On November 19, President-Elect Donald Trump introduced that Howard Lutnick, CEO of Cantor Fitzgerald and co-chair of his transition crew, can be his nominee for Commerce Secretary. Lutnick’s firm Cantor Fitzgerald and its subsidiaries are multinational in scope, promote the implementation of the United Nations’ Sustainable Improvement Objectives (which have main implications for debt politics and financial exercise), and are even straight partnered with overseas state-owned corporations that lately got here underneath scrutiny following the discharge of the contents of the laptop computer of the present (and lately pardoned) First Son, Hunter Biden.

Lutnick had beforehand been angling for a job as incoming Treasury Secretary, an unsurprising ambition given Cantor Fitzgerald’s outsized position within the U.S. Treasury market (i.e. the U.S. authorities debt market) and its relationship to greenback stablecoins, that are quickly changing into one of many important purchasers of U.S. debt. It’s unknown at the moment why Lutnick was handed over for Treasury, regardless of endorsement for the place from Elon Musk and RFK Jr., and appointed to Commerce as a substitute. Nonetheless, Trump’s earlier Commerce Secretary, Wilbur Ross, was extensively believed to have been given the position to repay a previous favor of main significance. In Ross’s case, it was his help in rescuing Trump from chapter within the early Nineties. On the time, Ross labored for Rothschild Inc., and when clarifying why the European banking dynasty had bailed out the long run President, Ross acknowledged “the Trump title continues to be very a lot an asset.” Shortly earlier than, Rothschild Inc. had been bankrolling the entry of Robert Maxwell, intelligence asset for Israel and arguably the Soviet Union, into the American economic system, with a selected deal with New York Metropolis.

Throughout and following the marketing campaign, Lutnick has been a significant supporter of Trump’s potential plan to implement an in depth tariff regime in lieu of revenue tax. If confirmed, Lutnick may even oversee the approval of the export of delicate know-how of nationwide safety curiosity overseas, negotiate free commerce agreements, and oversee the patents workplace, amongst different roles. Whereas mainstream stories on his appointment have famous his “hawkish” commerce stance with China and his connections to the cryptocurrency company, a lot has been not noted about Lutnick, his present enterprise entanglements and historic connections to intelligence networks which have sought to undermine the Commerce Division particularly to facilitate the switch of delicate U.S. navy know-how to ostensible adversary states, like China.

Satellogic: Commentary is Preservation

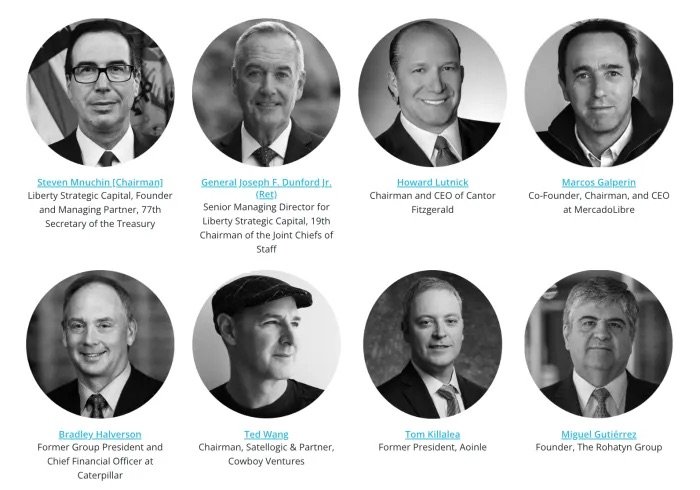

In exploring these points, it’s helpful to have a look at one firm now intently tied to Lutnick – Satellogic. Lutnick sits on Satellogic’s board, as does former Treasury Secretary from the earlier Trump administration Steve Mnuchin and former head of the Joint Chiefs of Employees underneath Trump, Common Joe Dunford. Mnuchin and Dunford invested closely in Satellogic via the personal fairness they now work for, Liberty Strategic Capital. Mnuchin has led that agency since its founding. Liberty Strategic Capital’s first funding was in a controversial Israeli intelligence-linked cybersecurity agency referred to as Cybereason. Cybereason’s co-founder and CEO Lior Div has described Cybereason as a continuation of his work in Israeli intelligence outfit Unit 8200, the place Div labored on offensive cyber assaults focusing on overseas nations. The agency turned controversial within the lead-up to the 2020 election for simulating, together with U.S. safety companies like DHS, the mandatory threshold of cyberattacks that might induce the cancellation of a U.S. presidential election and the imposition of martial legislation. Lutnick himself has important ties to Israel and is a widely known billionaire mega-donor to Israeli and Zionist causes (mentioned intimately later on this article).

Satellogic, for its half, employs a former Israeli intelligence officer, Aviv Cohen, as its head of “particular initiatives.” Cohen beforehand co-founded Fraud Sciences Corp. with Unit 8200 alum Saar Wilf, which was later bought to PayPal and now types the “back-bone” of its anti-fraud algorithm. Previous to that, Cohen labored for Core Safety Applied sciences, the agency beforehand co-founded by Satellogic’s co-founders that contracted for quite a few U.S. intelligence and navy companies. Since we reported on Cohen’s ties to Satellogic earlier this yr in April, Satellogic has made Aviv Cohen’s biography on the corporate web site personal.

In an interview with Bloomberg in January 2022, Lutnick and Mnuchin expressed the reasoning behind their enterprise into Satellogic through Liberty Strategic and CF Acquisition Group V, a subsidiary of Lutnick’s Cantor Fitzgerald. “We felt that area and the satellites particularly is absolutely the subsequent coming gigantic marketplace for knowledge,” defined Lutnick. “I imply, to have pictures of the entire Earth – knowledge on the entire Earth – the quantity of selections that may unlock, and the flexibility and the economics of how that may unlock, was extraordinary.” Lutnick furthered that their proprietary lens know-how permits clients of Satellogic to “depend the containers on the ships,” “depend the vehicles,” “depend the timber,” or “depend the variety of [panels] working and what’s not working in a photo voltaic farm,” which “unlocks an enormous, huge sea of alternative in marketplaces.”

