Financial institution of America and JPMorgan Chase are pledging to make an identical $1,000 contribution to their staff who open a Trump Account, a retirement financial savings plan introduced by the White Home final 12 months for youngsters born throughout President Trump’s second time period in workplace.

This system requires the federal authorities to start out every tax-preferred Trump Account for eligible children with $1,000, which might be invested within the inventory market on their behalf. To qualify for the accounts, youngsters have to be born within the U.S. between Jan. 1, 2025, and Dec. 31, 2028.

“JPMorganChase has demonstrated a long-term dedication to the monetary well being and well-being of all of our staff and their households all over the world, together with greater than 190,000 right here in the US,” CEO Jamie Dimon mentioned in an announcement on Wednesday. “By matching this contribution, we’re making it simpler for them to start out saving early, make investments properly and plan for his or her household’s monetary future.”

Financial institution of America additionally mentioned that it’s going to match the federal government’s $1,000 contribution for eligible staff. The corporate can even enable employees to make pre-tax contributions to their youngsters’s Trump Account.

“We applaud that the federal authorities is offering modern options for workers and households to plan for his or her future, and we welcome the chance to take part,” Financial institution of America mentioned.

Different firms and people have made comparable pledges to fund their employees’ Trump Accounts. Intel on Tuesday mentioned it would give its employees’ children a head begin by means of its contribution.

“By matching the federal authorities’s contribution, Intel is reinforcing our longstanding dedication to investing in our folks and increasing the methods we help staff’ households as they put together for the long run,” the corporate mentioned in an announcement.

In December, know-how entrepreneur Michael Dell and his spouse Susan mentioned they’d donate $250 to every Trump Account to 25 million American youngsters, a $6.25 billion funding.

Charles Schwab additionally mentioned final 12 months that it might seed worker Trump Accounts with $1,000, whereas BlackRock, BNY and Constitution Communications have made comparable guarantees.

When households can begin saving in a Trump Account

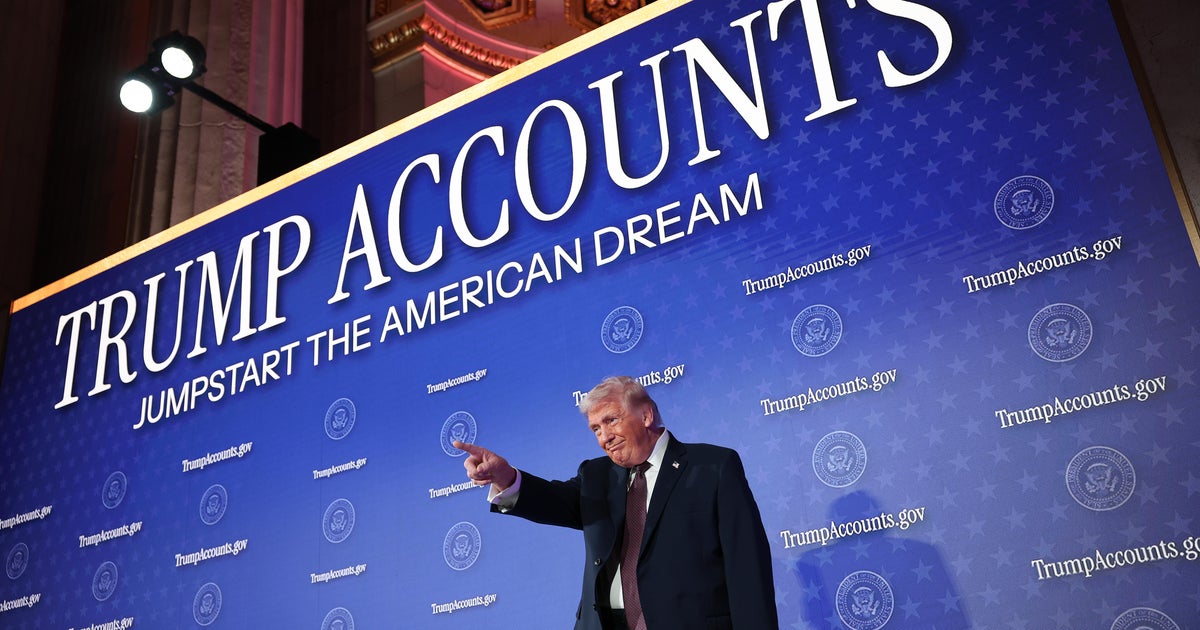

At a Treasury Division occasion selling the brand new funding car on Wednesday, Mr. Trump urged different U.S. employers to contribute to their employees’ Trump Accounts.

“Trump accounts will assist convey the hope and prosperity to each neighborhood,” he mentioned in touting the accounts as a approach for Individuals to economize to purchase a house, pay for faculty, put cash away for retirement and tackle different monetary wants.

Households can begin making monetary contributions to a Trump Account on July 4, in accordance to the Trump administration. Excluding the federal government’s $1,000 donation, a complete of $5,000 per baby may be deposited into an account every year.

“You bought $1,000 coming from the federal government that is going to be invested into an index fund,” U.S. Treasury Secretary Scott Bessent informed CBS Information’ Kelly O’Grady in an interview on Wednesday, including that “even when your baby would not get $1,000 from the federal government, you possibly can contribute in tax free. And we’ll have employers who’re contributing.”

Employers can contribute as much as $2,500 per 12 months to an worker’s account tax-free, which counts towards the $5,000 restrict. Most often, households can’t withdraw funds from a Trump Account earlier than a toddler turns 18.