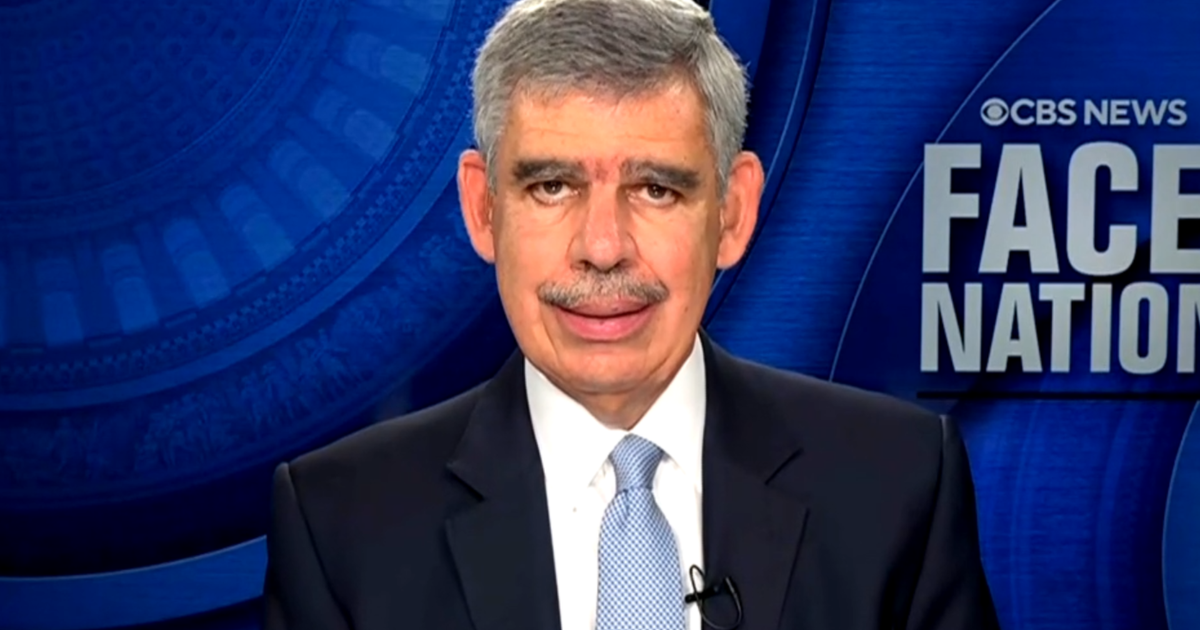

The next is the transcript of an interview with Mohamed El-Erian, chief financial advisor at Allianz, that aired on “Face the Nation with Margaret Brennan” on Aug. 24, 2025.

MARGARET BRENNAN: We flip now to the U.S. financial system. Mohamed El-Erian is the Chief Financial Advisor at Allianz, and he joins us this morning from Greenwich, Connecticut. Good morning to you.

MOHAMED EL-ERIAN: Good morning, Margaret.

MARGARET BRENNAN: So we noticed the Federal Reserve chair sign on Friday that the Fed goes to, as anticipated, start decreasing charges very quickly, however he is additionally cited slowing financial progress and a cooling job market. So why then did the monetary markets rally?

MOHAMED EL-ERIAN: As a result of he lastly pivoted to the danger that issues most for the U.S. financial system proper now. By assemble the Fed has to ship two issues, most employment and value stability, and the Fed is barely increased inflation and a weakening labor market. And what Powell lastly did, and many people really feel he ought to have achieved this earlier, is he stated the danger to the employment facet is increased than the danger to the inflation facet, and due to this fact an rate of interest reduce is warranted. As you already know, many people felt he ought to have reduce final month.

MARGARET BRENNAN: Properly, the Fed chair stated considerably increased tariffs are remaking your complete international commerce system. Tighter immigration coverage has slowed labor progress, and there are massive tax and regulation adjustments you possibly can’t fairly, you already know, quantify at this level, however it’s loads of uncertainty. Since economists need to construct off of fashions and knowledge, how do you expect the place we’re going if, mainly, he is saying throw out your fashions?

