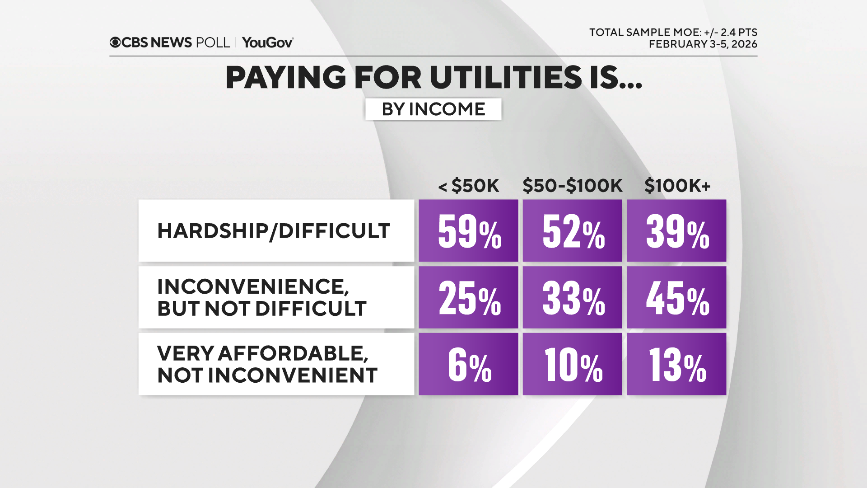

These in lower-income tiers are sometimes slicing again, and say utility prices have hit them laborious of late. However these extra intently tied to the inventory market are likely to say their total funds are good, and better earners say they will maintain spending the identical.

On the roles entrance, most who’ve one really feel at the least considerably safe about it, however that sense of safety is not as sturdy immediately because it was within the fall.

The job market

A majority of People really feel at the least considerably safe of their jobs, although the proportion that feels very safe has dropped barely from October. And most People really feel that in the event that they had been on the lookout for a job, it will be troublesome to search out the form of job they might need.

That is not solely linked to issues about AI — folks are likely to suppose discovering a job might be laborious, regardless of their view is on AI. However individuals who do suppose AI will have a tendency to scale back job availability of their discipline are much more pessimistic in regards to the prospect of discovering a job.

Costs

Most People nonetheless really feel costs are going up. That view, nonetheless, will not be as prevalent within the public because it was this fall.

Funds and earnings variations

As has been the case for years, the financial system finds People with two very completely different descriptions of their monetary scenario, partially hewing to their incomes and the way a lot their monetary scenario is tied to the inventory market.

For instance, when folks say the inventory market issues lots of their funds, they report their total scenario as higher.

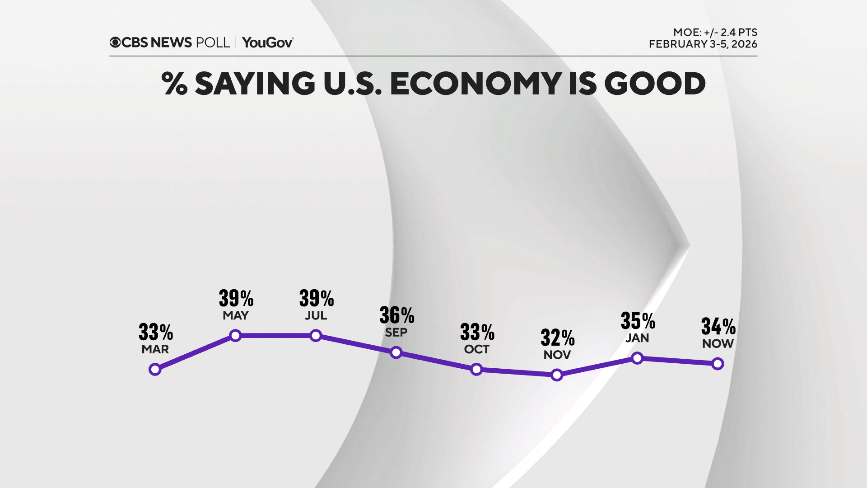

Total views of the financial system aren’t a lot modified of late. Most do suppose it’ll worsen, and the precise outlook nonetheless is not constructive: Only one in 5 suppose will probably be rising or booming within the subsequent 12 months.

Right now, most really feel the earnings hole between the richest and the center class is rising.

Spending

Amid the chilly climate and storms which have hit a lot of the nation recently, these at decrease earnings ranges say utility prices are troublesome or a hardship.

In the meantime, when it comes to discretionary purchases, these at comparatively decrease earnings ranges say they will be slicing again, whereas these with larger incomes say they will spend the identical.

This CBS Information/YouGov survey was carried out with a nationally consultant pattern of two,425 U.S. adults interviewed between February 3-5, 2026. The pattern was weighted to be consultant of adults nationwide in response to gender, age, race, and training, primarily based on the U.S. Census American Neighborhood Survey and Present Inhabitants Survey, in addition to 2024 presidential vote. The margin of error is ±2.4 factors.