In the identical interview, Mnuchin expressed comparable pleasure concerning the alternatives downstream of such detailed Earth observational know-how, however with a telling perception on how mentioned knowledge, when paired with synthetic intelligence, can advance the pursuits of the nationwide safety state and enhance government-led markets. “We’re very centered on investments the place not solely can we convey capital however we are able to convey our experience. And we’re significantly centered on the know-how space, nationwide safety, and different types the place we are able to add loads of worth,” Mnuchin articulated. “So what we preferred about that is nice know-how, very scalable, very reasonably priced, and the mix of getting loads of knowledge with loads of AI actually will allow each very large authorities markets, and extra importantly, very large business markets.”

Lutnick’s Cantor Fitzgerald, considered one of 24 major sellers of the New York Federal Reserve, isn’t any stranger to taking part within the financing of the information dealer trade, having given $100 million in fairness financing to Close to Intelligence Holdings’ effort to go public in Might 2022. Close to was based by Idealab’s Invoice Gross, the primary institutional investor in PayPal, and at the moment boasts being “the world’s largest supply of intelligence on individuals, locations and merchandise.” An October 2023 report by the Wall Avenue Journal revealed that Close to had “supplied knowledge to the U.S. navy through a maze of obscure advertising and marketing firms, cutouts, and conduits to protection contractors.”

Whereas Close to enterprise mannequin operates within the shadows, feeding off knowledge scraped from intelligent promoting mechanisms and unread consumer agreements behind cell functions, Satellogic is straight attacking the billions of potential income from “creat[ing] all new forms of markets” downstream of “scalable, reasonably priced imagery,” in accordance to Mnuchin. Lutnick, in the identical dialog with Bloomberg, boasted that Satellogic can “take a video from area of greater than a minute of an airport and let you know the model of aircraft that’s taking off,” in his argument that “this sort of knowledge is such a giant market.” Lutnick added that “imagery from satellites” is “one of many world’s nice marketplaces.” Echoing that very same line of considering, the previous Treasury Secretary acknowledged that he views Satellogic “as extra of an information firm than essentially only a area firm,” which might leverage “huge quantities of information” with the intention to “actually analyze local weather points, vitality provide, meals safety,” and “provide chains.”

With reference to local weather points, Lutnick claims that Satellogic’s know-how will “lastly finish the idea of local weather change” by “actually remap[ing] the Earth daily.” The dying of the particular idea of local weather change alluded to by Lutnick seemingly refers back to the popularized “left wing” modeling of the local weather emergency, versus the possible incoming “proper wing” carbon market, as articulated in earlier reporting from Limitless Hangout. An unstated wrinkle within the pricing of carbon, as proposed independently by Lutnick and fellow-Trump advisor Elon Musk, is the greenback denomination and thus the implications on the sale of United States’ Treasuries. In an concept to be explored later on this article, a carbon market denominated in {dollars} could not remedy the “local weather disaster,” but it surely simply may assist remedy the ever-looming debt disaster.

This place has already been taken by Lutnick’s Tether, because the buying of presidency bonds by the stablecoin issuer regularly will increase in quantity and stays poised to change into systemically vital, as coated in earlier reporting by Limitless Hangout. Whereas Lutnick’s immense connection to the Treasury market – whether or not via Cantor Fitzgerald itself or its custodial relationship and funding in Tether – led many to imagine he was in place to change into Treasury Secretary, Trump picked him for Commerce Secretary, and thus positioned him in a administration place over many public sector entities straight associated to his private-sector actions akin to Satellogic.

The “very sturdy, patentable know-how” constructed by Satellogic, as defined by Mnuchin, takes on a brand new that means with the appointment of Lutnick to the Division of Commerce (DOC), because of the DOC administration of the U.S. Patent and Trademark Workplace (USPTO). That is removed from the one battle of curiosity inside Lutnick’s enterprise into the general public sector, because the DOC manages many bureaus straight impacted by the proliferation of a U.S.-based, private-sector Earth commentary firm akin to Satellogic. Among the dozen bureaus underneath the DOC related to Satellogic – to not point out Lutnick’s place throughout the digital asset area through Cantor’s relationship with Tether – embody the Bureau of Financial Evaluation (BEA), the Bureau of Business and Safety (BIS), the Worldwide Commerce Administration (ITA), the Nationwide Technical Info Service (NTIS), and the Nationwide Telecommunications and Info Administration (NTIA), to not point out the aforementioned NOAA, and USPTO.

Apparently, the DOC additionally established the U.S. AI Security Institute devoted to upholding the asks throughout the October 2023 Biden-Harris govt order on “the Secure, Safe, and Reliable Improvement and Use of Synthetic Intelligence.” In October 2024, the Biden-Harris administration issued the primary ever nationwide safety memorandum on AI, empowering the DOC to “harness energy of AI for U.S. nationwide safety.” Earlier U.S. government-sponsored commissions, such because the Nationwide Safety Fee on AI, had concluded that it was obligatory to make sure U.S. navy and financial hegemony by forcing American customers off of “legacy methods” and onto AI-powered options, lest American AI firms lag behind their Chinese language counterparts, significantly within the fields of e-commerce and finance. Additionally they made the case for elevated, AI-powered mass surveillance – akin to that facilitated by Satellogic – as a method of advancing this trigger.

In August 2021, the Lutnick-linked Tether, through its subsidiary Northern Information, bought over 223,000 GPUs (graphical processing items) utilized in AI computing from the cryptocurrency agency block.one, which was based by Tether co-founder Brock Pierce. A month later, the stablecoin issuer spent practically half a billion {dollars} buying Bitcoin miners from block.one in a deal facilitated by Christian Angermeyer, a long-time good friend of Palantir’s Peter Thiel. Palantir, which has long-standing and really shut ties to the CIA, is a Satellogic accomplice and Palantir co-founder Joe Lonsdale donated closely to Trump (as did Palantir itself) whereas Thiel has extraordinarily shut ties with the incoming Vice President J.D. Vance.

