JPMorgan Chase & Co. (NYSE:JPM) is without doubt one of the shares Jim Cramer mentioned after the Fed charge lower. Cramer talked about the inventory through the episode and remarked:

“I’ll let you know, if JPMorgan had been again the place it was the opposite day, bear in mind, I mentioned to purchase the inventory as a result of they’d that assembly and despatched the inventory down. The inventory was, went right down to $300s. [It’s] at $317. I imply, sufficient already.”

Pixabay/Public Area

JPMorgan Chase & Co. (NYSE:JPM) gives monetary providers, together with banking, lending, funds, and funding administration. As well as, the corporate provides funding banking, asset administration, and advisory options. Throughout the October 27 episode, Cramer mentioned that the corporate is “extremely well-run.” The Mad Cash host said:

“So what’s my primary favourite? JPMorgan Chase, the nation’s largest financial institution on the $832 billion market cap, I feel it’s going to be the primary to a trillion. JPMorgan is extremely well-run. America’s prime banker, Jamie Dimon on the helm, its fortress steadiness sheet that enables the corporate to consolidate in instances of stress, like they did through the many banking crises two years in the past, the place they got here out the winner. However the cause I’ve JPMorgan as the favourite on this race with 3:1 odds may be very easy. The banks are on fireplace proper now, and proper now, this inventory is ridiculously low-cost. However this, , this factor trades at 15 instances this yr’s earnings estimates. Who mentioned that each inventory’s costly on this market? If we get a little bit a number of enlargement and folks say that they begin paying on 17.5 instances subsequent yr earnings estimates, then JPMorgan wins this race in a heartbeat.”

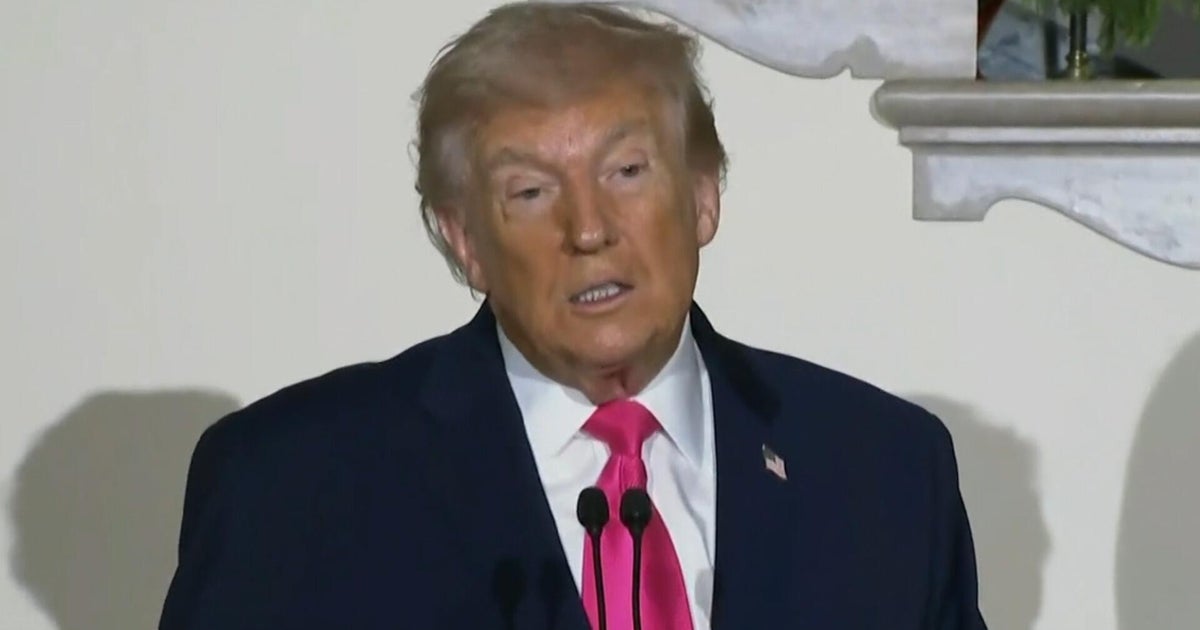

Whereas we acknowledge the potential of JPM as an funding, we consider sure AI shares provide larger upside potential and carry much less draw back danger. For those who’re in search of an especially undervalued AI inventory that additionally stands to profit considerably from Trump-era tariffs and the onshoring pattern, see our free report on the greatest short-term AI inventory.

READ NEXT: 30 Shares That Ought to Double in 3 Years and 11 Hidden AI Shares to Purchase Proper Now.

Disclosure: None. This text is initially printed at Insider Monkey.