MOHAMED EL-ERIAN: So one of many issues is he hasn’t appeared ahead sufficient. He is been very knowledge dependent, and due to this fact he has tended to be late. Look, there’s something promising in our future, and that’s productiveness enhancement that comes from thrilling innovation in AI in life sciences and robotics and different areas. We simply need to handle a difficult few months within the interval forward. And if that problem is mishandled, we will be unable to get the alternatives that we’ve got that offset loads of structural headwinds, and that features excessive debt and excessive deficits.

MARGARET BRENNAN: I wish to ask you about one thing we have been discussing with Congressman Lawe- Lawler simply earlier than you, and that’s this uncommon choice for the U.S. authorities to take a stake in chip maker Intel. That firm has been struggling of late and its CEO was criticized by the president United States. He was criticized by the chair of the Senate Intelligence Committee, Tom Cotton. President Trump talked about all of that on Friday, and he stated this.

[SOUND ON TAPE STARTS]

PRESIDENT DONALD TRUMP:

He walked in wanting to maintain his job and he ended up giving us $10 billion for america. So we picked up $10 billion. And we do loads of offers like that.

[SOUND ON TAPE ENDS]

MARGARET BRENNAN: The president stated the CEO needed to maintain his job, so he supplied a ten% stake in his firm. Is that this signaling a brand new period for U.S. coverage? I imply, central planning of the financial system?

MOHAMED EL-ERIAN: I do not suppose so, Margaret. Look, because the congressman stated, it is good to ship the message that firms is not going to get one thing for nothing, and that’s what they’ve gotten used to since 2008, all of the bailouts. And what they’re saying now–

MARGARET BRENNAN: –Which have been paid back–

MOHAMED EL-ERIAN: Which have been paid again, however on the time, the federal government took monumental threat in lots of, many areas. An important distinction, if I could, right here, is between possession and management. Sure, the federal government can personal 10% however it should not management how this firm manages its affair, as a result of as soon as we go down that highway that could be a actually harmful highway, and that may eat away at what makes America actually particular, which is a dynamic, entrepreneurial financial system.

MARGARET BRENNAN: And I imagine the Commerce Secretary stated there will not be management, however that’s one thing to observe for. I wish to additionally ask you about political stress, not simply on the Federal Reserve Chair, which you’ve got nodded to, however the President can be now threatening to fireside Federal Reserve Governor Lisa Prepare dinner. They’re accusing her with out publicly disclosed proof of mortgage fraud and urging an investigation. In reality, the Justice Division wrote a letter to Chair Powell, encouraging her to be eliminated. Are you involved that that is beginning to be a sample right here of political interference with the Federal Reserve?

MOHAMED EL-ERIAN: So these allegations are unproven, and it is necessary to emphasize that. Having simply stated that, that is the fifth time within the final 5 years that there was allegations towards a Fed official. And already 4 of them have needed to resign. So what I am involved about is that there appears to have been a tradition that has developed on the Fed that has resulted in these 4 resignations. However I’m very apprehensive about preserving Fed independence. And an unbiased central financial institution is crucial to the properly being of the financial system, and there is a lot of causes for that. So you already know, one has to disting- distinguish between the 2. I can not converse to the unproven allegations, however I do suppose it is actually necessary to defend the central financial institution independence.

MARGARET BRENNAN: Properly, as I perceive it, the governor has stated she needs to, you already know, share info, and is denying wrongdoing right here. However simply the actual fact that it’s the President directing the eye in the direction of her would not this recommend that even when Jerome Powell steps apart as head of the Federal Reserve, that this is not going to cease this massive highlight on the central financial institution that’s so highly effective, and that the concern you’ve of political interference could not go away?

MOHAMED EL-ERIAN: Sure, and I- my concern and my concern is that the longer Chair Powell is in his place, and it runs out in Might, the longer he is in his place till then, the extra this acts as a magnet for attacking, not solely deeper assaults from the president, however a lot broader from the political system. And that is one factor that fairly a couple of individuals are apprehensive about.

MARGARET BRENNAN: Mohamed El-Erian, thanks a lot for sharing your perception at present. We’ll depart it there. We’ll be again in a second.