Palantir (PLTR) inventory fell 7.95% on Tuesday as the corporate reported a robust quarter that left some buyers with questions over the corporate’s lofty valuation.

Palantir’s fourth quarter steering got here in above Wall Road’s expectations late Monday, defying fears some analysts had over the influence from the continuing US authorities shutdown.

Palantir mentioned it foresees income of simply over $1.3 billion for the fourth quarter, forward of the $1.2 billion projected by Wall Road analysts tracked by Bloomberg. The protection tech agency expects to see an adjusted working revenue between $695 million and $699 million for the interval, greater than the roughly $575 million anticipated.

The corporate additionally lifted its full-year income steering to $4.4 billion from its earlier outlook of $4.15 billion. Even with Tuesday’s decline, the inventory is up over 150% this 12 months.

Learn extra: Reside protection of company earnings

Nonetheless, some Wall Road analysts voiced considerations that Palantir’s efficiency and steering fail to justify its valuation.

Shares commerce at a ahead 12-month price-to-earnings ratio of 230, far above the P/E ratio of 35 for the “Magnificent Seven” Massive Tech shares, per Bloomberg information.

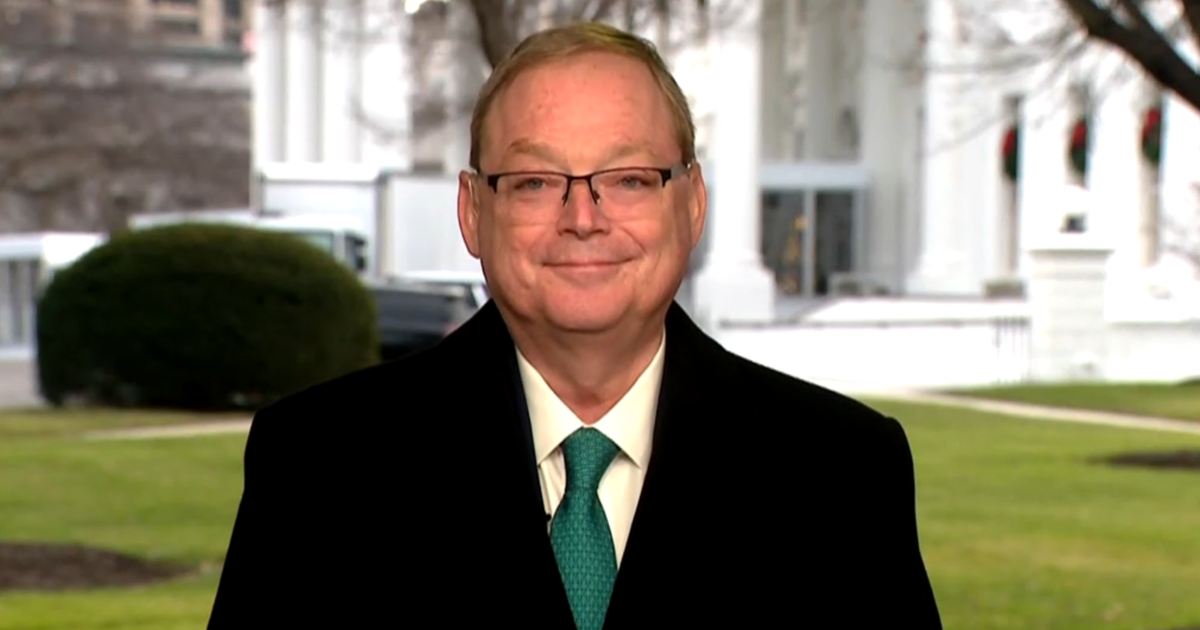

“We consider the danger/reward is unfavorable as the present valuation is prone to any downtick within the AI hype cycle,” Jefferies analyst Brent Thill wrote in a word to buyers Tuesday, sustaining his Underperform score on the inventory.

Palantir sells its synthetic intelligence software program to companies and governments within the US and overseas. Its tech does every thing from provide chain evaluation to surveillance and figuring out army targets. The agency’s offers with the Israeli army and ICE have drawn public backlash.

The corporate’s third quarter outcomes additionally topped analyst estimates. Its adjusted earnings per share of $0.21 had been forward of the $0.17 anticipated by Wall Road and greater than double its EPS of $0.10 within the third quarter of 2024.

The protection tech agency reported income of $1.18 billion for the three months by means of Sept. 30, a 63% improve from the earlier 12 months and above the $1.09 billion anticipated by Wall Road analysts tracked by Bloomberg.

Driving that income beat was Palantir’s enterprise in the US. Its income from US authorities contracts jumped 52% to $486 million, above the $471 million anticipated. The corporate’s US business phase, in the meantime, noticed income soar 121% year-over-year to $397 million, increased than the projected $342 million.

In a letter to shareholders on Monday, CEO Alex Karp known as Palantir’s US business enterprise “an absolute juggernaut.”