Wells Fargo & Firm (NYSE:WFC) is likely one of the greatest Goldman Sachs financial institution shares. On September 17, a bloc of 15 Democratic senators, beneath Arizona’s Ruben Gallego’s management, requested Wells Fargo to finish what they referred to as efforts to discourage worker unionization.

The group instructed CEO Charlie Scharf in a letter that creating higher labor relations could scale back what they take into account a poisonous office and assist the financial institution rebound from previous controversies.

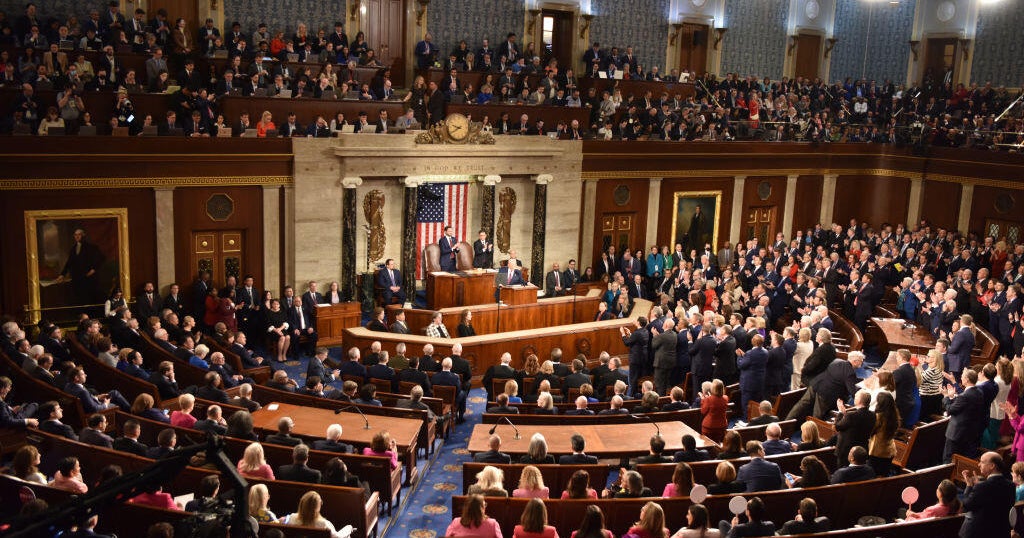

Rob Wilson / Shutterstock.com

The lawmakers asserted that Wells Fargo & Firm (NYSE:WFC) has taken a notably harsher stance in opposition to workers searching for to arrange unions in states together with Arizona, Florida, North Carolina, and Wyoming. The senators’ letter talked about that six expenses of unfair labor practices have been introduced earlier than the Nationwide Labor Relations Board (NLRB) in opposition to WFC this yr.

The group additionally claimed that aggressive gross sales quotas within the financial institution’s previous have contributed to buyer mistreatment, lack of workers, and low wages, which led staff to hunt unions.

The letter highlighted staff’ rights to honest pay, protected circumstances, and whistleblower protections as properly, urgent Scharf to halt the corporate’s anti-union initiatives.

Whereas we acknowledge the potential of WFC as an funding, we imagine sure AI shares provide larger upside potential and carry much less draw back threat. When you’re on the lookout for a particularly undervalued AI inventory that additionally stands to profit considerably from Trump-era tariffs and the onshoring development, see our free report on the greatest short-term AI inventory.

READ NEXT: Dow 20 Shares Record: Ranked By Hedge Fund Bullishness Index and 10 Unstoppable Dividend Shares to Purchase Now.

Disclosure. None.