By CHRISTOPHER RUGABER, Related Press Economics Author

WASHINGTON (AP) — Simply three weeks in the past, Federal Reserve Chair Jerome Powell spoke to reporters after the central financial institution had stored its key rate of interest unchanged for a fifth straight assembly and stated the job market was “stable.”

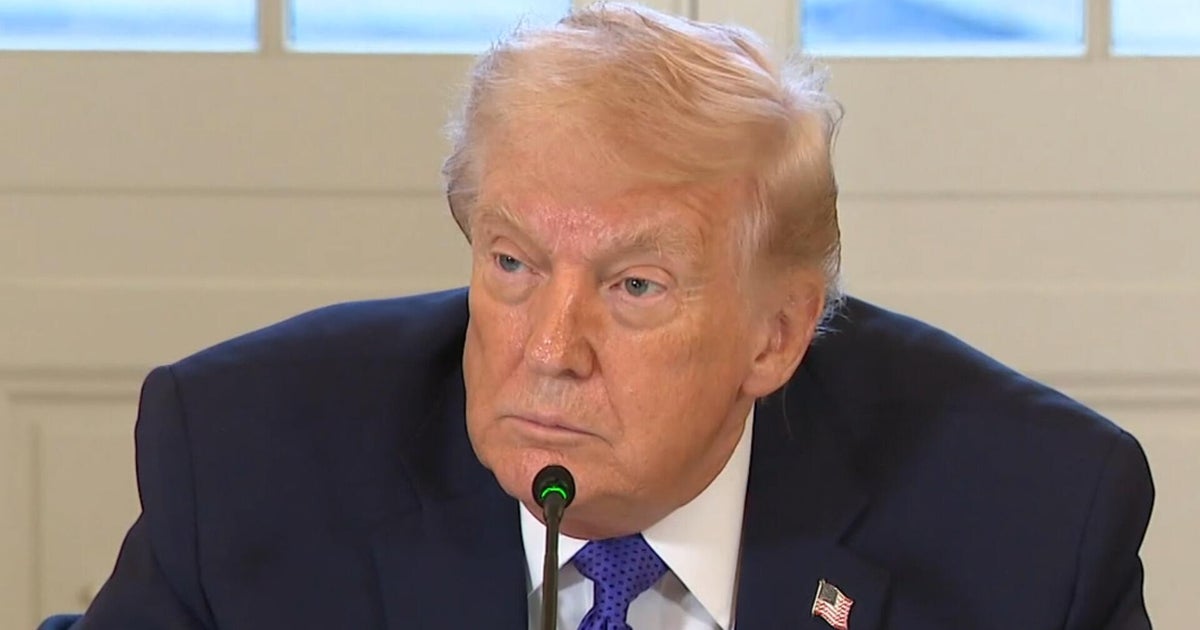

His evaluation was essential as a result of if the job market is wholesome, there may be much less want for the Fed to chop its key rate of interest, as President Donald Trump has demanded. Two days later, the Labor Division issued a report that solid doubt on that evaluation, displaying hiring was weak in July and far decrease than beforehand estimated in Might and June.

So, there shall be plenty of consideration paid by Wall Road and the White Home to Powell’s high-profile speech Friday on the Fed’s annual financial symposium in Jackson Gap, Wyoming. If the famously data-dependent Powell shifts gears and takes a gloomier view of the job market, that might open the door for a price lower on the Fed’s subsequent assembly in September.

Powell may additionally keep on with the cautious strategy he’s maintained all yr and reiterate that the central financial institution wants extra time to judge the affect of Trump’s sweeping tariffs on inflation.

Most economists count on Powell to sign {that a} price lower is probably going this yr, however received’t essentially commit to 1 subsequent month. That would disappoint Wall Road, which has put excessive odds on a September lower.

Powell’s speech, his final handle at Jackson Gap as chair earlier than his time period ends in Might, will happen towards a very fraught backdrop. A couple of week after the roles numbers, the most recent inflation report confirmed that value progress crept increased in July. Core costs, which exclude the risky meals and vitality classes, rose 3.1% from a yr in the past, above the Fed’s 2% goal.

