DETROIT – Rivian Automotive beat Wall Road’s expectations for the third quarter, as the corporate reported a its second quarterly gross revenue this yr due to a three way partnership with Volkswagen and its software program and companies enterprise.

Here is what Wall Road anticipated, based mostly on common analysts’ estimates compiled by LSEG:

- Loss per share: 65 cents adjusted vs. a lack of 72 cents anticipated

- Income: $1.56 billion vs. $1.5 billion anticipated

Rivian inventory was up greater than 3% in prolonged buying and selling Tuesday, after closing down 5.2% at $12.50 per share. The inventory is off roughly 6% this yr.

Relating to its gross revenue, which is carefully watched by traders, the corporate reported $24 million throughout the third quarter, beating FactSet consensus estimates of a $38.6 million loss. Each the corporate’s automotive and software program and companies carried out higher than anticipated.

“Whereas we face near-term uncertainty from commerce, tariffs, and regulatory coverage, we stay centered on long-term progress and worth creation,” Rivian CEO and founder RJ Scaringe mentioned Tuesday within the firm’s shareholder letter.

Rivian’s inventory in 2025

Rivian’s gross revenue included a $130 million loss in its automotive operations — which was a $249 million enchancment from the identical interval a yr earlier — that was offset by $154 million from its VW three way partnership and software program and companies.

Traders view gross revenue as a key indicator of a enterprise’s profitability earlier than working bills, curiosity and taxes.

Rivian maintained its beforehand lowered 2025 steering that features an adjusted earnings lack of between $2 billion and $2.25 billion, capital expenditures of $1.8 billion to $1.9 billion and automobile deliveries of 41,500 models to 43,500 models. It additionally reconfirmed a gross revenue round breakeven, down from a modest revenue goal earlier within the yr.

The corporate additionally reaffirmed manufacturing timing of its new R2 midsize automobile for the primary half of subsequent yr on the firm’s sole plant in Illinois.

Rivian ended the third quarter with $7.7 billion in complete liquidity, together with almost $7.1 billion in money, money equivalents, and short-term investments that Scaringe mentioned has it “very well positioned” for the R2 launch.

Scaringe mentioned Tuesday that the corporate doesn’t anticipate considerations about uncommon earth minerals from China or chips from China-owned auto provider Nexperia to delay manufacturing of the R2.

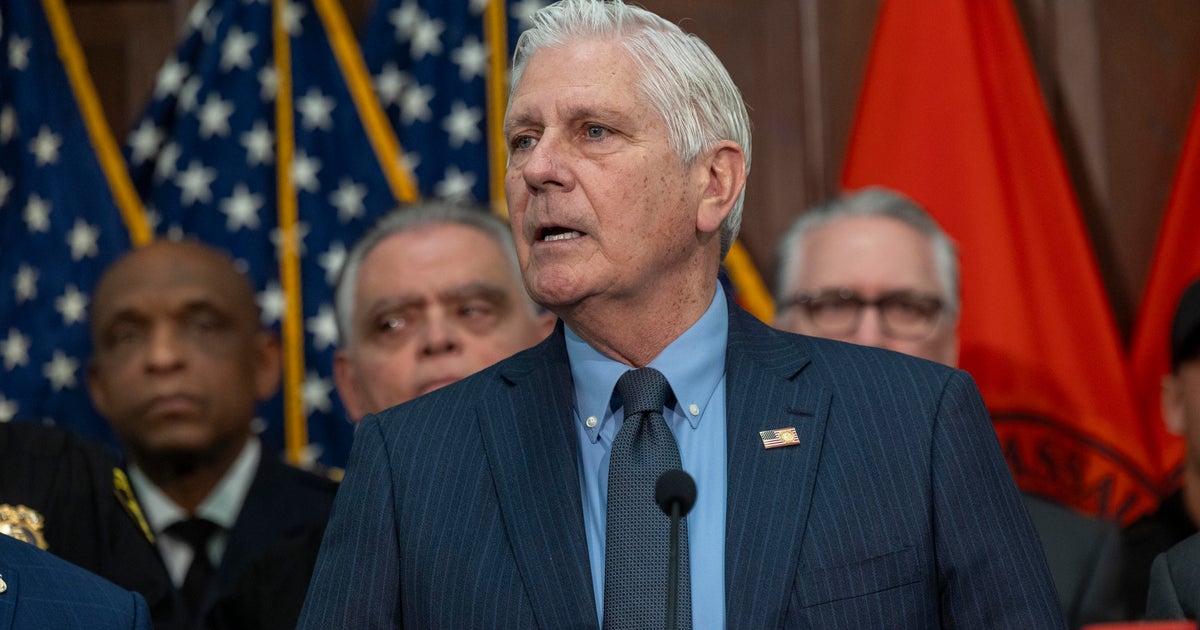

Rivian CEO Robert “RJ” Scaringe speaks on the launch of the Rivian R2 electrical automobile on the Rivian South Coast Theater in Laguna Seaside, California, on March 7, 2024.

Patrick T. Fallon | Afp | Getty Photos

“This is not one thing we’re seeing as a possible for delay in R2 simply due to how we constructed and designed the provision chain, and the readiness that is gone into making ready for the launch,” he informed CNBC’s Phil LeBeau throughout an interview. “Within the extra speedy time period, Nexperia, it is simply we do must have this resolved.”

China on Saturday mentioned it could take into account some exemptions for Nexperia chip exports, which it has ceased amid commerce talks with the U.S. and after Dutch authorities took over the corporate within the Netherlands.

Rivian’s income for the third quarter was a 78% improve in contrast with $874 million a yr earlier. The corporate’s web loss attributable to widespread stockholders barely widened from $1.1 billion, or a lack of $1.08 per share, throughout the third quarter of final yr to $1.17 billion, or a lack of 96 cents, throughout the newest quarter. Excluding one time-items, together with for analysis and improvement, amongst different issues, the corporate misplaced 65 cents per share.

EV producers similar to Rivian face industrywide points similar to rising prices as a result of tariffs and slower forecasted gross sales of EVs, in addition to company-specific issues that embody new product challenges, and regulatory adjustments which might be negatively impacting gross sales and earnings, together with the top of client federal incentives.

Rivian didn’t instantly give an replace on the impacts of tariffs on its enterprise or regulatory adjustments. The corporate has beforehand mentioned the levies are costing it “a pair thousand {dollars} per unit” this yr, and that altering laws are negatively impacting its operations.

![[Tambay] Salamat sa usiserong paslit, naiba ang pananaw ko sa Noche Buena [Tambay] Salamat sa usiserong paslit, naiba ang pananaw ko sa Noche Buena](https://www.rappler.com/tachyon/2025/12/tambay-dec-20-2025.jpg)