Since Lutnick’s Cantor Fitzgerald helped take Satellogic public through SPAC, Satellogic – based in Argentina and beforehand primarily based in Uruguay – has now redomiciled in the USA in an effort to acquire profitable authorities contracts. The corporate’s transfer to Delaware was prompted by Satellogic’s poor financials after going public. Nonetheless, authorities contracts have been sluggish to look for the agency, with Satellogic securing its first authorities contract with NASA simply this previous September. Nonetheless, a Lutnick-run Commerce Division may alter Satellogic’s possibilities in securing future contracts. This battle of curiosity between Lutnick’s personal sector dealings along with his newfound authorities appointment was famous by Politico in October 2024, which claimed that Lutnick was “improperly mixing his enterprise along with his duties standing up a possible administration.” In response to the report, Lutnick took conferences on Capitol Hill underneath the guise of transition crew issues, then “allegedly us[ed] the chance to speak about issues impacting his funding agency, Cantor Fitzgerald,” which additionally included “high-stakes regulatory issues involving its cryptocurrency enterprise.”

This battle of curiosity is notable partly as a result of a number of the bureaus Lutnick will oversee as Commerce Secretary, such because the NOAA, are targets of Satellogic’s contracting ambitions. For example, Satellogic markets itself as in a position to measure carbon emissions from area and has promoted its current NASA contract as a part of the federal government effort to focus on local weather change. NOAA and different companies housed underneath the Commerce Division accumulate local weather knowledge for the U.S. authorities. As might be famous once more shortly, Lutnick was an early pioneer of digital carbon emissions buying and selling and his firm is a significant advocate for the implementation of the UN’S SDGs, a part of an over-arching UN-supported plan that features utilizing area satellites to measure carbon emissions.

Final yr, the NOAA granted Satellogic a distant sensing license, serving to safe “Satellogic’s technique to capitalize on high-value alternatives within the U.S.,” particularly because it pertains to U.S. authorities contracts. The license grants Satellogic NOAA oversight and the flexibility to safe contracts with U.S. protection and intelligence companies, a significant objective of the corporate per Satellogic president Matt Tirman.

Satellogic was co-founded in 2010 by CEO Emiliano Kargieman and CTO Gerardo Richarte after spending “a while” on the NASA Ames Campus in Mountain View, CA. Each Kargieman and Richarte beforehand labored for Core Safety Applied sciences, which was co-founded by Kargieman and boasted nationwide safety state purchasers akin to Homeland Safety, NSA, NASA, Lockheed Martin, and DARPA. In 1998, Core Safety was acknowledged as an “Endeavor Entrepreneur” by the Endeavor Basis, whereas Satellogic’s eventual seed spherical increase was funded by Endeavor’s Santiago Pinto Escalier, along with Ariel Arrieta and NXTP Ventures, and the Kargieman-advised Starlight Ventures. Kargieman later based Aconcagua Ventures in a three way partnership with Craig Cogut’s Pegasus Capital, and served as a Member of the Particular Initiatives Group on the World Financial institution. Pegasus Capital turned the primary funder of Satellogic-partner CC35, a gaggle in search of to impose a fraudulent carbon market on a lot of Latin America, as coated in earlier reporting from Unlimited Hangout.

One other Core Safety Applied sciences worker that migrated to Satellogic with Kargieman and Richarte is Aviv Cohen, the aforementioned ex-Israeli intelligence officer who’s now Satellogic’s head of “particular initiatives.” Chinese language tech large Tencent, which owns a big stake in Elon Musk’s Tesla, additionally invested in Satellogic’s Sequence A, as did Endeavor Catalyst, which is run by LinkedIn/PayPal’s Reid Hoffman, and Valor Capital, whose companions embody figures tied to U.S. navy and intelligence actions in Latin America, a former CEO of PayPal, in addition to CBDC improvement on the continent. Valor can also be suggested by Brian Brooks. Brooks was a former worker at OneWest Financial institution alongside Mnuchin, and was made Performing Comptroller of the Forex in Might 2020 through Mnuchin’s designation, the place he launched “regulatory initiatives that supplied banks with the inexperienced mild to supply cryptocurrency custody companies and stablecoin cost methods.”

In February 2022, Palantir – a non-public sector intelligence agency led by PayPal-founder Peter Thiel and created with CIA funds to exchange a controversial DARPA mass surveillance and data-mining program – dedicated to a 5 yr strategic partnership with Satellogic. Satellogic’s partnership with Palantir permits its “authorities and business clients”, which embody the CIA and J.P. Morgan, entry to Satellogic’s Aleph platform APIs to feed uncooked satellite tv for pc imagery to Palantir’s MetaConstellation and Edge AI. This partnership builds on a earlier collaboration between Satellogic and Palantir to “discipline distinctive AI capabilities to the orbital edge,” together with “stay upgrades to the satellite tv for pc’s onboard AI” that allows “an ultra-low-latency maritime use-case.” Palantir and Satellogic clients, which embody the Pentagon’s House Techniques Command, House Power, SpaceX, the federal government of India, and others, will quickly have entry to the Edge AI platform operating on Satellogic satellites “to supply clients tailor-made AI insights.” That is anticipated to extend Satellogic’s enterprise of “knowledge merchandise, streamline pipeline administration, and additional scale buyer supply required for weekly and day by day world remaps.” A few of their clients, like the federal government/navy of Ukraine, have been making use of each Palantir and Satellogic “insights” on to the battlefield for over two years. This underscores that Satellogic’s know-how is clearly meant to be used in each civilian and navy settings.

Epstein Entanglements

In 2022, Satellogic signed a far-reaching settlement with Elon Musk’s SpaceX, itself a significant U.S. navy and intelligence contractor. SpaceX stays Satellogic’s “most well-liked launch supplier” for launching its satellites into near-Earth orbit. Throughout the marketing campaign and for the reason that election, Lutnick and Musk have collaborated extensively, with Musk even endorsing Lutnick for his most well-liked nomination as Trump’s incoming Treasury Secretary.

