00:04 Speaker A

Time now for our inventory of the day, Uncommon Earth shares. MP Supplies, the biggest uncommon earth producer within the Western hemisphere is down now after two straight days of beneficial properties and shutting Monday at a recent document excessive. The sector although, has been up since Friday on experiences that China is including new export restrictions on uncommon earth minerals. That is stoking one other spherical of commerce tensions between the world’s two largest economies. China controls almost 70% of world uncommon earth mining and near 90% of processing capability. Meaning any coverage transfer from Beijing can shortly ripple throughout industries from electrical automobiles and clear vitality to even the chips that energy AI. Nonetheless with me is my spherical desk for for immediately, Lale Akoner, Michael O’Rourke, and Brooke DiPalma. And Brooke, I wish to begin with you right here on the strikes that we’re seeing in a few of these uncommon earth shares as a result of lots of these coverage linked trades, they’re gaining lots of of consideration this week.

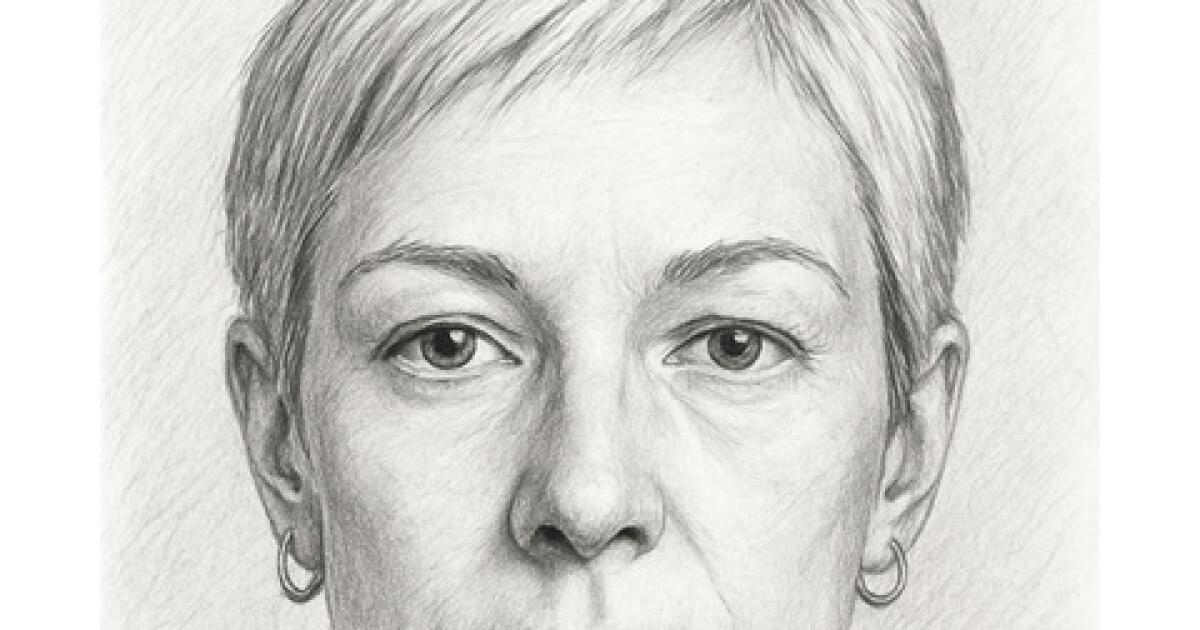

01:02 Brooke DiPalma

Yeah, we have seen some main strikes in the case of these uh uncommon earth shares over the course of those previous two days. We had essential metals leap greater than 36% within the pre-market buying and selling. US uncommon earth was up about 11%, MP supplies up about 8%, in addition to others like vitality fuels and Neo Corp additionally rose about 14 to fifteen%. And this actually is predicated upon this notion that uh Beijing’s new export controls on uncommon Earth are actually designed to primarily pressure the US to drop these restrictions on promoting these chips to China. And so it truly is a part of this bigger dialog present process and the affect that these uncommon earth uh, , restrictions can have and traders actually seeking to acquire in the case of these uh particular shares as effectively.

01:54 Speaker A

Now Lale, you have mentioned China’s uncommon metals ban might dampen the AI revolution. Stroll me by means of a few of that concern and the broader implications there.

02:07 Lale Akoner

Positive, I feel to begin with, the market does um suppose that really this might set off a concern of of a provide squeeze if you’ll. Um the truth that they’re clearly very dominant in in these exports. And likewise the market is pricing in that the US will merely should speed up um its efforts to construct an unbiased uh uncommon earth um provide chain. And these are essential uh supplies clearly for magnets utilized in EVs, in protection, in AI, and and and in essential tech. And due to this fact you might see that the market is being um a bit of cautious by way of how they value in its impact on on on the large tech. I additionally see um investor sentiment um being affected by this notion of capital rotating into the extra actual belongings which have strategic utility and therefore the capital movement that we’re seeing in the mean time. However sure, I feel the volatility does inform us that the market is worried about what it will imply within the quick time period for the for the AI commerce.

03:22 Speaker A

And talking of volatility, crypto has been on the transfer fairly aggressively since these renewed US-China commerce tensions. And that is coming as gold is at a document excessive. Michael, you have been writing in regards to the so-called debasement commerce, which is actually traders shedding confidence in central banks and shifting in the direction of laborious belongings. Is crypto a part of that story in any respect?

03:49 Michael O’Rourke

Properly, it has been a part of that story and been a part of that commerce, however I really suppose that commerce might be has much more hype to it than substance. So, like I mentioned, there there are underlying notions there, whether or not it’s, , anticipated Central Financial institution easing, um whether or not it’s, , these geopolitical issues, whether or not it is fears about devaluation of the greenback or, , American exceptionalism being over. Um what we have seen is that this euphoric run, particularly in issues like, , gold and silver, clearly each hit one other set of document highs this morning. However , I feel lots of this, , goes again to the pandemic in 2020, when the Central Financial institution wound up doing an enormous QE program, doubling its greater than doubling its steadiness sheet. And the place we’re we’re immediately is we’re reversing that course of. You simply do not see it each day. However that has, , that insecurity in governments. and once more, that goes from every little thing from the elections we see to authorities shutdowns, the shortage of the lack for governments to go budgets, has fueled this commerce to this point this summer time.

05:06 Speaker A

Proper. into this fall.