By Erik Wasson and Steven T. Dennis, Bloomberg Information

The Republican-controlled Congress has been excellent to most of company America this 12 months. Foremost among the many boons is a $4 trillion tax lower package deal that prolonged and added beneficiant breaks for companies giant and small.

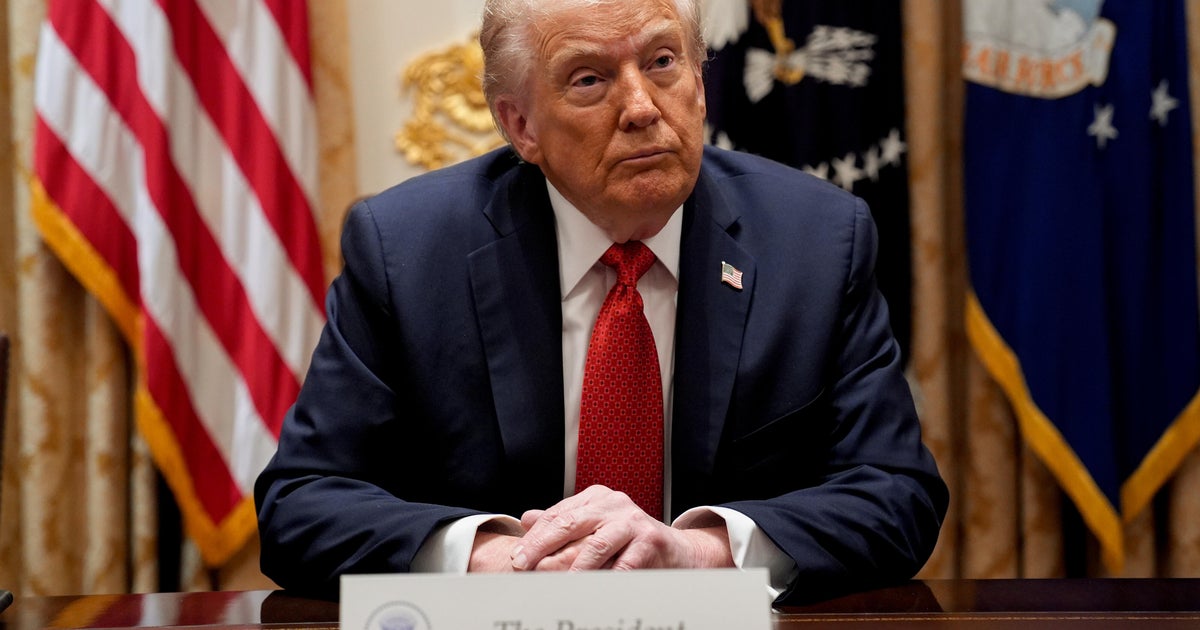

Nevertheless it hasn’t been all excellent news for U.S. corporations and a few industries have benefited greater than others. The legislative department’s acquiescence to President Donald Trump’s sharp tariff will increase raised enter prices throughout the economic system and provoked retaliatory strikes in opposition to U.S. farm exports.

The health-care sector, renewable vitality corporations and Las Vegas’s casinos have taken legislative hits whereas chipmakers, drug corporations and personal fairness fended off probably expensive congressional interventions.

Listed here are this 12 months’s winners and losers:

Winners

Nvidia

America’s most useful firm beat again influential Republican China hawks’ efforts to insert provisions in laws aimed toward guaranteeing U.S. corporations get first dibs on Nvidia’s merchandise. Chief Government Officer Jensen Huang’s visits to Congress and the White Home additionally helped pave the way in which for Trump administration actions easing export restrictions so the corporate may promote superior chips to Chinese language prospects.

Personal fairness

The battle to protect a tax break cherished by non-public fairness proved to be one of many uncommon cases this 12 months when congressional Republicans stood as much as Trump, rebuffing the president’s early calls for to boost taxes on carried curiosity.

The availability would have eradicated a decrease revenue tax price for a key portion of personal fairness executives’ compensation. PE corporations labored to squelch the change in tandem with enterprise capital and actual property partnerships, whose executives and dealmakers additionally profit. Higher but, non-public fairness additionally received an expanded curiosity expensing tax break.

Oil & gasoline

Vitality corporations secured a tax break value greater than $1 billion for oil and gasoline producers within the Trump tax package deal. The availability permits companies topic to a 15% company different minimal tax to deduct sure drilling prices when calculating their taxable revenue. Firms together with ConocoPhillips Co., Ovintiv Inc. and Civitas Sources Inc. lobbied in favor of it.

Crypto

Digital property corporations achieved a breakthrough with the passage of a light-touch regulatory legislation for dollar-pegged stablecoins, clearing the way in which for broader use of the expertise in on a regular basis finance. An business drive for a broader rewrite of securities and commodities legal guidelines to arrange favorable regulation of cryptoassets is transferring nearer to the end line. A $263 million marketing campaign battle chest the crypto business has amassed in super-PACs is bound to assist.