Notably, Musk’s SpaceX was allegedly infiltrated by Lutnick’s former next-door neighbor, intelligence asset, pedophile and sexual blackmailer Jeffrey Epstein. Epstein reportedly launched a member of his “entourage” to Musk’s brother Kimbal, then on the board of SpaceX. That younger girl, who had beforehand “dated” Epstein and lived on the 301 66th St East house complicated now recognized to have housed girls Epstein trafficked, then dated Kimbal Musk from 2011 to 2012. As a consequence, the connection with Kimbal “introduced Epstein into contact with the Musk household and its companies.” This allegedly culminated in Epstein touring SpaceX amenities in 2012, a declare a SpaceX legal professional very belatedly denied after the incident was first reported by Enterprise Insider. Kimbal Musk can also be on the board of one other of his brother’s firms – Tesla – and, previous to his 2019 arrest, Epstein confirmed claims from sources that he was privately advising Tesla in 2018 to journalist James Stewart. After Epstein was notorious, Musk denied the claims. Per Stewart, Epstein was apparently a part of the tried deal to take Tesla personal with Saudi cash in 2018. Epstein was additionally a really shut advisor at the moment to the then and present de facto chief Muhammad bin Salman. Since then, an Epstein affiliate turned enterprise capitalist, Nicole Junkermann, has change into a important investor in SpaceX.

As well as, Elon Musk himself was subpoenaed as a part of the now-shuttered USVI lawsuit in opposition to the financial institution JP Morgan for its position in facilitating Epstein’s crimes and is understood to have socialized with Epstein and Ghislaine Maxwell on a number of events previous to Epstein’s 2019 arrest and dying later that very same yr. In a single such assembly, brokered by LinkedIn co-founder Reid Hoffman, Musk was reported to have launched Epstein to Mark Zuckerberg of Fb/Meta. Musk additionally attended the Edge Basis’s “billionaire dinners,” which courted high figures in Silicon Valley and operated as a de facto entrance for an Epstein-run affect operation for a number of years, coinciding with the genesis of the “billionaire dinners.” Moreover, Richard Sorkin, the CEO of Elon and Kimbal Musk’s first firm Zip2, joined an Israeli intelligence-linked tech firm headed by Ghislaine Maxwell’s sister Isabel Maxwell shortly after the sale of Zip2 to Compaq in 1999.

As well as, Musk shares some enterprise hyperlinks to Epstein associates. For example, a significant provider to Tesla, LS Energy (through its subsidiary EVgo), and its affiliated hedge fund Luminus Administration are intently linked to Jonathan Barrett, who was a managing director of LS Energy and has led Luminus Administration since 2011. Barrett additionally held a number of different senior roles at LS Energy between 2003 and 2008. Barrett is a former protégé of Jeffrey Epstein’s who began his profession working at Epstein’s agency J. Epstein & Co. and in addition turned the CFO and Vice President of Ossa Properties, the true property agency run by Epstein’s brother Mark and co-founded by Barrett’s brother Anthony. Barrett listed his authorized deal with for a few years as being 301 66 St East in Manhattan, an house complicated that’s majority owned by Ossa that housed lots of the girls actively being trafficked by Jeffrey Epstein and which was frequented by Epstein’s associates, together with a number of who stayed in a single day, like former Israeli Prime Minister Ehud Barak.

LS Energy, the place Barrett was a high govt, has been investigated “for fraudulent conveyance of belongings” in a number of chapter instances. As well as, LS Energy’s founder, Mike Segal – whose son Paul is now the agency’s CEO, did enterprise with the Bufalino crime household. Luminus Administration was additionally the biggest shareholder in Valaris, which bought $650 million in oil rigs to Musk’s SpaceX in 2020. As well as, one other agency intently linked to Luminus – Luminus Capital Administration and the Luminus Capital Companions Grasp Fund – counts Alex Erskine as a director. Erskine was beforehand a director for the Jeffrey Epstein-chaired monetary automobile Liquid Funding, which was partially owned by Bear Stearns earlier than its collapse throughout the 2008 monetary disaster.

As lately famous, Howard Lutnick was the long-time next-door neighbor of Epstein’s now notorious New York townhouse at 9 E. 71st St. Lesser recognized maybe, is Epstein’s lengthy historical past with that property and that connection of the entity that finally bought the house to Lutnick. Lutnick’s deal with, 11 E. 71st St., was first bought by a Leslie Wexner-controlled entity referred to as SAM Conversion Corp in 1988, a yr earlier than the 9 East 71st Avenue Corp. (of which Epstein was president) purchased the neighboring dwelling. In 1992, SAM Conversion Corp. – with Epstein now its Vice President – bought the 11 E 71st St property to the 11 East 71st Avenue Belief – the place Epstein was a trustee – for “ten {dollars} and different precious consideration paid by the get together of the second half,” in response to Crain’s New York. Throughout this time, Leslie Wexner “refurbished” the property at 9 E. 71st St. for tens of thousands and thousands of {dollars}, which included including an uncommon “safety system” reportedly later used to file movies, allegedly for the needs of blackmail, as soon as Epstein inhabited the residence. It’s unknown if comparable “refurbishments” have been made to the neighboring home later purchased by Lutnick that was additionally underneath Epstein/Wexner management on the identical time.

In 1996, with Epstein already inhabiting 9 E. 71st St. for at the very least a yr, the neighboring dwelling at 11 E. 71st St. was bought to Comet Belief for “ten {dollars} and different precious consideration.” Some stories have urged the value paid for the house was round $6.2 million. The trustee of Comet concerned within the sale was Guido Goldman, the son of well-known Zionist Nahum Goldman, a really shut good friend of Henry Kissinger and founding father of the German Marshall Fund, which later spawned the controversial Alliance for Securing Democracy. Goldman was additionally the obvious liaison between the Council on Overseas Relations (CFR) and the CIA. On the time the sale was made to Goldman and the Comet Belief, Epstein was additionally a part of the CFR and, in response to a 2001 report within the UK’s Night Commonplace, advised people who he had as soon as labored for the CIA.