Stubbornly elevated inflation pushes the Fed in the wrong way that weak hiring does: It suggests the central financial institution’s short-term price ought to keep at its present 4.3%, fairly than be lower. That might imply different borrowing prices for mortgages, auto loans, and enterprise loans, would keep elevated.

“So the plot has thickened,” stated David Wilcox, a former high Fed economist and now director of financial analysis at Bloomberg Economics and likewise a senior fellow on the Peterson Institute. “The dilemma that the Fed is in has develop into, if something, extra intense.”

Powell can be navigating an unprecedented stage of public criticism by Trump, in addition to efforts by the president to take better management of the Fed, which has lengthy been unbiased from day-to-day politics.

Most observers credit score Powell for his nimble dealing with of the pressures. An iconic second in his tenure was Trump’s go to to tour the Fed’s renovation of its workplace buildings final month. Trump had charged that Powell mismanaged the undertaking, which had ballooned in value to $2.5 billion, from an earlier estimate of $1.9 billion.

With each the president and Fed chair in white onerous hats on the constructing website, in entrance of cameras, Trump claimed the price had mushroomed even additional to $3.1 trillion. Powell shook his head, so Trump handed him a bit of paper purporting to again up his declare.

Powell calmly dismissed the determine, noting that the $3.1 billion included the price of renovating a 3rd constructing 5 years earlier.

“That was simply such a basic Powell,” stated Diane Swonk, chief economist at KPMG. “He simply doesn’t get fazed. He’s obtained a humility that oftentimes I believe is missing amongst my colleagues in economics.”

Powell appeared to not less than briefly assuage Trump throughout the tour, after which the president backed off his threats to fireside the Fed chair over the undertaking.

The assaults from Trump are the most recent challenges for Powell in an unusually tumultuous eight years as Fed chair. Not lengthy after being appointed by Trump in 2018, Powell endured the president’s criticisms because the Fed slowly raised its key price from the low ranges the place it had remained for years after the 2008-2009 Nice Recession.

Powell then discovered himself grappling with the pandemic, and after that the worst inflation spike in 4 many years that occurred as authorities stimulus checks fueled spending whereas crippled provide chains left fewer items obtainable.

Powell then oversaw a fast collection of price hikes that had been extensively predicted to trigger a recession, however the economic system continued plugging forward.

In his newest try to strain the Fed, on Wednesday Trump known as on Fed governor Lisa Cook dinner to step down, after an administration official, Invoice Pulte, accused her of mortgage fraud. Pulte is head of the company that regulates mortgage giants Fannie Mae and Freddie Mac.

Cook dinner stated in a press release that she wouldn’t be “bullied” into resigning and added that she was getting ready to reply the fees.

For Powell, there’s a tough resolution to make on rates of interest. The Fed’s “twin mandate” requires it to maintain costs secure whereas searching for most employment. However whereas the weak jobs knowledge recommend the necessity for a lower, many Fed officers concern inflation will worsen within the coming months.

“There may be nonetheless a good quantity that’s nonetheless excellent,” Raphael Bostic, president of the Fed’s Atlanta department, stated in an interview, referring to tariff-led value hikes. “One suggestions we’ve gotten each in our surveys and from direct conversations (with companies) means that many nonetheless need to see the worth that they cost their clients enhance from the place we’re at present.”

Different economists, nonetheless, level to the sharp slowdown in housing as an indication of a weak economic system. Gross sales of present properties fell in June to their lowest stage in 9 months amid elevated mortgage charges. Client spending has additionally been modest this yr, and progress was simply 1.2% at an annual price within the first half of 2025.

“There’s not so much to love in regards to the economic system proper now outdoors of AI,” stated Neil Dutta, an economist at Renaissance Macro. “The weak spot within the economic system isn’t about tariffs,” however as a substitute the Fed’s excessive charges, he added.

Initially Printed: