That is AI generated summarization, which can have errors. For context, all the time seek advice from the total article.

Introducing GoTyme Financial institution’s trendy techie persona in its internet collection

Editor’s notice: This content material is sponsored by GoTyme Financial institution and was produced by BrandRap, the gross sales and advertising arm of Rappler. No member of the information and editorial workforce participated within the manufacturing of this piece.

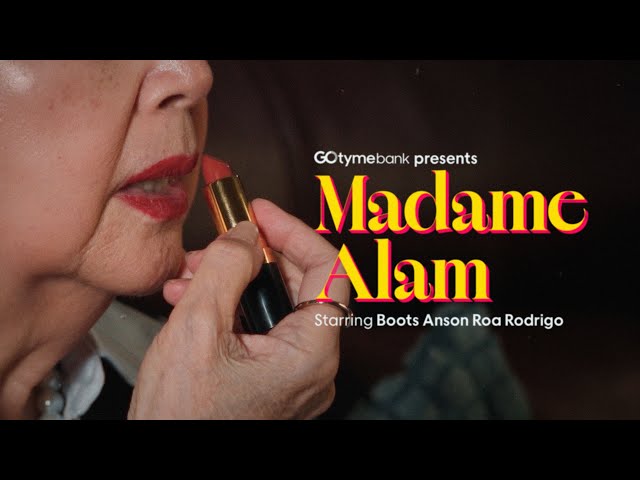

Cybersecurity usually feels intimidating – stuffed with complicated phrases like digital infrastructure, infinite verifications, and complicated techniques. To make the subject extra accessible, GoTyme Financial institution launched “Madame Alam”, an online collection that takes a contemporary, relatable method to educating Filipinos about cellular banking and digital safety.

Contemplate Madame Alam because the smart aged woman who has lived by way of the totally different eras of recent banking, from the normal methods and being in bodily areas to digital means and making transactions by way of cellular units and computer systems.

Performed by Boots Anson-Roa Rodrigo, Madame Alam is the lola who is much from frail and forgetful; she practices essential vigilance and retains up-to-date with out lacking a beat. Her movies up the ante from the enduring Lola Techie, propping herself up in a hardwood-furnished set donning a vested button-down shirt with pearls, prepared for clutching.

In her introduction, she dives straight into the significance of defending one’s id and remembers how old-school con artists used to get away with loans by way of faux IDs. Fortunately,

she has found out the methods and schemes of fraudsters and scammers. Distrustful of them, she doesn’t click on hyperlinks despatched through textual content, verifies senders of emails, and makes use of in-app biometric authentication, a safety function utilized by GoTyme Financial institution.

For the succeeding episodes, Madame Alam confidently shares extra know-how in fraud prevention: warning towards sharing one-time passwords (OTP) and choosing safer log-in choices and digital playing cards. Her practicality shines within the recommendation she fingers out: safety trumps loyalty in the case of safeguarding cash, outsmart the fraudsters, and reduce away the nonsense.

“Our mission is to unlock each Filipino’s monetary potential — and that begins with confidence. Cybersecurity doesn’t should be difficult. Via Madame Alam, we’re making fraud prevention relatable and simple to know, so individuals can financial institution securely and give attention to reaching their objectives,” stated Nate Clarke, president & CEO of GoTyme Financial institution.

GoTyme Financial institution chief data officer Gigi Puno added, “Our precedence is straightforward: to maintain our prospects’ hard-earned cash secure. By combining superior security measures with relatable training by way of Madame Alam, we’re making banking safe and simple for everybody.”

Whereas the net collection showcases all of the methods GoTyme Financial institution can shield its prospects by way of its superior know-how, it additionally acknowledges the significance of adjusting person habits by that includes a formidable determine like Madame Alam. Made in partnership with the Philippine Nationwide Police Anti-Cybercrime Group, the collection supplies smart but simplified training for everybody.

With a champion like GoTyme Financial institution and the unmistakable knowledge of Madame Alam, digital banking may be simple. This method goes to point out their uncompromising customary for security and proves that for GoTyme, safety is a non-negotiable dedication, guaranteeing transactions are protected by best-in-class know-how that stands as much as Madame Alam’s strict scrutiny.

Keep One Step Forward. Need extra ideas, methods, and rip-off alerts? Comply with @gotymebank on social media for the most recent information, updates, and episodes of the Madame Alam collection. – Rappler.com