The Comet Belief was considered one of three trusts established “for the good thing about descendants of the late Minda de Gunzberg,” who was born Minda Bronfman and was the sister to Charles and Edgar Bronfman. Their father, Sam Bronfman, constructed the household liquor empire largely to his ties to organized crime components throughout the American Prohibition period. Charles Bronfman co-founded the “Mega Group” with Leslie Wexner in 1991, which spawned Birthright Israel, a corporation that counts the Lutnicks as amongst their high donors. As well as, Edgar Bronfman was arguably the primary participant within the insider buying and selling scandal that allegedly resulted in Epstein leaving Bear Stearns in 1981. Edgar’s son, Edgar Jr., additionally seems in Epstein’s black ebook of contacts and Edgar’s daughters, Sara and Clare, have been central figures within the NXIVM intercourse cult scandal. The Comet Belief later bought the house to Howard Lutnick, once more for “10 {dollars} and different precious consideration” and Lutnick took out a $4 million mortgage on the property the identical day the sale was made. Lutnick has by no means publicly commented on his property’s historical past or any data concerning his relationship along with his former next-door neighbor.

Notably, Edgar Bronfman Jr. closely funds and chairs the start-up accelerator community, Endeavor, which backs Satellogic, amongst different firms. One other main backer of Endeavor is Pierre Omidyar, a significant donor to Clinton and Obama with a protracted historical past of collaborating with U.S. intelligence. (Lutnick himself was a significant donor to Clinton’s 2016 presidential marketing campaign and has lengthy backed a wide range of Democrats earlier than deciding to again Trump comparatively lately.)

As well as, alongside Lutnick on Satellogic’s board is Marcos Galperin, Argentina’s richest man, who is taken into account Endeavor’s earliest success story and who maintains shut ties to the group. Endeavor targets rising market start-ups particularly and can also be very intently linked to a detailed affiliate of Jeffrey Epstein’s, LinkedIn co-founder Reid Hoffman. One other main determine within the Endeavor community is Eduardo Elzstain, an Argentine oligarch who – like many different Argentines linked to Endeavor – has cultivated shut ties to present president of Argentina Javier Milei. Elzstain, a long-time affiliate of George Soros, hosts the Argentine equal of Bilderberg – the annual, closed-to-the-public Llao Llao Discussion board which is frequented by members of Endeavor Argentina. Elzstain can also be on the board of the WJC – whose long-time president was Edgar Bronfman Sr. Elzstain additionally boasts shut ties to the apocalyptic-messianic Chabad Lubavitch motion, which has important ties to Donald Trump, Trump’s son-in-law Jared Kushner, and in addition to Howard Lutnick.

Lutnick and the Seek for Greenback Debt Sinks

Along with being backed by Endeavor, Satellogic is now additionally backed by Tether, which boasts vital ties to Lutnick. Cantor, which is “majority-owned by its CEO Lutnick,” was lately revealed to be a 5% proprietor of Tether after a $600 million funding, in response to reporting from The Wall Avenue Journal. The assumed largest shareholder of Tether, co-founder Giancarlo Devasini, reportedly advised the paper that “Lutnick will use his political clout to attempt to defuse threats dealing with Tether.”

Whereas already pegged for Commerce Secretary and verbally dedicated to stepping down as CEO at Cantor upon Senate affirmation, Lutnick is at the moment working intently with Trump by “vetting candidates for different high authorities jobs that would contain supervising Tether.” Whereas naturally the regulation on stablecoin issuers would have profound implications for Tether and its minority-owner Cantor, the significance of this blossoming trade as a net-buyer of presidency bonds in an period of excessive inflation (and $36 trillion in already-issued debt) pegs Tether and its ilk as systemically vital to the USA authorities’s survival.

To ensure that an incoming Trump administration to efficiently meet the calls for of their congressional price range, whereas additionally servicing our compounding trillions in debt already owed, the Treasury must discover a keen purchaser for that newly issued debt. Within the previous 18 months, a brand new excessive quantity internet purchaser of this debt has appeared within the type of stablecoin issuers, akin to Tether or Circle, which have bought over $150 billion of U.S. debt within the type of securities issued by the Treasury with the intention to “again” the issuance of their dollar-pegged tokens with a dollar-denominated asset. For some perspective, China and Japan, traditionally the U.S.’ largest collectors, maintain just below and simply over $1 trillion, respectively, in these identical debt devices. Regardless of solely present for a decade, and solely surpassing a $10 billion market cap in 2020 – the identical yr Trump’s OCC handed a bulletin permitting U.S. banks to carry stablecoins – Tether is already earmarked for over 10% the Treasuries held by both of the U.S.’ largest nation-state collectors. As beforehand talked about, Tether’s spectacular stash of Treasuries are custodied by Lutnick’s Cantor.

Utilizing stablecoins as a way to mitigate the U.S. debt drawback has been circulating amongst Republicans for a while, together with former Speaker of the Home Paul Ryan, who articulated this precise sentiment in a current op-ed with The Wall Avenue Journal titled “Crypto Might Stave Off a U.S. Debt Disaster.” Ryan claims that “stablecoins backed by {dollars} present demand for U.S. public debt” and thus “a strategy to sustain with China.” He speculated that “the [debt] disaster is prone to begin with a failed Treasury public sale,” which in flip results in “an unsightly surgical procedure on the price range.” The previous Speaker predicted that “the greenback will undergo a significant confidence shock” and in consequence asks, “What will be accomplished?” His reply is to “begin by taking stablecoins significantly.” Tether’s CEO Paolo Ardoino echoed this sentiment, referring to Tether as “the most effective good friend of the U.S. authorities,” attributable to “maintain[ing] extra U.S. Treasury securities than Germany, way more than some other competitor or some other monetary establishment on this planet.” Tether additionally notably is partnered with U.S. companies just like the FBI and Secret Service.

Greenback-backed stablecoins are arriving as “an vital internet purchaser of U.S. authorities debt,” Ryan notes, with stablecoin issuers now the 18th largest holder of U.S. Debt. Ryan goes on to say that “if fiat-backed greenback stablecoin issuers have been a rustic,” that nation “would sit simply outdoors the highest 10 in international locations holding Treasurys,” nonetheless lower than Hong Kong however “bigger than Saudi Arabia,” the U.S.’ former accomplice within the petrodollar system. Ardoino articulated that Tether is “glad to decentralize the possession of the U.S. debt, making the U.S. way more resilient.”

