Private Sector Leads Infrastructure Development Push

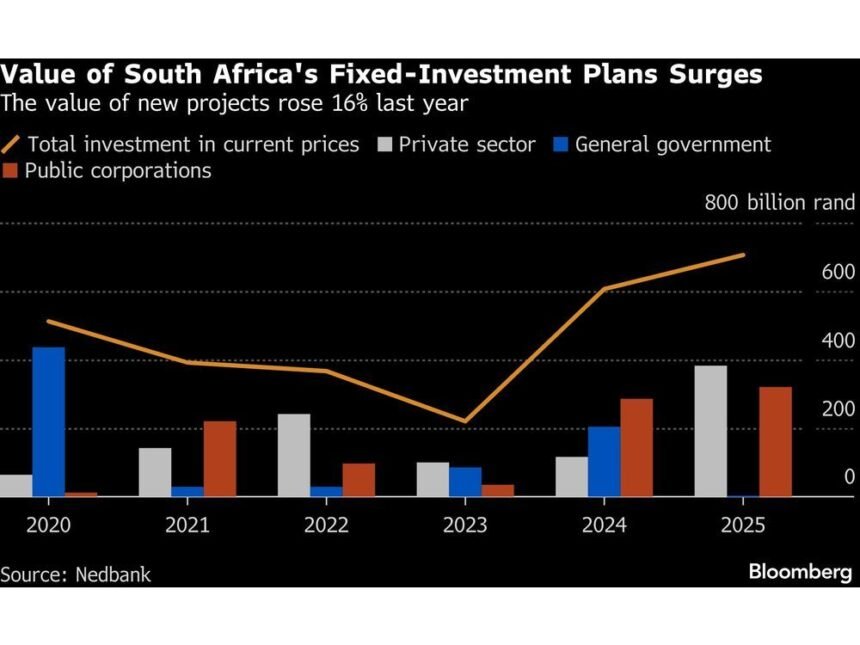

Newly announced capital investment projects in South Africa reached 705.6 billion rand ($44 billion) last year, marking a 16% increase from previous commitments. Banking sector analysis reveals private sector pledges tripled to 382.5 billion rand compared to 2024 figures, signaling renewed confidence in Africa’s largest economy.

Major Private Sector Initiatives

Telecommunications provider Vodacom Group unveiled an 85.2 billion rand initiative to modernize digital infrastructure through network upgrades and accelerated 5G deployment. Meanwhile, NT55 Investments committed 50 billion rand toward developing an inland port in Gauteng province featuring integrated rail and truck terminals designed to alleviate freight congestion.

Public Sector Investment Shifts

While state-owned enterprises increased planned investments by 12% – primarily driven by Eskom’s 320 billion rand power infrastructure upgrade – direct government project funding dropped sharply to 2.9 billion rand from 204 billion rand in 2024. This decline follows completion of major housing and wastewater treatment initiatives announced in previous years.

Addressing Infrastructure Deficits

Economic analysis confirms years of underinvestment have created significant infrastructure gaps constraining economic growth. Recent reforms under Operation Vulindlela, a presidential task force targeting energy and logistics challenges, show nearly half of planned measures progressing on schedule despite some implementation delays.

Economic Outlook and Challenges

Improved risk assessment metrics show credit-default swap spreads on sovereign debt narrowing to their lowest levels since 2010. Banking sector forecasts project capital formation growth rebounding to 2% by 2026 after an expected contraction next year, though analysts caution that high operational costs and potential U.S. trade barriers could temper investment momentum.

Market observers note that falling inflation and borrowing costs are gradually boosting domestic demand, potentially absorbing industrial spare capacity and encouraging business expansion. The government’s inaugural infrastructure bond offering last year attracted bids exceeding twice the 11.8 billion rand target, demonstrating investor appetite for development projects.