When US president Donald Trump launched his personal meme cryptocurrency on January 17, days earlier than his return to the White Home, I used to be midway up a Swiss alp, attending a crypto convention within the city of St. Moritz.

Memecoins, which usually haven’t any function past monetary hypothesis, had been having a second. The earlier yr, thousands and thousands of latest memecoins had flooded the market; a couple of, like Fartcoin, had rocketed to billion-dollar valuations. Pump.Enjoyable, a platform for launching and buying and selling memecoins, had grow to be one of many fastest-growing crypto launchpad companies ever. Now, the soon-to-be president was getting in on the act.

Over lunch on the second day of the convention, beneath the ornate stucco ceiling and golden chandeliers of the venue’s eating corridor, I situated a desk designated for a dialog about memecoins. Whereas different tables had been half full, the memecoin workshop was oversubscribed; latecomers pulled up chairs to create two full rows.

The dialogue was led by Nagendra Bharatula, founding father of funding agency G-20 Group. Bharatula had lately coauthored a paper arguing that memecoins, regardless of their juvenile spirit, had a spot in skilled traders’ portfolios. Within the six months prior, a basket of 25 “bluechip memecoins”—an oxymoron if ever there was one—had outperformed bitcoin by 150 p.c, he identified. A few of the attendees murmured their approval.

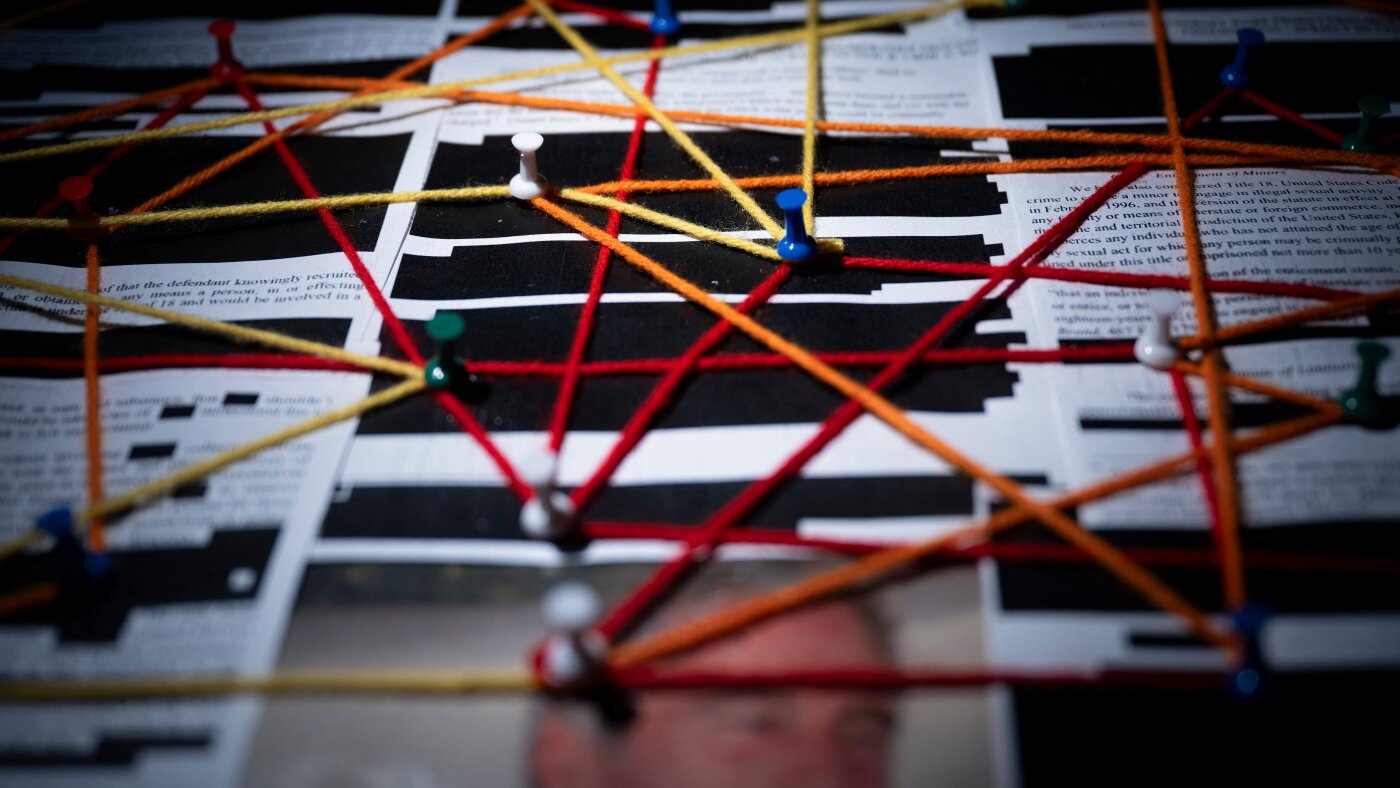

Since then, the shine has come off the memecoin market. The paper worth of Trump’s coin, which climbed to a peak of $14 billion two days after its launch, has cratered to roughly $1 billion. A whole bunch of 1000’s of small traders misplaced their shirts. Pump.Enjoyable’s day by day income, a proxy for the general urge for food for memecoin buying and selling, is barely greater than a tenth of what it was in January. The memecoin gold rush has spawned a raft of litigation.

Subsequent up: the stablecoin. If memecoins are symbolic of reckless abandon and unflinching profiteering in cryptoland, stablecoins are a logo of the business’s seek for function and respectability. Designed to carry a gradual $1 valuation, stablecoins are pitched by proponents as a quicker and cheaper solution to make on a regular basis funds and worldwide cash transfers.

In a yr wherein the US has declared itself open for crypto enterprise, the place beforehand crypto companies feared regulatory backlash beneath the Biden administration, stablecoins have supplanted memecoins because the coin à la mode—and punctured the mainstream.

Although stablecoins have been round since 2014, they’ve predominantly been utilized by crypto merchants as a secure harbor throughout bouts of market volatility, not by common folks. The idea has additionally confronted resistance from regulators skeptical of a brand new type of cash; Diem, a stablecoin enterprise incubated at Meta, famously shuttered in 2022 within the face of broad-based opposition.

.png)

.jpg)