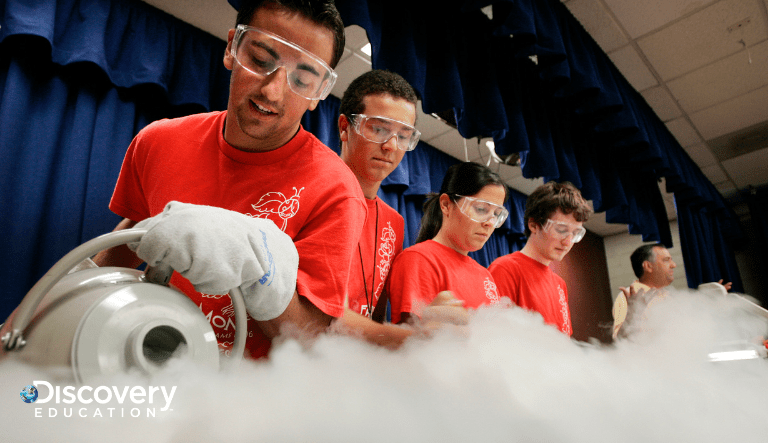

An open-air strip retail middle in Richmond, Virginia.

Courtesy of Nuveen

A model of this text first appeared within the CNBC Property Play e-newsletter with Diana Olick. Property Play covers new and evolving alternatives for the actual property investor, from people to enterprise capitalists, personal fairness funds, household places of work, institutional traders and enormous public firms. Enroll to obtain future editions, straight to your inbox.

It could be an understatement to say that retail actual property has had a tough experience. It began with the start of e-commerce and escalated with the Covid-19 pandemic. Its restoration has been splintered, given the various subsectors of retail, from giant indoor malls to big-box facilities to grocery-anchored, open-air strip facilities.

It is that final subsector that Chad Phillips, world head of Nuveen Actual Property and answerable for over $140 billion of business actual property fairness and debt investments, says is the massive alternative immediately.

“We have leaned into this resilient, open-air technique the final two years fairly closely,” mentioned Phillips.

That is grocery-anchored facilities with, maybe, a CVS and a pizza place and the like. Emptiness charges in these areas had been 7.8% at first of 2016, however got here all the way down to 4.4% by the start of this yr, in line with knowledge from CoStar Group.

“It survived Covid. It survived the Amazon impact,” Phillips mentioned. “The occupancies inside our grocery-anchored, open-air portfolio in good areas is over 95% leased.”

Every time a tenant closes its doorways, Nuveen is ready to refill the spot shortly resulting from such robust demand, Phillips mentioned.

He admitted that retail actual property had been overbuilt for a very long time within the U.S. Ultimately, builders grew to become extra disciplined, particularly with the start of e-commerce. That resulted in a correction that created one thing of an undersupply immediately.

“The [capitalization] charges that you would be able to purchase them at are pretty enticing,” mentioned Phillips. “So the whole returns are good. You are shopping for at far lower than substitute price. So you set all of it collectively, and it is a very resilient, important actual property want the place we are able to make robust, risk-adjusted returns.”

Whereas bigger, indoor mall site visitors is rising, particularly within the highest-end malls, Phillips mentioned he likes this smaller sector as a result of they’re “bite-sized offers.” You possibly can promote them simply. They’re liquid. Malls are usually not.

It is also an element of easy provide and demand. Roughly 15 years in the past, allocations to retail had been over 30% for actual property traders, however that dropped to 10% as a result of the returns had been weak, in line with Nuveen. Now, in simply the final 12 months, the returns are enhancing, and traders are wanting once more.

“I would not say they’re flooding again, however we have raised year-to-date [for] convenience-based retail $1.4 billion of fairness with leverage,” Phillips mentioned. “That places us over $2.5 billion of shopping for energy for these kinds of methods. So yeah, I do suppose that traders are turning their heads.”

This isn’t to say that the sector, like every other, isn’t with out danger. After just a few years of outperformance, it is beginning to decelerate.

“After 5 years of constant demand and hire development, fundamentals are softening,” wrote Brandon Svec, nationwide director of U.S. retail analytics at CoStar Group in a current firm e-newsletter, noting emptiness charges in grocery-anchored, open-air areas have ticked up for 3 consecutive quarters. (Although they’re nonetheless close to historic lows.)

However Svec added that the broader retail leasing atmosphere tells a distinct story.

“With little new retail house anticipated to be added over the subsequent few years, and availability circumstances sitting close to traditionally tight ranges, retailers are staying lively of their pursuit of recent areas,” Svec mentioned.

He additionally mentioned there’s concern concerning the state of the general economic system, shopper confidence and shopper spending.

After robust hire development in earlier years for the grocery-anchored, open-air subsector, it has stalled this yr, with annual hire development the weakest in additional than a decade. It is a clear departure from prior years, Svec emphasised.

Phillips mentioned that is why the technique requires that traders be significantly choosy concerning the properties.

Shopper confidence ebbs and flows, and that has an influence on whether or not they will go to those facilities for espresso or to get a manicure. The prevailing buyer base, particularly these with greater financial savings charges who can stand up to greater unemployment, are very important to selecting the place to speculate.

Phillips mentioned a median family revenue of over $100,000 and a largely millennial, well-educated inhabitants are among the many standards he appears for.

Competitors amongst traders is rising, however to not the purpose the place good offers cannot get completed, he mentioned, citing low, double-digit returns.

He added low ranges of recent development are serving to to maintain vacancies down, and the areas draw constant crowds.

“I do suppose it is so much about comfort and being within the path of that comfort, and that is the place we need to make investments,” mentioned Phillips.