Satellogic, and thus Tether and Cantor, are additionally concerned within the improvement of carbon markets and predatory local weather finance endeavors. Cantor was a pioneer of digital carbon emissions buying and selling and continues to advertise local weather finance in addition to implementation of the UN’s Sustainable Improvement Objectives (SDGs). Satellogic positions itself as in a position to measure carbon emissions from area, a coverage supported within the UN doc “Our Frequent Agenda” and has begun to try to do that through GREEN+, as coated in earlier reporting by Limitless Hangout.

NOAA, which granted Satellogic a license and which Lutnick will oversee, collects local weather knowledge for the federal government and the Commerce Division typically would play a significant position in establishing any type of “carbon pricing,” whether or not a carbon market, as Satellogic helps to construct, or a carbon tax, a coverage lengthy supported by outstanding Trump backers like Elon Musk. Naturally, the promotion of a carbon tax –tellingly proposed by one of many world’s richest males who additionally occurs to personal the biggest EV firm on this planet – would merely additional the category divide that at the moment exists in the USA, with the wealthy having no issues upgrading to emission-free automobiles nor assembly the bills introduced on by such a tax system. The precise enforcement, and thus the profitable creation, of such a proposal requires precisely the kind of knowledge supplied by an Earth commentary firm – a discipline by which Satellogic stands considerably alone.

Carbon pricing is solely not doable with out government-vetted, correct measurements of carbon molecule density, and thus the marketplace for dependable knowledge service suppliers has quietly been dominated by Satellogic. Because the debt devices of the personal sector evolve alongside the proliferation of blockchain know-how, the information that makes these good contracts execute to finally settle not goes to a human arbitrator, however somewhat a consciousness-free protocol that reduces a pair of potential outcomes to a single output. This oracle and settlement protocol is seemingly poised to be the blockchain, at the very least that’s the argument made on this piece, and exemplified by lots of the associates and companions of Satellogic, together with Lutnick. These novel inexperienced finance devices will be upheld and paid out by blockchains and good contracts, together with the Bitcoin-sidechain Rootstock, which was listed on paperwork as being one other accomplice of GREEN+ alongside Satellogic and CC35.

Moreover, akin to within the case of Satellogic accomplice O.N.E. Amazon, entities can create completely new blockchain protocols to subject and uphold settlement of tokenized “actual world belongings,” often called RWAs. O.N.E. Amazon is chaired by Peter Knez, who oversaw the creation of ETFs (alternate traded funds) whereas heading Barclay’s iShares division. iShares is now owned by BlackRock after being bought within the aftermath of the 2008 monetary disaster, and options the quickest rising ETF in historical past, the iShares IBIT Bitcoin ETF.

O.N.E. Amazon goals to create “sustainable affect for the surroundings and buyers through the use of next-generation know-how to convey innovation to conservation.” The “innovation” O.N.E. Amazon affords is associated to its issuance of a capped-supply of “regulated O.N.E. Amazon Digital Asset Securit[ies].” Per Knez, “every safety will signify the perceived worth of 1 hectare of biome within the Amazon rainforest, backed by a 30-year preservation settlement over that land,” capped at 750 million, “similar to the hectarage of the rainforest.” In different phrases, every safety issued represents one hectare of the Amazon. O.N.E Amazon asserts that “buyers will profit from the potential capital appreciation of the safety” largely attributable to “the finite measurement” of the rainforest it’s tokenizing.

Knez co-authored a paper with Mysten Labs – based by former Fb/Meta workers who helped develop their stablecoin challenge, Libra/Diem, as coated in earlier reporting by Limitless Hangout – titled “Preserving Nature’s Ledger: Blockchains in Biodiversity Conservation,” which promotes a framework that focuses on “tokenization methods for biodiversity species and for IoT [internet of things] options, akin to sensors, drones, and satellites to watch and file knowledge associated to species and ecosystems.” Satellogic isn’t the one regarding agency partnered with O.N.E. Amazon, as an illustration, Aecom, – the successor to the CIA-linked Ashland Oil – at the moment contracts extensively with USAID, which is extensively believed to be a CIA entrance group. Apparently, Knez’ co-founder, Rodrigo Veloso, performed a big position within the efforts to take Trump Media & Know-how Group (TMTG) public, the guardian firm of the Trump-centric social community Reality Social.

With the carbon credit score market and tokenized RWAs presenting themselves as the popular debt devices of the fashionable period, Lutnick’s Satellogic finds itself able to act as an important pillar of the encroaching new monetary system, assuming the U.S. can get different nations to take part in these new know-how spheres. That is the position that the Division of Commerce has beforehand and controversially performed, and thus value investigating the current historical past of the DOC as Lutnick prepares to commandeer it.

The Commerce Division and the Legacy of “Chinagate”

Although Lutnick’s aforementioned ties to the Epstein-Wexner-Bronfman community are circumstantial, Lutnick’s ties to the federal government of Israel (which had a big relationship with Epstein) and Zionist causes are quite a few. Certainly, Lutnick has mentioned that his important cause for deciding to work with the Trump marketing campaign was due to Trump’s excessive pro-Israel stance, with Trump having personally advised Lutnick’s spouse Alison that “I would be the finest President for Israel.”

In that previous yr, Lutnick’s Cantor Fitzgerald Aid Fund, has donated closely to help Israel’s genocidal struggle within the Gaza Strip along with $7 million the fund gave “to help these impacted by the way in which in Israel.” A portion of this went to the Israeli volunteer-based emergency companies group, United Hatzalah, which is itself a member of the World Financial Discussion board and whose founder Eli Beer, an Israeli actual property mogul, has been a WEF Younger World Chief and award recipient from Klaus Schwab’s Schwab Basis for Social Entrepreneurship. Lutnick and his spouse chaired United Hatzalah’s United Hatzalah annual fundraising gala earlier this yr. United Hatzalah turned notorious in some circles final yr for fabricating claims of Hamas brutality on October 7th, together with claims of a child burnt in an oven, that the group later admitted have been unfaithful.