Pharma

Drug corporations principally succeeded in blocking legislative efforts to manage their hovering costs. Whereas Trump talked up requiring huge value cuts from pharmaceutical corporations, Republican leaders on Capitol Hill made no strikes to codify such a coverage. Nonetheless, the Senate’s affirmation of Well being and Human Companies Secretary Robert Kennedy Jr. empowered a foe of vaccine makers.

Tech giants

Expertise giants have stymied public stress for federal laws to manage social media and different tech merchandise amid rising concern over hurt to kids. Even so, the business to this point hasn’t been capable of safe a federal legislation blocking state regulation of synthetic intelligence. The Trump administration stepped in with an government order to override state AI rules, although that faces authorized challenges.

Monetary planners

The wealth administration business got here out forward when Senate Republican chief John Thune’s marketing campaign so as to add a repeal of the property tax to Trump’s tax legislation foundered. The tax overhaul saved in place the complicated loopholes that the wealthy make use of monetary planners to navigate on their behalf.

Protection & aerospace

The protection business thwarted efforts by Elon Musk’s DOGE group to chop army spending and scored huge will increase within the Pentagon funds. Trump’s huge tax and spending package deal included $150 billion in new protection spending.

A protection coverage invoice Congress simply handed got here in $8 billion above the White Home request. Notable beneficiaries embody Anduril Industries Inc., Palantir Applied sciences Inc. and Boeing Co. with the brand new F-47 fighter. A provision to permit the Pentagon to restore weapons methods with out paying contractors to take action was defeated.

Home automotive sellers

Automobile sellers received a tax break for mortgage curiosity on purchases of latest U.S.-built cars.

Massive companies

The $4 trillion Trump tax lower invoice prolonged a bevy of 2017 tax breaks that had expired. Producers received bonus depreciation for the price of manufacturing upgrades and a analysis and improvement tax break. Makes an attempt to pay for these by scaling again the company state and native tax deduction and to extend the inventory buyback tax had been crushed again by a heavy lobbying effort.

Small companies

The 2017 legislation that allowed pass-through companies to deduct as much as 20% of their certified enterprise revenue from their taxable revenue was completely prolonged.

Losers

Hospitals

A $50 billion bailout for rural hospitals included in Trump’s tax lower plan received’t offset the lack of funding from Medicaid cuts within the legislation. Thousands and thousands of Individuals will lose medical insurance within the coming years, in keeping with forecasts, resulting in a surge in uncompensated care in emergency rooms.

Well being insurers

Large insurers are in line to lose thousands and thousands of consumers with the expiration of enhanced Obamacare premium tax credit on the finish of this month. Fewer wholesome folks signing up for insurance policies additionally may additional hurt insurers’ backside traces. Whereas a bipartisan group of moderates in each events are attempting to resume the credit in January they face an uphill battle in opposition to Republican congressional leaders, who oppose the trouble.

Inexperienced vitality

The Trump tax invoice ended former President Joe Biden’s signature tax credit for photo voltaic, wind and different renewable vitality sources and curtailed the $7,500 shopper electrical car tax credit score for vehicles made by Tesla Inc., Rivian Automotive Inc. and Normal Motors Co. Renewable vitality corporations Sunnova Vitality Worldwide Inc., Photo voltaic Mosaic Inc. and Pine Gate Renewables LLC all filed for chapter safety this 12 months partly as a result of ending of tax incentives.

Banks

Crypto bros’ acquire is bankers’ loss because the stablecoin laws Congress handed this 12 months threatens the banking sector’s lengthy and worthwhile dominance of the funds system. Nonetheless, bankers’ congressional allies blocked votes on bank card competitors laws, which might lower into the almost $190 billion in swipe charges retailers pay yearly to banks, Visa Inc. and Mastercard Inc. Congress additionally repealed a Biden-era regulation limiting financial institution overdraft charges.

Casinos

Below the tax invoice, skilled gamblers would solely be capable to deduct 90% of their losses in opposition to their winnings, resulting in a state of affairs the place they might nonetheless owe revenue tax in the event that they break even over a 12 months or lose cash total. Main on line casino corporations are pushing to repeal the supply, fearing a drop-off in enterprise from their greatest prospects.

Airways

Airways misplaced lots of of thousands and thousands of {dollars} in ticket income in the course of the longest authorities shutdown in historical past because the Trump administration moved to curtail flights in the course of the congressional deadlock. Delta Air Traces Inc. alone estimated it took a $200 million hit from the shutdown.

Importers

Retailers and different importers stung by Trump’s tariffs bought little assist from lawmakers this 12 months, as Republicans largely sat again whereas the president claimed broad authority to rewrite the world’s buying and selling order. Home Speaker Mike Johnson, an in depth Trump ally, has to this point managed to delay a looming ground battle over the legality of the tariffs till a minimum of the top of January.

With help from Roxana Tiron, Ari Natter, Katanga Johnson and Emily Birnbaum.

©2025 Bloomberg Information. Go to at bloomberg.com. Distributed by Tribune Content material Company, LLC.