Lutnick’s appointment to be Commerce Secretary is critical in mild of the actual fact of his ties to Israel, Zionist organizations and his circumstantial ties to the Epstein nework, as Israel – and Epstein particularly – have been a part of a significant, largely forgotten scandal of the Clinton period that culminated with the obvious homicide of Clinton’s Commerce Secretary Ron Brown and lots of workers of the Commerce’s Worldwide Commerce Administration (ITA) workplace. Commerce and ITA had been focused by figures tied to each the Chinese language authorities and Israel with the objective of transferring delicate U.S. navy know-how, primarily satellites, to China in alternate for the covert arms smuggling of banned Chinese language weapons into city facilities within the U.S. West Coast. On the time, these city facilities have been additionally being focused with a CIA-manufactured crack cocaine epidemic, as reported by the late Gary Webb. The smuggling of arms into these areas was clearly meant to be irritate a multi-pronged effort by what was basically the Iran-Contra community (of which Invoice Clinton had been half) to decimate minority communities in West Coast city facilities, with the obvious objective of facilitating the expansion of the personal jail trade and the jail labor pool.

As detailed within the ebook One Nation Below Blackmail, the Commerce Division – and the ITA particularly – offers with the export of non-agricultural U.S. merchandise overseas, and was apparently the primary goal of what’s now remembered as a “marketing campaign finance scandal” sometimes called “Chinagate.” Nonetheless, the scandal – although intimately involving Chinese language government-owned corporations – is considerably bigger than China in scope and needs to be seen as a continuation of the CIA-Israeli intelligence nexus liable for unlawful operations that harmed American nationwide safety, akin to people who fashioned the majority of the Iran-Contra scandal underneath the Reagan and Bush administrations. Invoice Clinton had been intimately concerned with the Iran-Contra nexus whereas he was governor of Arkansas, which was partially facilitated by his long-time connection to his political benefactor Jackson Stephens, who was additionally tied to Iran-Contra. Finally, that is the place the group liable for the genesis of Chinagate will be discovered.

Stephens and his enterprise companions, the Riady household, have been largely accountable for the hiring of important Chinagate figures like Johnny Huang to the Commerce Division’s ITA. Shortly earlier than Chinagate started, the Riadys turned enterprise companions of the Chinese language authorities. Different central figures in Chinagate, like Mark Middleton and C. Joseph Giroir, have been linked to and later employed by the Riady household straight because the scandal unfolded. Middleton, notably, was the primary individual whom Jeffrey Epstein would go to on the Clinton White Home. Most of these visits have been made within the lead-up to the 1996 presidential election, the election round which the “marketing campaign finance scandal” side of Chinagate occurred.

The marketing campaign finance side of Chinagate finally served to grant non-Americans, just like the Riadys and their allies, unprecedented entry primarily to Ron Brown, then head of Commerce. The Riadys and their associates used a number of “strawmen” to masks unlawful marketing campaign contributions to Clinton’s re-election marketing campaign. There have been additionally American businessman who sought particular entry to Brown, like Bernard Schwartz of Loral, who had been the largest donor to the DNC for the 1996 election and used his entry to Brown to safe conferences with main Chinese language politicians and businessmen accountable for state-owned enterprises. A separate probe into Loral was opened as Chinagate started to be investigated, as Loral-produced satellites have been found within the fingers of Chinese language military-linked corporations and due to obvious proof that Loral had facilitated “an unauthorized switch of missile know-how” to China. Schwartz had beforehand used his affect to foyer the Clinton administration to maneuver approvals for satellite tv for pc exports overseas from the State Division, to Brown’s Commerce Division.

In the meantime, different figures in Chinagate efficiently pushed Clinton to ban Chinese language weapons imports (the U.S. was then their largest marketplace for weapons) with the intention to safe Congressional approval of “most favored nation” commerce standing for China. Nonetheless, figures introduced into shut contact with Clinton by the Chinagate nexus, like China’s “high weapons supplier” Wang Jun, have been later concerned in efforts to illegally smuggle very giant quantities of these banned weapons into the U.S. These smuggling efforts have been later partially foiled by the FBI in what’s now known as Operation Dragon Hearth. Nonetheless, the highest operatives – together with these linked to Wang Jun – that have been concerned within the smuggling effort have been tipped off and managed to flee the U.S., with solely their underlings finally taking the blame.

But, there may be additionally the likelihood that the Iran-Contra period airline that had beforehand been concerned in arms smuggling and drug trafficking within the Reagan/Bush period could have performed a task in holding it going. An American billionaire with shut ties to each China and Israel, Leslie Wexner, and his shut affiliate Jeffrey Epstein have been concerned with the re-location of that CIA-linked airline, Southern Air Transport, from Miami to Ohio and shifted its important routes from between North, Central and South America to between Ohio and Hong Kong. Ohio officers on the time suspected that the change in route and Wexner’s acquisition of the airline was linked to organized crime and, simply years prior, Ohio legislation enforcement had produced documentation (which was later closely censored) linking Wexner on to organized crime pursuits. In the meantime, Epstein cultivated shut ties with key figures in Chinagate concurrently, significantly with Mark Middleton – who was later killed in a homicide made to appear to be a suicide after Epstein’s in depth visits with him on the Clinton White Home have been made public.

Middleton was not the one determine in Chinagate to undergo a grisly destiny. Simply as “Chinagate” was starting to return to mild, Ron Brown and far of the highest brass on the ITA have been “requested unexpectedly to journey to Croatia.” The “sudden” journey provide was made shortly after Brown agreed to a plea deal the place he would have testified in probes that might have uncovered a big a part of the “Chinagate” nexus if he had been in a position to testify. The Croatia journey, nonetheless, led to tragedy when the aircraft carrying Brown and high Commerce personnel crashed, killing everybody on board. President Clinton publicly mentioned the crash was attributable to “a peculiar mixture of circumstances” and, three days after the crash, the pinnacle of navigation on the Croatian airport allegedly “accountable” for the crash was discovered lifeless, shot within the chest. His dying was rapidly dominated a “suicide.” On the crash website, unusual anomalies have been discovered by the U.S. navy investigators who responded to the scene, who recognized an obvious gunshot wound in Brown’s cranium that, clearly, wouldn’t have brought on by the crash itself.

Finally, proximity to Epstein and the state of Israel is sophisticated when one considers the long-running and documented historical past of Israel passing delicate American safety know-how shared with “our best ally,” a phenomenon that preceded and continued after the “Chinagate” scandal. Thus, Howard Lutnick’s ties not solely to Israel and his circumstantial but proximal relationship to Epstein needs to be scrutinized as ought to Lutnick’s enterprise ties to China. For example, the BGC Group, which Lutnick controls, has a three way partnership with the Chinese language state-owned China Credit score Belief. China Credit score Belief is the biggest shareholder in Harvest Fund Administration, which created BHR Companions alongside the Hunter Biden-linked agency Rosemont Seneca and the Thornton Group, headed by James Bulger, nephew of the notorious mobster James “Whitey” Bulger.

Notably, one other determine in Trump’s sphere (although not poised to serve a proper or casual position in his subsequent administration) – Blackwater founder Erik Prince – is intently financially linked to one of many important Chinese language corporations that had been concerned in Chinagate, CITIC, which is the largest shareholder in Prince’s Frontier Companies Group.

Lutnick, The Greenback and Monetary Management

The explanation behind exploring the position the Division of Commerce has performed within the Chinagate and Iran-Contra scandals is to not falsely affiliate the incoming Lutnick-led DOC with historic corruption – seeing as how Lutnick has loads of his personal controversial connections and conflicts of curiosity, as detailed above – however somewhat to exhibit the decades-long know-how switch as a necessity for imperial financial hegemony.

Whereas the USA has been historical past’s most up-to-date empire of alternative for imposing a unilateral financial paradigm on a lot of the world within the post-World Struggle II period, the teams which have lengthy dominated the American institution – or extra appropriately the Anglo-American institution – have been working for over a century to create “a world system of monetary management in personal fingers in a position to dominate the political system of every nation and the economic system of the world as an entire.” Per historian Caroll Quigley, this method can be managed in “feudalistic trend” by principally bankers, who hammer out secret agreements at frequent personal conferences and conferences.

Samuel Pisar, a outstanding lawyer for main U.S.-based companies, stepfather to present Secretary of State Anthony Blinken, and one of many closest associates and confidants of Robert Maxwell, brazenly advised Congress in 1971 that this world system of monetary management in personal fingers had already arrived. Pisar spoke of this method because the rise of the “transideological company,” the place the corporations of the “capitalist” West have been merging and/ or forging important agreements or joint ventures with the state-owned companies of the “communist” East. The end result, per Pisar, was that “all typical instruments of nationwide coverage” had change into “anachronistic” and that nation states have been not “reliable financial entit[ies].” Pisar, who declined to sentence this phenomenon, famous that the 2 important automobiles driving the rise of this world system of monetary management in personal (or semi-private) fingers are the rise of the multinational company, know-how switch and the dominance of the US greenback outdoors of American home markets, e.g. the Eurodollar market. Now, with a lot of this world monetary management system well-established and entrenched, the world will be extra simply on-boarded onto a single, hegemonic foreign money managed by entities that finally reply to the now hegemonic “transideological company.”

The profitable proliferation of a brand new monetary system throughout the globe with digital {dollars} native to the web is innately reliant on broadband web, mobile community suppliers, readily-available smartphones powered by economical microprocessors, and wide-spread operational data of each pillar upholding blockchain know-how. The technological infrastructure wanted to subject digital securities, “decentralize” authorities debt, tokenize parcels of the rain forest, or to uphold a carbon market, result in many surveillance issues that come downstream of the realities of a very digital economic system.

The know-how switch – led in no small half by varied iterations of the DOC – has enabled a globalized, web greenback and thus severely neutered the flexibility of non-U.S. central banks and governments to retain capital inside their border. Apparently, the infrastructure upholding the nationwide safety pursuits of the USA is dominated by personal sector, U.S.-based FinTech stalwarts, together with the house owners of the fiber optic cables operating beneath our oceans and Satellogic’s satellites-as-a-service orbiting our skies. This authorized or Constitutional barrier between the general public sectors pursuits and the personal sector that builds the know-how actualizing mentioned pursuits permits the information brokers that glean data straight from these technological spigots to package deal and promote consumer knowledge to each personal and public entities alike. In few industries is this idea extra harmful for the liberty and privateness of worldwide residents than it’s throughout the purely digital economic system perpetuated by Lutnick’s Tether, and the e-carbon market regime made doable by Lutnick’s Satellogic.

Regardless of the populist momentum current in U.S. political rhetoric for the reason that dominating election evening show placed on by the incoming Trump administration, the nation finds itself in a dangerous place. Properly, it actually can be if not for the technology-driven monetary revolution ready within the (West?) wings. With the nation practically $40 trillion {dollars} within the gap, and with protection spending now outpaced by merely servicing the curiosity on mentioned debt, if it wasn’t for the personal sector rescue unit – led in no small half by firms affiliated with Lutnick – the incoming Pink-branches of American energy can be dealing with a severe disaster. Fortunately, the worldwide know-how switch wanted to facilitate the dollarized panopticon has lengthy been accomplished, and the hegemonic-weakening leaks within the proverbial dyke have been plugged by the likes of Tether and Satellogic, whose few aggressive predators – be it fellow American FinTech firms or worldwide intelligence associates – now discover themselves on the whim of a Division of Commerce and govt department all-but-ready to play king-maker through regulation and enforcement.

On the finish of the day, the federal government isn’t any completely different from an organization, with a price range needing to be serviced alongside personnel and hiring necessities – each of which demand excessive portions of excessive constancy knowledge. This knowledge might be sequestered, distributed, and parsed through the fiber optic cables, the microprocessors, the blockchains and the satellites the U.S. produces. It’s thus actually becoming then that the subsequent section of American empire will as soon as once more be upheld by personal firms and the likes of our new Commerce Secretary Howard Lutnick.